January 7, 2026

Memo to MomentumX Investors:

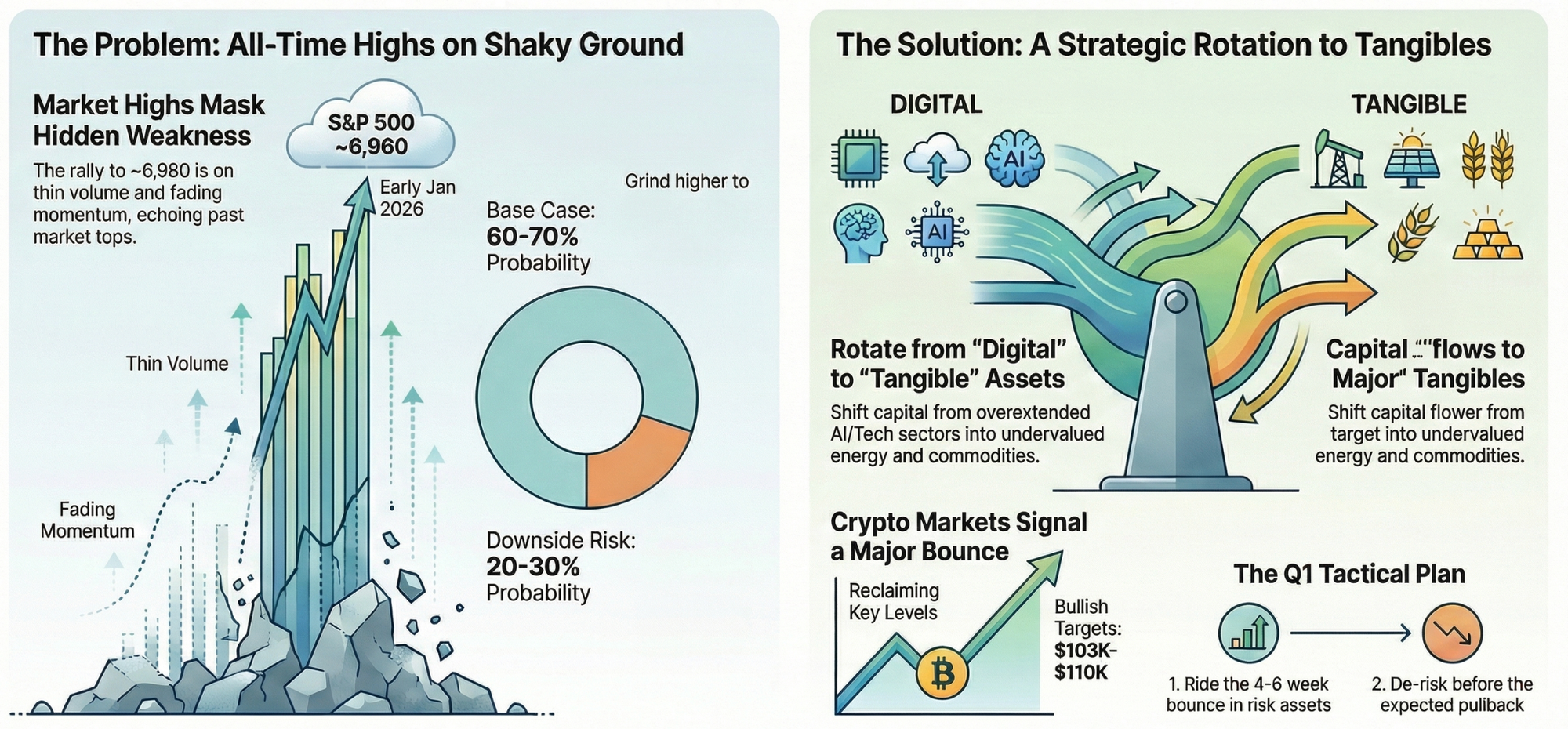

Happy New Year, legends. 2026 opens with a loaded setup: risk assets grinding to fresh highs amid rotational leadership, but second-level signals flash classic distribution characteristics. Discipline will separate winners from the crowd as we navigate the next 4-8 weeks of short-term juice before potential cracks emerge.The S&P 500 closed the first trading week of 2026 at new all-time highs around 6,960, extending the rally on resilient momentum and early-year flows. Yet beneath the surface, acceleration is fading, volumes remain thin, and overbought conditions stretch back to September—a textbook echo of the Dec '23–Feb '24 phase. This is smart money engineering upside to pull in retail while positioning for the turn. Our base case: mild gains or consolidation toward 7,100-7,200 (60-70% probability) over the coming weeks, providing asymmetric opportunities in rotational plays. Downside risks (20-30%) point to a 5-10% pullback if catalysts disappoint, with a deeper 12-20% correction likely late January or mid-February.Probabilistic view: Resilience holds short-term, but risks are underpriced. Fed pause likely in Q1 amid sticky inflation; geopolitical spillovers (Venezuela) contained so far but inflation-sensitive. Rotation into cyclicals, energy, and commodities gathers pace—this is where the edge lies.

Audio version available - for your car play, faster and easier to consume.

Alpha Brief:

Grinding Higher – The Distribution Setup

(3 min read)

2026 launches with a resilient grind: S&P 500 at fresh ATHs (~6,960), echoing late-2025's masked tensions. Range warfare thesis evolves—no washout imminent, but distribution hallmarks dominate: overbought since September, fading momentum, thin volumes. Retail euphoria draws capital; smart money rotates quietly. We're capturing short-term extension (probable turn late Jan/mid-Feb), prioritizing probabilities over certainty.

The Rotation Mechanism: AI Repricing in Motion Structural repricing accelerates—from AI concentration to tangible assets (energy, commodities, cyclicals). Consensus hugs silicon; flows target real-economy bedrock. Multi-wave compression via higher gaps builds energy for final leg. Extension to 7,100-7,200: high-asymmetry distribution, priming mid-year 12-20% correction as narrative cracks.

