Date: November 24 - 26, 2025

Subject: Alpha Report: Market Regime & Engine Calibration.

⚙️ Operational Note: Syncing to the New Cadence

Before we unpack today's signal, a quick protocol update:

We are in the final execution phase of the Engine 2.0 deployment. As we officially exit Test Access, we are rolling out site upgrades incrementally—specifically integrating the Flight Deck with our real-time Momentum X Ignite channels (Telegram & Discord).

The Status:

- Precision Over Speed: To ensure data integrity during this infrastructure switchover, we held back last week's report.

- Force Multiplier: The full team is now hired, onboarded, and positioned to execute the new mandate.

- The Context: For the full breakdown of our roadmap and the personal context behind recent delays, see the Engine Room Dispatch link below.

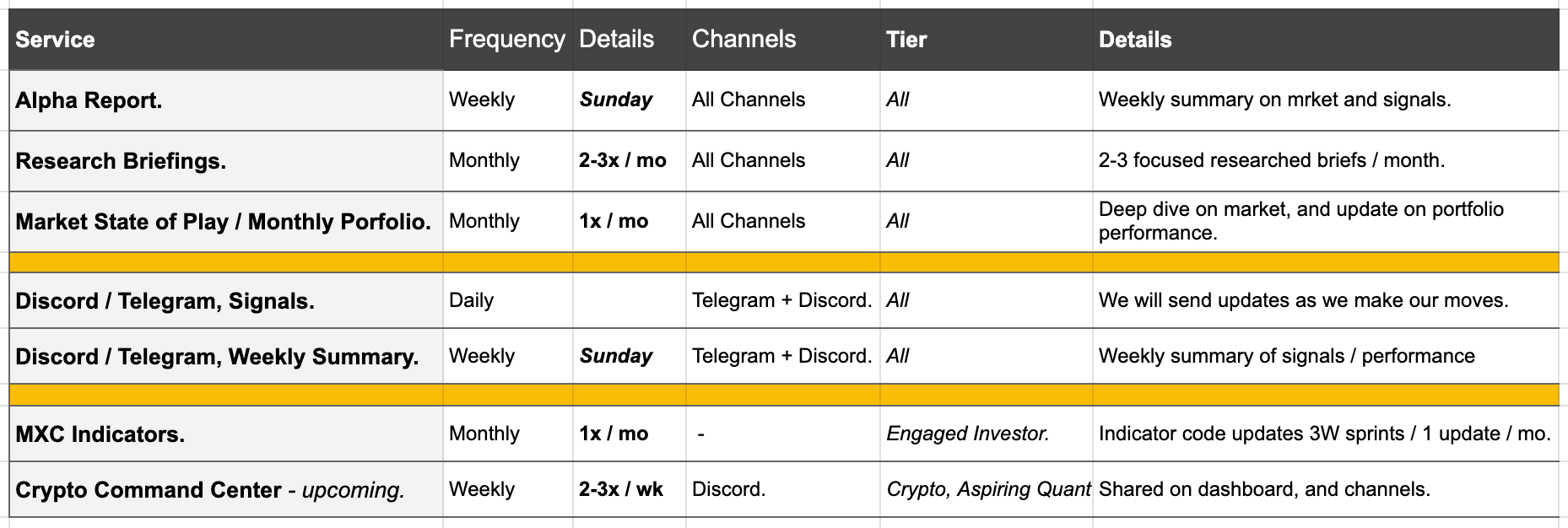

The New Schedule, as we shift into full service:

- Today: Tactical Signal Update.

- Next Deep Dive: The full-cycle analysis, new Alpha Report is in production for Sunday, Dec 1.

Let's look at the markets.

The 3 Min Alpha Brief

Our Updated Base Case: Approaching the floor before the rally. We exited the markets (reduced positions) in early October, sidestepping the bulk of this move. We are now almost at the bottom, which we expect to form this week or next. Ideal targets are SPX 6400 and QQQ 550-540 area; a high volatility event could briefly wick us down to the 6250 area. In the crypto universe, both BTC and ETH sit on key institutional support zones (Annual and Rally AVWAPs). We expect a reversal to confirm in the next 2-3 weeks and will be taking positions accordingly.

- US Equities: SPX Correction Status. The expected 6-10% correction is currently underway on both price and time, effectively "washing out risk" to build a sustainable structure for a Q1/Q2 rally. The ideal bottoming target is the 6350/6450 area, with a bear case risk of a sharp decline to ~6220 (200-VWMA) if consolidation breaks down. Once stabilized, the primary upside target is 7200, with potential to reach 7300.

- SPX Strategy: We are ceasing/closing shorts (taking profits) and view the current pullback as a "Buy The Dip" opportunity. We are shifting focus to specific "generational low" plays—which we have shared in the past, and already started sharing updates on in the Discord.

- Crypto Majors ($BTC, $ETH): BTC & ETH are parked squarely on the "smart money" support zone (Annual & Rally AVWAP) with a confirmed 'B' (bottom signal). The data points to a high-odds reversal kicking off in the next 2-4 weeks, and we are already seeing green shoots across several Alts.

