Comprehensive Analysis Through the 2025–2026 Risk Reset

Executive Summary: The Digital Asset Treasury sector enters its most critical inflection point as a result of three converging forces: regulatory re-classification risk (MSCI exclusion decision January 15, 2026), technological proof-of-concept challenges (BMNR MAVAN staking launch Q1 2026), and structural valuation reset driven by spot ETF competition and forced consolidation.

Our comprehensive research validates that DATs will survive as an asset class, but only 50% of existing players will endure beyond 2026 - a contraction from 200+ companies to an estimated 1-2 dominant players per token.

The 3-6 month window from December 2025 through June 2026 requires disciplined portfolio rotation from premium-dependent leverage vehicles (MSTR, BMNR) into structurally advantaged income generators (SBET) and defensive operational businesses (MARA, RIOT), with substantial cash reserves (20-30%) earmarked for the inevitable "generational bottom" buying opportunity when BTC reaches $60-70k in Summer 2026.

Investors who successfully navigate this reset will position themselves to own the consolidated winners of the next cycle - entities that have proven capital discipline, staking revenue generation, and survival through macro stress.

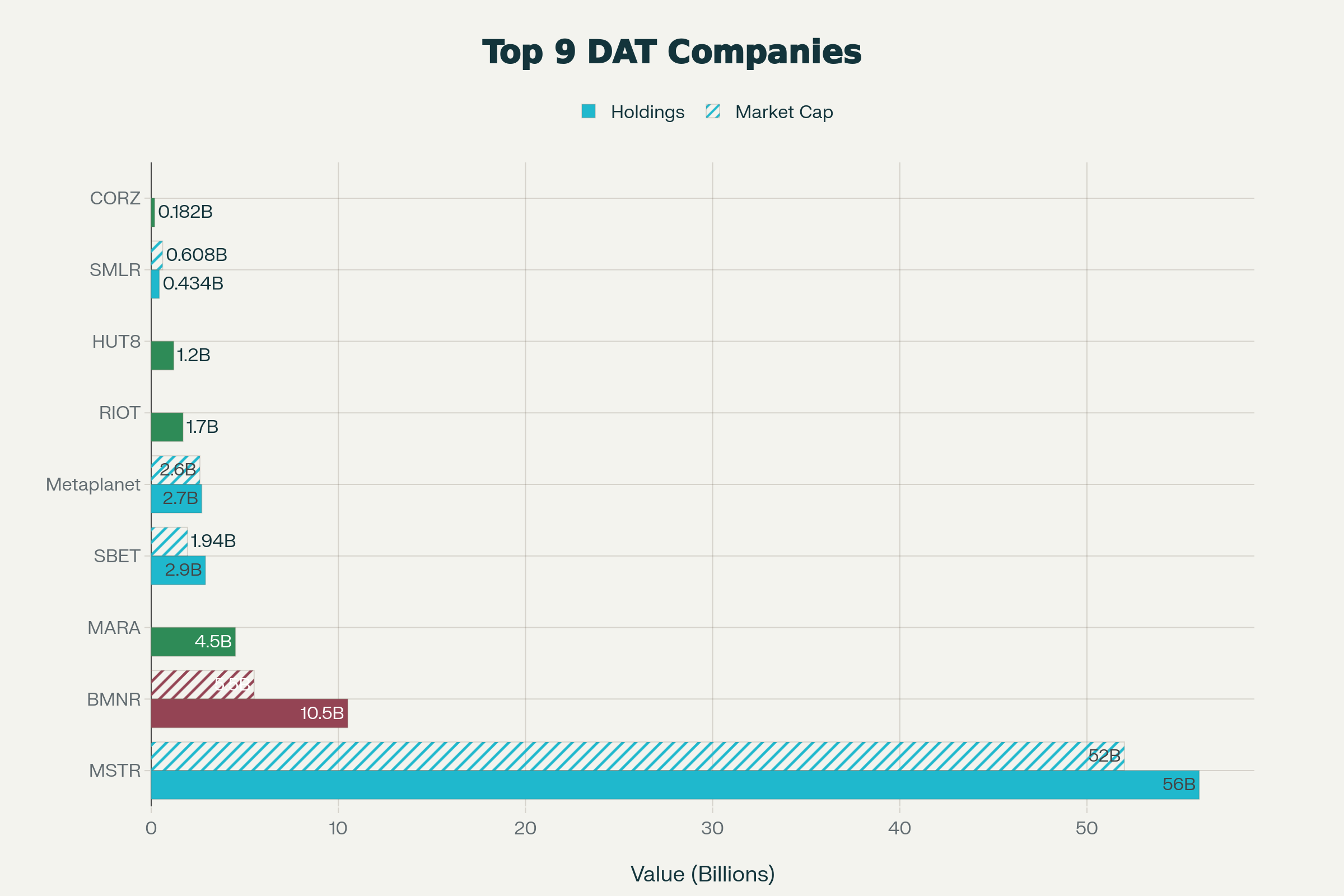

DAT Sector landscape showing Holdings Value vs Market Cap for top 9 companies. MSTR dominates with $56B in Bitcoin but $52B market cap shows compression. BMNR leads Ethereum with $10.5B holdings. Metaplanet and SBET emerging as Asia and staking plays

Understanding the what (Extinction Event) is only half the battle. You need the how (Execution) and the map for BTC and the Crypto market. We have mapped the specific pivot points, accumulation zones, and invalidation points for the next 3 weeks through 6 months in our comprehensive Alpha Report.