Technical Architecture: Key Decision Levels * ~7,000+ (Extension Zone): Caution—distribution prime unless breadth surges.

- 6,820-6,900 (The Floor): Critical weekly defense; bullish above.

- <6,820 (The Warning): Downside retest 6,600-6,500 (or 6,150-6,000)—high-asymmetry base for ~7,800 year-end.

2026 Performance Recap: Connecting the Dots Strong open on 2025 foundation (ETH/rare earth April entries, October crypto top call, ALB/SQM trims).

- YTD Performance: S&P +1.48% | Our Book +1.93% via rotations.

- Outlook: Bases confirmed across risk; turning points deliver juice. Path: Q1 grind 7,200-7,400, then H1 pullback.

Strategic Directives: The Resilience Trade Clarity over noise—selective dips to 6,820 for generational lows (commodities/energy).

The Plan: * Ride 4-6 week bounce in risk/crypto.

- Rotate overextended tech/AI into depressed reals pre-February turn.

- De-risk ~7,200—insulate vs. 12-20% wall, position for resumption.

Equities and Broad Market

Bullish structure intact above 6,820-6,900 support. Short-term momentum retains juice—enough to rally retail further amid rotational leadership. Yet leaders strain early: $PLTR shows broken 2W momentum, "T" top, negative volume—a harbinger for broader tops. Distribution grind echoes Dec'23-Feb'24: low-volume climb, fading acceleration.

- Probabilistic Base (60-70%): +2-5% to 7,100-7,200 next weeks.

- Underpriced Risks: Fed pause, debt rollover, AI concentration.

Crypto Majors ($BTC / $ETH): The Turning Point

Thesis sharply positive—roadmap inflection here. Extreme fear cleared, unlocking bounce asymmetry.

Core Setup: * BTC Price Action: Reclaiming $93K (~$92,500-93,000); coiled (explosive precedent).

- Signals: 3D buy signal locked; multi-frame bullish.

- Flows: ETF flows positive (+$471M Jan 2, ~$1.2B early); tax harvesting cleared.

- Sentiment: Fear & Greed rising; USDT dominance cracking (risk rotation).

- Targets: Path $94K $\rightarrow$ 103-110K; support $80,500-81,000$ (break is bearish).

- Action: Nimble/selective amid overbought—video signals incoming.

Altcoins: Bounce in Progress

Broad aggressive surge now consolidating—real demand supplanting leverage in rotation.

IGNITE PRO: We shared top 8-10 scanned setups by signal and spot strength. Set slightly lower targets given anticipated consolidation before next leg higher. Crypto Channels open for chats.

- Standouts: MEME.C & OTHERS.D flashing solid risk-on (charts today).

