a13v, Tiger Quant

The new home-page and site is live.

Engine 2.0 is live. We are exiting Accumulation. SPX bottoming near 6400. BTC/ETH on institutional support. Shorts closing shorts; we are buying the dip. This is the protocol upgrade you've been waiting for. Read the full Alpha Report inside.

Founding Members & MomentumX Investors, We’re rolling out a major improvement to how Signals and market updates are delivered — and this change affects every MomentumX member. Starting now, all real-time Signal Alerts, quick market notes, weekly summaries, and cycle context will be sent instantly through our Momentum X Ignite

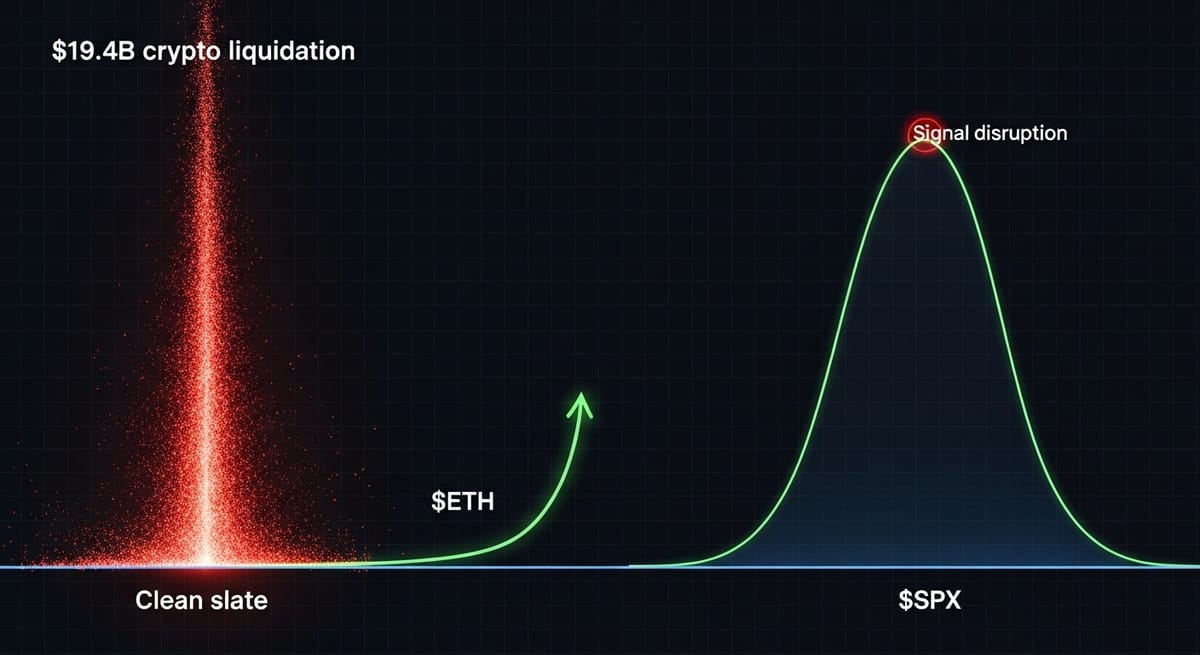

Crypto - $19.4B flush created a clean slate. We expect a final topping in TradFi ($SPX ~7k), which we'll use to sell the bounce. High probability remains for one last push for $ETH to a new ATH (~$6k)... $BTC's R:R is poor. The altcoin dream fades (30% prob). The play: use strength to de-risk.

The Powell pivot is here, creating a deceptive market. While equities enter a potential 3-6 week melt-up, crypto hesitates, flashing warning signs. We cut through the noise to identify the real high-conviction signal and the tactical plays required for this complex new market phase.

Don't get lost in the noise. The signal is simple: The Fed has capitulated. They've confessed they will sacrifice their 2% inflation target to save the labor market. This is a profound, unpriced policy shift. Our latest analysis unpacks the asymmetric trade setup.