Part I: The Structural Basis for DAT Transformation

Understanding DATs in the Post-ETF Era

The fundamental misconception driving recent DAT underperformance is the belief that these vehicles are interchangeable with passive ETFs. They are not. DATs are closed-end operating companies that actively manage leverage, capital structure, and execution strategy in ways ETFs cannot replicate, but with corresponding operational and balance-sheet risks that ETFs entirely avoid.

The DAT Structural Advantages Over ETFs:

The DAT Structural Disadvantages vs ETFs:

| Dimension | DAT Risk | ETF Advantage |

|---|---|---|

| Operational Risk | Management execution, capital allocation decisions | Rules-based passive model |

| Leverage Risk | Balance sheet risk, debt covenants, margin calls | No leverage = no liquidation spiral risk |

| Valuation Risk | Trades at premium/discount to NAV (reflexive dynamics) | Intraday creation/redemption keeps NAV tight |

| Regulatory Risk | Index exclusion, reclassification (>50% crypto = fund not company) | Transparent fund structure, no classification ambiguity |

| Cost Structure | Management overhead, debt service reduces returns | Passive fee (0.2-0.4% for iShares/Fidelity products) |

This distinction is critical: DATs are no longer the low-cost entry point for institutions that they were in 2020-2024 when spot ETFs were unavailable.

Instead, they must justify their existence on thesis-intensive grounds: yield generation (staking), operational efficiency (mining), or founder credibility (Lubin). This is the "structural shift" that Bitwise CIO Matt Hougan identified in November 2025.

The Market Has Priced In DAT Compression

Across the entire sector, the natural state is now discount to NAV, not premium. The data is unambiguous:

- MSTR: Trading 1.16x NAV (historically 1.5-3.0x) — premium compression underway, mNAV <1.0 risk if MSCI exclusion confirmed

- BMNR: Estimated 0.43-0.50x NAV — distressed dislocation with $4B unrealized losses

- SBET: Trading 0.14x NAV — capitulation pricing despite generating actual staking revenue

- MTPLF: Trading 0.99x NAV — rare at-NAV pricing suggests Japanese markets less enthusiastic about DAT premium arbitrage

Per Bitwise's November 2025 framework, "the natural state of a passive treasury is a discount". This inverts the entire DAT investment thesis from "buy premium leverage plays" to "accumulate at distressed discounts."

Part II: The MSCI Binary Event and Forced Selling Mechanics

January 15, 2026: The Existential Inflection Point

On January 15, 2026, MSCI will announce its final decision on whether Digital Asset Treasury companies - specifically those where digital assets comprise >50% of holdings and are the core business activity - will be excluded from its flagship indices (MSCI USA, MSCI World, MSCI ACWI). This single decision point carries the potential to redistribute $2.8-8.8 billion in corporate ownership across a matter of weeks.

The Forced Selling Cascade:

- Immediate Impact (MSCI Exclusion Alone): JPMorgan estimates approximately $9 billion of Strategy's $59 billion market cap is held in passive MSCI-tracking funds. Exclusion from MSCI USA would force immediate selling of ~$2.8 billion worth of MSTR shares.

- Cascade Effect (If Other Indices Follow): If S&P, Nasdaq 100, and FTSE harmonize with MSCI's classification and exclude DATs with >50% crypto holdings, total forced selling could escalate to $8.8 billion across all indices.

- Valuation Collapse Mechanism: Forced equity selling does not directly force Bitcoin sales, but it does:

- Depress the stock price below fundamental NAV

- Compress or eliminate the NAV premium that enables accretive capital raising

- Weaken the company's ability to issue stock or raise new capital

- Potentially breach debt covenants if stock-based lending or convertible debt is involved

- Create the conditions for the "death spiral": forced deleveraging → asset sales → further price pressure

- The mNAV 1.0 Threshold: This is where Strategy would face an existential choice. CEO Phong Le has publicly stated the company could engage in "Bitcoin sales as a last resort" if mNAV falls below 1.0. Currently at 1.16, a 15% decline in either BTC price or stock price could breach this threshold.

Historical Precedent: While DATs are a novel category, the index exclusion impact can be modeled from fund reclassification events. When active ETFs were subject to new tax rules in 2018-2019, similar forced-redemption cascades occurred. The difference: those were spreads of 200-500 basis points of underperformance; a multi-billion-dollar sovereign wealth fund exclusion event could easily trigger 1000+ basis point underperformance.

Post-Decision Scenario Planning

This post is for paying subscribers only

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.