Level 3: Starter or Engaged Investor, big play

Post updated from March 16, 2025.

Post updated from June 28, 2025.

Executive Summary

This report provides our final, consolidated analysis of the Physical Palladium Shares ETF (PALL). It synthesizes our proprietary data, recent market developments, and a rigorous analysis of the geopolitical landscape.

Our central thesis is that Palladium represents a classic, institutional-grade contrarian opportunity. The asset has reached a critical inflection point where objective, quantitative data is beginning to diverge from a deeply entrenched and overwhelmingly pessimistic narrative. A multi-year accumulation base has formed, and recent action signals a potential shift from this foundation.

This analysis will deconstruct the narratives, present the data from our Duo-Lens system, and outline a strategic framework for navigating the probabilities.

2. The Dominant Narrative: A Story of Industrial Weakness

First-level thinking is driven by simple, powerful stories. For the past two years, the story of palladium has been one of inevitable decline, and our external research confirms this is the prevailing consensus view. This narrative is built on two pillars:

- Structural Demand Destruction: The accelerating global transition to Battery Electric Vehicles (BEVs) fundamentally erodes demand from palladium’s primary use case: catalytic converters in internal combustion engines (>80% of demand).

- Substitution: In the remaining automotive market, cost-conscious manufacturers have aggressively substituted palladium with its cheaper sister metal, platinum.

This powerful narrative is responsible for the asset’s 70%+ price collapse from its 2022 peak. The market has fully priced in this story of weakness.

3. The Counter-Argument from Data: The Duo-Lens View

Our process demands we trust data over stories. While the narrative is bleak, our proprietary system reveals a different reality taking shape.

