The 3 Min Alpha Brief

US Equities: The Thesis Has Evolved

As noted in our last update, we successfully sidestepped the bulk of the late October correction by reducing positions early. However, the market has spoken: the recovery to ~6850 has decisively invalidated our "Final Washout to 6400" thesis. As per our previous directive, holding above 6750 negated the crash scenario. We are no longer digging trenches; we are actively navigating the grind.

The New Reality: Range Warfare

We have moved from "Washout to 6400" to "Range Warfare."

A rare technical signal (the Zweig Breadth Thrust) attempted to fire in late November. It was a "Near Miss" - strong enough to force hedged funds to panic-buy (preventing lower lows) but too weak to trigger an automatic bull run.

- The Result: The market is now stuck between Momentum (the recent chase) and Gravity (high valuations). Expect a choppy grind, not a straight line up.

The Setup: Three Decision Tiers

We are watching three simple lines in the sand:

- 6900+ (The Trap): Be careful here. Unless participation broadens significantly, a move above 6900 is likely a "bull trap" to sell into.

- 6801 (The Floor): This is our critical defense line. As long as we hold this weekly support, the consolidation is healthy.

- < 6700 (The Warning): If we lose this level, the "Near Miss" rally has failed, and we re-evaluate downside targets.

Strategy: The "Insulation" Trade

We are buyers of our "Generational Low" plays on dips into 6750, but we are NOT chasing the S&P 500. The index is expensive (~24x earnings). Bottom Line: The easy short is gone. The easy long doesn't exist. Be tactical, buy the generational value plays we mapped out earlier, and respect the range.

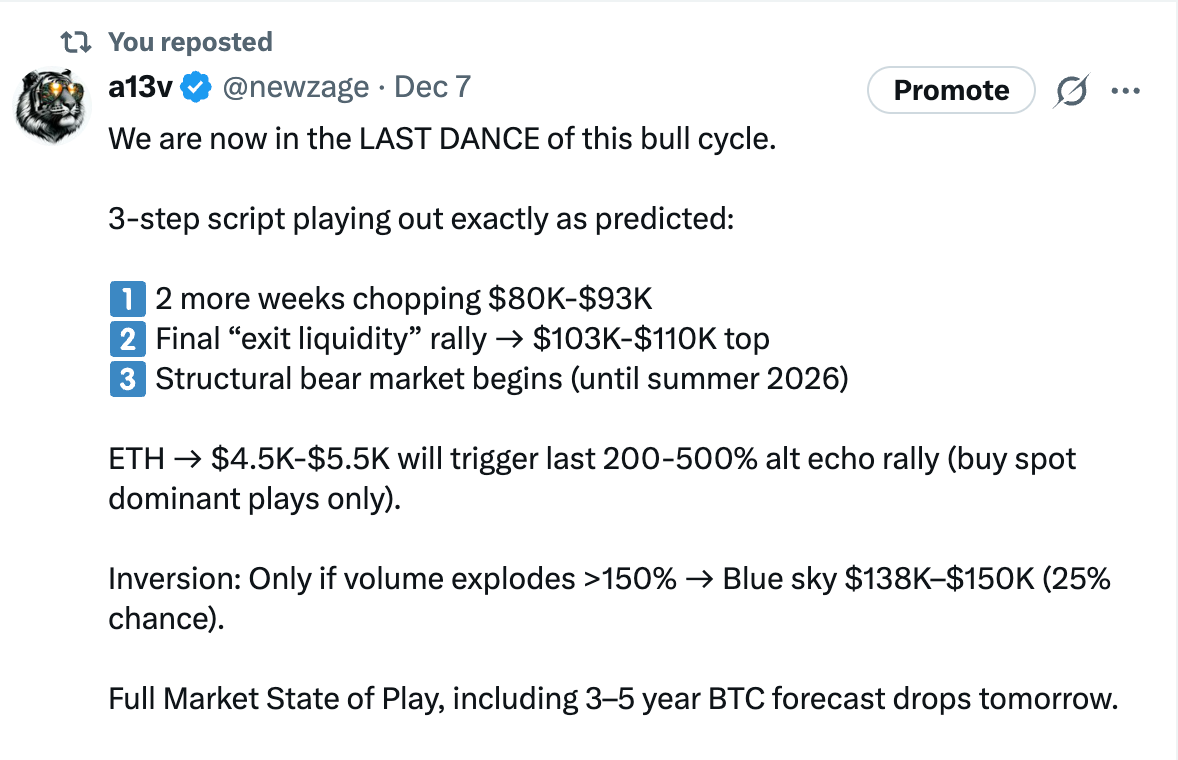

Crypto Majors ($BTC, $ETH): The "Last Dance"

Nothing has materially changed from our last update. The thesis remains intact: we are in consolidation above AVWAPS before the "final dance." Our recent tweet (below) is the best summary of our stance.

ETH / ETHT is very close t0 giving us a signal - but we believe both BTC and ETH may retest the range lows on a Hawkish FOMC update.

Alts will follow BTC from deeply oversold conditions - still expect 200-500% bounce for select Alts.

Action: Follow KINETIC FLOW, our crypto video update coming later this week. Your mandate is to catch the "Last Dance" and lock in generational lows before the crowd returns.

How We're Playing It: YTD Performance & Strategy

YTD Performance Metrics

Our portfolio performance stands at 98% IRR year-to-date (since March 2025). We gave back a few percentage points in December due to select tactical shorts (IONZ, RGTZ).

- The Error: Misstep driven by rigidity. We pressed shorts expecting the SPX 6400 washout even after the data shifted.

- The Antagonist: Our own Greed.

- The Fix: We are exiting these positions at SPX 6700 to realign with the current range-bound reality. Transparency is our baseline; we audit the losses as strictly as the wins.

Strategic Stance: Capital Deployment

Our priority is shifting from capital preservation to deployment into value.

- Sectors: We are increasing position sizing in Offshore Drilling, Cannabis, and PGM/Metals.

- New Focus: We are adding key plays in Shipping and Natural Gas (new reports live this week).

- The Asymmetry: Supply constraints meet inelastic demand, yet they trade at recession valuations.

Tactical Alts: When signals fire in the Ignite Channels, we will also play high-beta setups (specifically RIOT, SBET, MTPLF, XRP, CRCL). These are Q1 tactical plays, not long-term holds.

The MSTR Anomaly: MicroStrategy (MSTR) is a Short above $250 in this rally. The premium has entered a "Reflexivity Death Spiral." - read about it here:

This post is for paying subscribers only

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.