- Discipline: Edge in resilient names, not echoes.

Commodities & Great Rotation: Digital to Tangibles Pullback constructive: Gold (~$4,440–4,460) healthy amid contained geopolitics. Oil/gas exhausted—$BOIL reversal forming. Favor as correction alternatives; supply bottlenecks + inelastic demand fuel 2026 asymmetry. Core rotation: tangible cleanse of digital excess.

Sentiment & Forward View: Probabilistic Lean Bulls load Goldilocks and are true believers in BBB (Big Beautiful Bill) massive liquidity; bears hammer AI/debt. Near-term bullish tilt—H1 drawdown lighter (12-20%), constructive tangible shift. Contrarian: Record VIX shorts coil a bomb beneath euphoric distribution. Second-level edge is forged here.

How We're Playing It:

YTD Performance & Strategy

YTD Performance Metrics

Ignite Positioning at +1.93% YTD (outperforming S&P +1.48%). Early 2026 strength driven by targeted rotations and risk management—no major givebacks yet. We closed 2025 below our 115% target but still delivered strong outperformance. Tracking toward another banner year as rotational setups deliver.

Strategic Stance: Capital Deployment

Priority firmly on deployment - short-term juice and bottoming tangibles deliver awaited entries.

- Sectors: Increasing exposure in energy, commodities, and select cyclicals - building the rotation basket.

- Capture crypto bounce setups for the 4-6 week run.

- New Focus: Positioning select commodities (oil/gas reversal plays) and energy, with emphasis on nuclear - new briefing + signals coming this week.

- The Asymmetry: Inelastic demand meets supply constraints in real assets —trading at depressed levels despite structural tailwinds. Compelling multi-quarter to multi-year holds.

Key Updates This Week: * Crypto: Turning point confirmed—nimble adds on selective majors/alts (PRO setups live).

- Commodities: Accumulating reversal formations; $BOIL exhaustion signals prime entry.

- Equities: Buying dips above 6,820–6,900; monitoring leader strain for rotation triggers.

Actionable Takeaways

- RETAIL TRAILBLAZER: Focus on rotational deployment. Buy dips in generational-low equities (e.g., MRNA) and commodity/energy tangibles - more signals coming. As we issue tactical signals in risk assets/crypto, buy based on your risk tolerance—all positions are risk-managed via sizing, but if you can't stomach volatility, stay out.

- PRO: Jump on KINETIC videos and IGNITE PRO signals - top 8-10 alts shared with adjusted targets. Crypto Channels open; expect resilient, spot-strong plays to lead. Use Tactical Buys on Flight Deck to capture the 4-6 week risk rally into distribution.

- INSIDER: Quant screens firing on tangible rotations - new models and scans dropping soon for the rotation edge. Experiment with MXC PULSE and MXC SVSI. New exclusive indicators incoming this week.

✈️ The Flight Deck: Tactical Directives

Status as of: January 7, 2026

https://www.momentumx.capital/flight-deck/

Operational Alert: Real-time signals on MomentumX Ignite (Telegram/Discord).

- We have 4-6 weeks of risky assets and crypto run up - until Feb 2026

- New Focus: Positioning select commodities (oil/gas reversal plays) and energy, with focus on Nuclear - new signals coming this week.

- All detailed signals are in Discord and Telegram.

- Flight Deck was updated -

Note that we will be refreshing the new Performance Dashboard and Track Record vs. SP500 pages to support performance pricing - sections below, and Dahsboard screen will be updated respectively by this Friday, 9/01/2026.

Track active positions via the ledger — full transparency on entries/exits:

Deep Dive

Chart of the Week S&P 500 Dec '23–Feb '24 parallel:

Thin-volume grind, fading momentum—the distribution blueprint. Watch extension to ~7,200 before the turn.

Crypto Bounce: Majors & Alts MEME.C and OTHERS.D flashing strong risk-on signals - charts highlight resilience in the alt consolidation.

Our take: BTC, ETH, and these alt/meme indexes are firing hard. Smart money appears to be using crypto to rally retail as part of the final distribution leg - we're timing entries and exits precisely with these signals.

BTC and ETH buy signals confirmed. Alts signals are shared in IGNITE PRO.

Charts below.

Stay tuned for the full 2026 Market State of Play this weekend - finally - took us some time to get it ready.

MomentumX Team