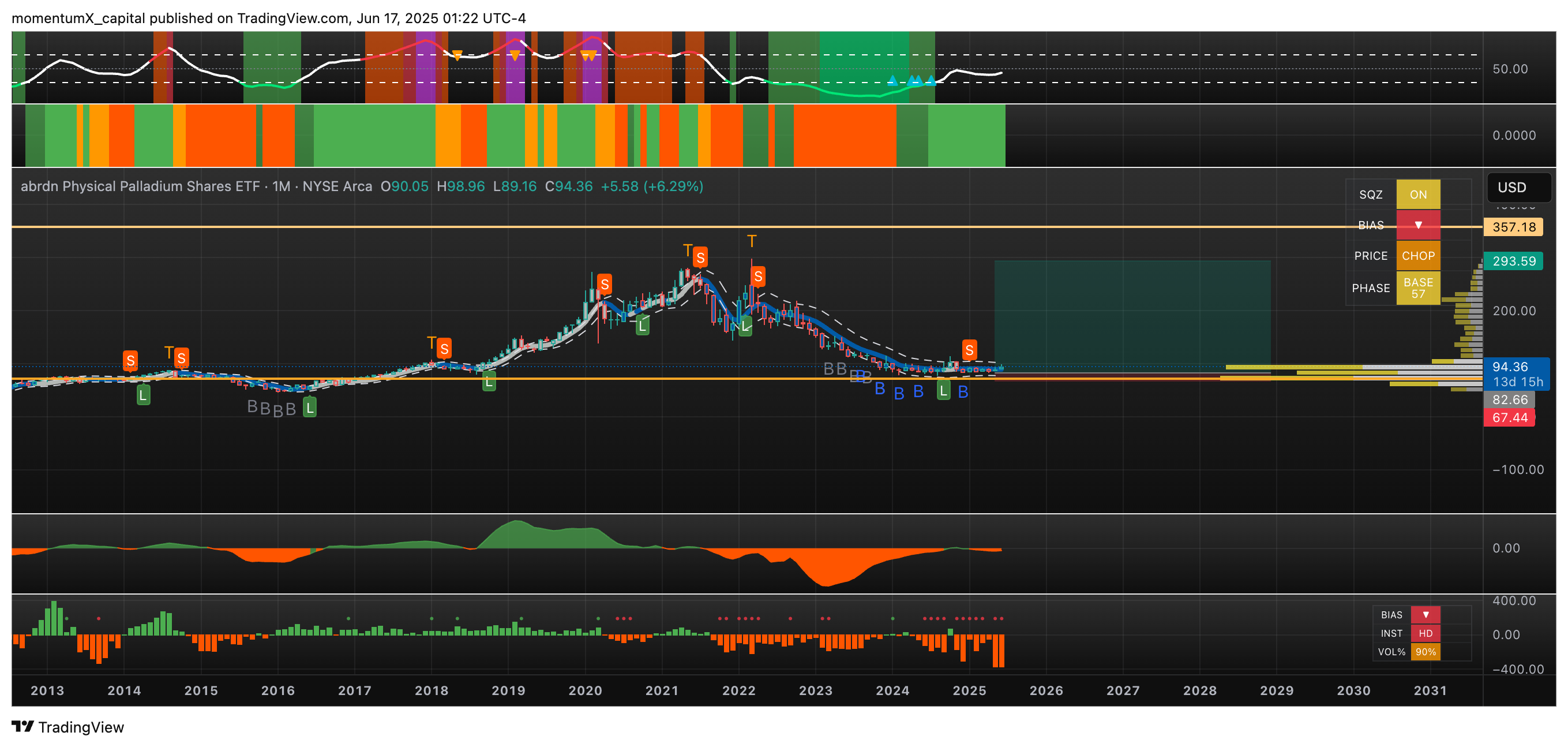

- Lens 1: Timeless Wisdom (The Foundation): Our system identifies a 16-20 month accumulation base, the kind of structural foundation required for a new, durable uptrend. However, its current Base Quality Score is 52/100. This "B-Grade" rating signifies a solid, but not yet perfect, foundation, implying that risks of failure or re-testing remain elevated.

- Lens 2: Modern Quant (The Ignition): The recent action on the 3-Week timeframe shows a breakout from this base, crucially supported by a spike in institutional volume. This is an actionable, quantitative signal that the dynamic may be shifting from accumulation to the beginning of a Mark-Up phase.

4. The Geopolitical Framework: The Structural Floor

A comprehensive analysis must account for geopolitics, separating material facts from seductive but minor narratives.

- Immaterial Factors: Niche demand from sectors like defense, while real, is a rounding error in the global supply/demand equation. It lacks the materiality to alter the primary thesis.

- The Critical Supply Risk: As confirmed by CSIS data, Russia is the world's largest holder of palladium reserves. This presents a significant and permanent supply-side risk. The crucial second-level question is why the price collapsed despite this known risk. The answer is that the market has, until now, judged the certainty of demand destruction to be a more powerful force than the potential for a supply disruption.

We view this geopolitical risk not as an immediate price catalyst, but as a structural support beam. It establishes a strategic floor for the asset, preventing complete collapse and creating the fundamental value proposition upon which the current accumulation base is built.