- Bitcoin Context: BTC is at a local pivot with a likely retest of 103k–110k max; failure to break higher than 110k would confirm the bear trend. While the cycle is late-stage (technically over for BTC), we expect an ETH run to 5k–6k and asymmetrical upside in Alts.

- The Alts Play: This will be an "Alts bounce" targeting 200-300% returns, but make no mistake—broad Alt season was cancelled. Don't confuse the end of the party with the last dance. Trade accordingly.

How We're Playing It: YTD & Strategic Stance

YTD Performance Metrics. Our portfolio performance remains robust, standing at 104.5% IRR year-to-date (since March 2025). We are currently up 2.6% in November with a strategic target to close the month at ~5%. We successfully executed tactical shorts on RGTI and IONQ (capturing the reversion on extended quantum/tech plays); we are looking to close these soon to rotate capital back into accumulation.

- Strategic Stance: Capital Deployment. Our priority is shifting from capital preservation to aggressive deployment. We are mapping the next set of entries with a focus on increasing position sizing in "generational low" sectors: specifically Offshore Drilling, Cannabis, and PGM/Metals.

- The Crypto "Last Dance": We are activating the Crypto Command Center to capture the final, high-velocity rotation of this cycle. We anticipate 200-400% runs in select assets before the music stops. Our focus is on high-beta setups like ETHT, MTPLF, and CRCL. This is a tactical extraction operation, not a "hold forever" phase.

🚁 The Flight Deck: Tactical Directives

Status as of: November 26, 2025

Operational Alert: Real-time tactical signals have migrated to the live feed. For immediate execution directives, you must be connected to Momentum X Ignite.

The quickest way to follow our position updates on Telegram.

The quickest way to follow our position updates on Discord.

Protocol Update: The Flight Deck is upgrading to a standalone Command Center.

- The Link: Deploying today on this page and via Ignite channels.

- The Function: While Ignite handles speed (new directives & alerts), the Flight Deck will serve as the record. It will house the active Portfolio Positions, Tactical Trades (outside core allocation), and the immutable Track Record of our signals.

Current Directive: Monitor Discord/Telegram for entry triggers. Check Flight Deck for position management.

(current positions from Flight Deck for reference)

Peformance Dashboard will be updated later this week.

Our Performance Dashboard is your complete playbook. It tracks every asset on our radar—whether we're holding it or watching for an entry—and displays the critical data we use to make decisions, including its current asset phase and our quantitative score.

Actionable Takeaways

- Starter / Retail Trailblazer: Prepare for re-entry. We are issuing new signals to re-enter Generational Plays (Offshore, Metals) and position for the "Last Dance" in crypto.

Action: Sign up and wathc for Ignite. The focus is on high-conviction, structural value setups where the risk/reward is heavily skewed in your favor. - Engaged / Aggressive Investors Directive: Capture the velocity. Your mandate is to catch the "Last Dance" in crypto and lock in generational lows before the crowd returns.

The Upgrade: We strongly encourage you to deploy the Engine 2.0 Indicators immediately. These represent a significant leap in precision over previous tools and are essential for navigating the current volatility. - Aspiring Quants Directive: Access the source. We delayed the library release to ensure code integrity, but the wait is over.

The Drop: Next week, we release the Pinescript and Python Libraries and Source Code for select Engine 2.0 indicators. You will finally have the keys to look under the hood and experiment with the signal logic yourself.

Part 2: The Deep Dive

No research papers in this Report; instead, we focus on the critical technical setup forming right now.

Key Chart: Ethereum (ETH) & Bitcoin (BTC) (Detailed charts shared in Discord and Telegram)

- The Setup: BTC & ETH are parked squarely on the "smart money" support zone, defined by the Annual & Rally AVWAPs. Our engine has printed a confirmed 'B' (Bottom) Signal.

- The Confluence: We have a powerful alignment of the "B" signal with price touching the YTD and C1 (Start of Rally) AVWAPs. This confluence suggests institutional defense of these levels.

- The Probability: The data points to a high-odds reversal kicking off in the next 2-4 weeks.

- The Trigger (Critical): While the price structure is bullish, MXC VTM (Volume Trend Microstructure) is currently showing negative pressure. We need the VTM to flip positive to confirm the reversal before aggressive allocation. This is the "discipline" phase.

- Market Breadth: We are seeing early "green shoots" across many Alts which are bouncing from significantly oversold areas.

PS: Update From The Team.

We launched this pilot in September with a singular directive: to stress-test our algorithms and separate signal from noise alongside you. We targeted early November for full deployment, but life—much like the markets—delivered a volatility spike we couldn't predict.

Transparency is our edge. The last four-five weeks were a personal crucible. I’ve spent the majority of this time working from a palliative care unit, navigating the loss of two close family members.

While I addressed the immediate reality in front of me, the MomentumX Team didn't blink. They didn't just maintain the course; they expanded the infrastructure.

The Silver Lining: Focus in the Chaos There is a distinct clarity that comes from stepping back. Working from that hospital room forced a singular, high-level focus. It allowed me to look at our engine not as a day-trader, but as an architect.

We used this time to strip down the MomentumX Duo Lens Framework and rebuild it for speed. We are back online, and the engine is running hotter than before.

Test Access wraps in 14 days. Lets get to work!

MomentumX Team