Level 4: Turbo Quant

In any competitive field, the quality of your results is determined by the quality of your questions. Most traders in the digital asset space are asking the wrong one. They are consumed by daily volatility, asking, "What will the price be tomorrow?" This is first-level thinking—an exhausting and unwinnable game of reacting to noise.

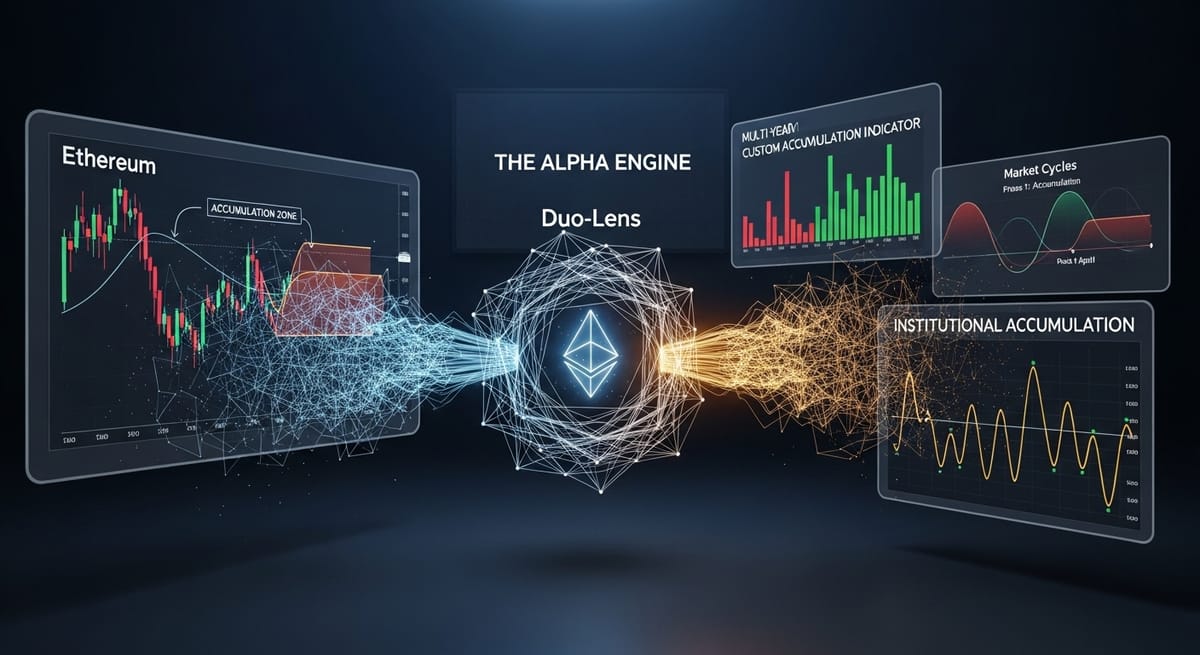

The far more incisive question is the one that underpins our entire philosophy: "Where are we in the market cycle?" For capital-intensive assets like Ethereum ($ETH), compelling institutional accumulation zones are rare, appearing only every few years. Our data indicates we have entered such a period.

The 2nd indicator from the bottom is our institutional accumulation indicator, last time it gave a signal was in 2022 June and then in November when institutions were buying at $0.95-1.2k / ETH.

The Narrative of Confusion vs. The Reality of the Data

The first-level narrative is one of confusion and paralysis. Choppy, sideways price action is misinterpreted by the crowd as a lack of opportunity. They are waiting for an explosive, obvious trend to tell them it’s safe to act. This is precisely the noise our system is engineered to filter. We trust price and data, not popular opinion.

So, what does the data say?

Our proprietary Duo-Lens system provides a clear, two-fold answer that cuts through the market chatter.

- The Timeless Wisdom Lens (The Cycle): The first lens applies the codified framework of market phases. What we observe in Ethereum is a textbook Accumulation Phase (Phase 1). A deep and durable structural foundation is being built, bearing a striking resemblance to the major bottoming process seen in late 2022. This is the "cause" that precedes a significant "effect."

- The Modern Quant Lens (The Confirmation): The second lens confirms this cyclical view with hard data. Our proprietary accumulation indicators, which track institutional capital flows, began to show quiet but persistent buying in mid-April and continued throughout May. While retail traders were sidelined by the lack of a clear trend, institutional capital was methodically building positions at favorable prices.

A Second-Level Approach to Risk

Intellectual honesty, a trait we value above all else, requires a sober assessment of risk. Could near-term volatility push prices down to test the $2,000 - $2,300 range for ETH? Certainly. The probabilities are favorable, but they are never certainties.

However, the second-level thinker interprets this possibility not as a threat, but as a potential opportunity. Our internal analysis identified the initial accumulation signals in April; any significant dip from here would not be a reason for panic, but a chance to add to core positions at a greater margin of safety. A test of the lower bounds of a confirmed accumulation zone is a gift to the patient investor.

The Timeless Principle

This analysis brings us to a foundational investment principle: The most powerful and durable market advances are built on a foundation of quiet accumulation, long before the crowd feels it is safe to participate. The data is clear—the smart money has made its move. We trust the process, not the narrative, and have positioned our portfolio accordingly.

A separate, detailed analysis of select altcoins that stand to benefit from this major cycle turn will follow. Until then, manage risk, keep leverage low, and focus on the right questions.

In the section below we provide code examples on how to trace both low accumulation periods and trace institutional buying finger prints.

This post is for subscribers only

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.