5. Cycles Overlay: Short-Term Bullish but within Prolonged Decline

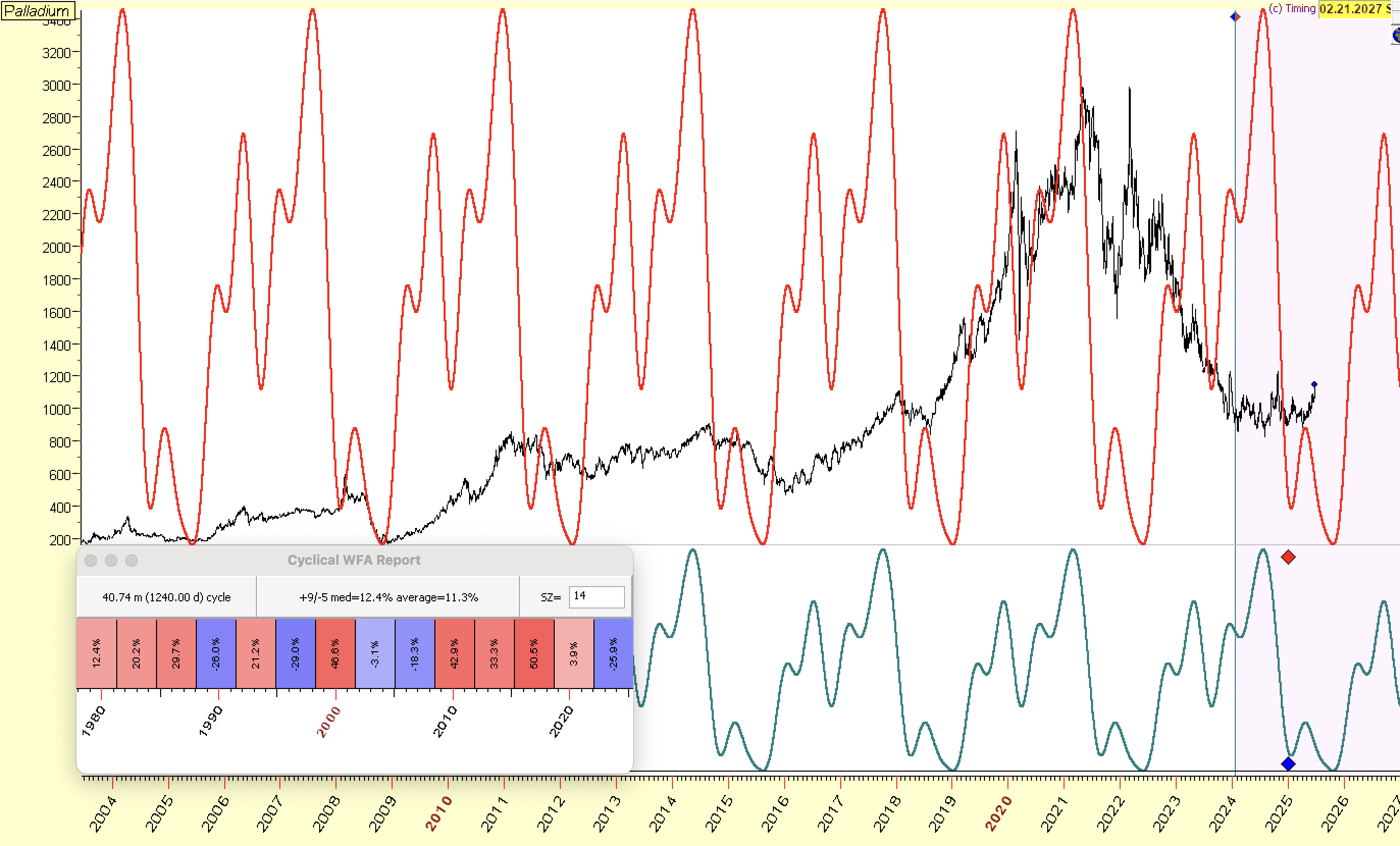

3.5 year cycle has rather weak correlation score with cycle lows often coming later indicating prolonged bearish price action. Last cycle low was Dec 2021, so current cycle already failed (price is below where cycle started) with very pronounced left translation (peak in the first half of the cycle). While ideal low is projected around end of 2025, given the above analysis we can potentially expect next low to fall a bit further out into 2026.

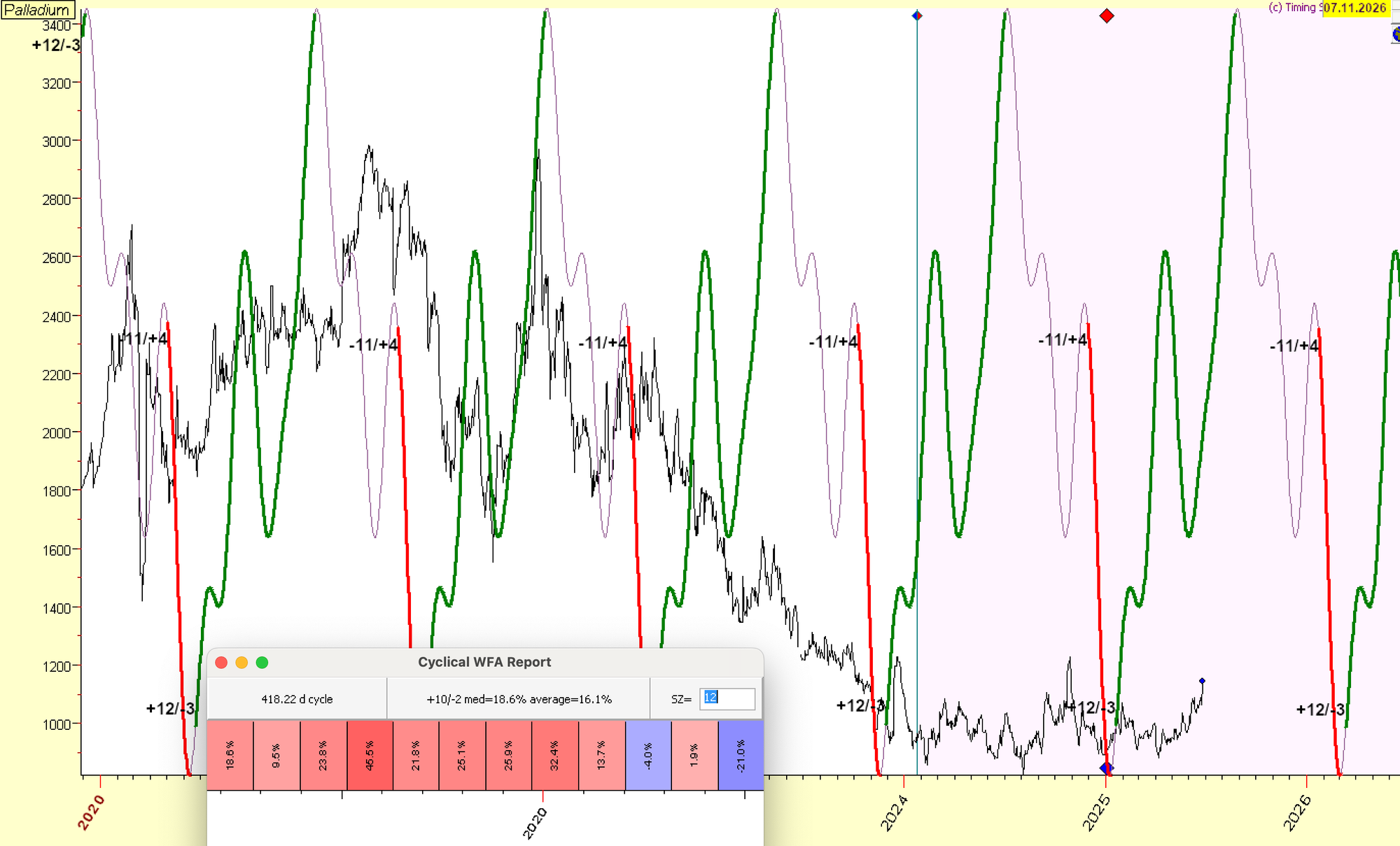

18 Month nominal cycle (418 days average length) is rising and has more time to push higher this summer. Weak period is early next year into 2026 low where in our opinion 18 month cycle low will sync up with 3.5 year cycle low to form next major buy point for what could be multi year trend move:

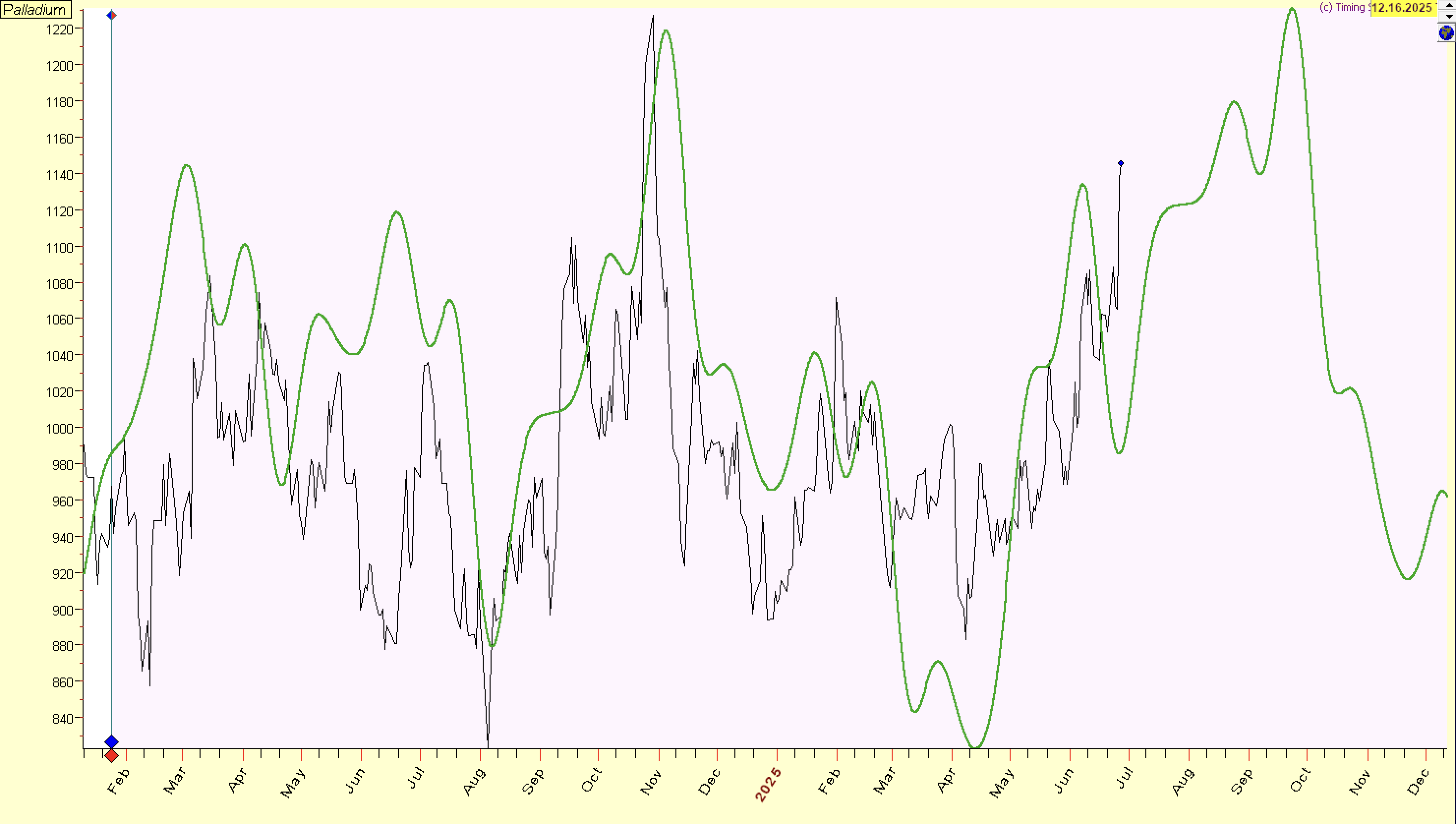

When we add shorter cycles, we get a more detailed view with bullish bias in Q3 2025, followed by Q4 decline where longer cycles should push price lower. Note, projection was created in January 2024, so all the data since then is out of sample, i.e. forecast.

6. Synthesis: The Inflection Point

The narrative and the data come together to define the current inflection point. The two-year downtrend was the market fully pricing in the negative automotive story. The accumulation base is the battleground where that narrative exhausts itself against the hard floor of geopolitical scarcity.

The recent breakout is the first tangible evidence that the balance of power in this battle may be shifting. With the bad news potentially priced in, the ever-present supply risk can begin to exert its influence on price once more.

7. Strategic Implications & Risk Management

This is not a simple "buy" signal; it is a nuanced opportunity that demands a sophisticated strategy.

- A Tale of Two Timeframes: The 3-Week chart provides the signal to engage, while the "B-Grade" Monthly chart provides the context for managing risk.

- Risk-Adjusted Positioning: The sub-par Base Score warrants prudent risk management. This could include smaller initial position sizes and defined stop-losses to protect against a "fake breakout," a scenario whose probability is elevated due to the imperfect base.

- Price Objectives: Our price objectives are checkpoints, not predictions. The confluence of our models identifies the $140-$145 zone as the first logical and high-probability target for a successful breakout. We will re-evaluate the market's structure if and when this checkpoint is reached.

8. Concluding Principle

Superior returns are rarely found in the comfort of consensus. They are generated by identifying the precise moment when a deeply-ingrained narrative has been fully priced into an asset, allowing objective data and underlying structural realities to reassert their influence.

The setup in palladium is a masterclass in this process. It requires intellectual honesty, a dual-lens perspective to see both the signal and the context, and the decisive patience to act when the data provides a quantifiable edge.

Cycles analysis suggests we have more upside in the current up phase but should be ready for Q4 2025 decline into 2026 major 3.5 year cycle low as recessionary impulse will likely affect car demand and put pressure on palladium demand.

Below this point is an update from Teddy Marks and our quant team for subscribers only - as you will see Teddy is quite a bit more excited about the prospects and outlines a good risk management framework for us.

This post is for subscribers on the THE PRO and THE INSIDER tiers only.

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.