EXECUTIVE SUMMARY: THE END OF THE MONOPOLY

To the consensus observer, MicroStrategy (MSTR) is a Bitcoin proxy. To the forensic analyst, it is a financial machine built for a specific era - an era that is ending. We are transitioning from the "Accumulation Phase" to the "Consolidation Phase," and the mathematics of the sector are being rewritten.

The central thesis is unambiguous: The "Saylor Premium" ($46/share) is a relic of a monopoly that no longer exists.

For four years, MSTR enjoyed an enclosure: it was the only vehicle for institutional leverage. That enclosure has been breached by three forces: the efficiency of spot ETFs, the yield of emerging competitors (SBET, BMNR), and the "Chronos Constraint" of the 2027 maturity wall.

We project the premium will compress from ~$15 billion to near-zero by 2028. This is not a failure of the company; it is the inevitable efficiency of a maturing market.

The trade is no longer "buying Bitcoin"; the trade is "selling the premium" and rotating into yield, defense, and eventually, deep value.

- Report Series Part 1: Crypto's Last Dance and DAT Sector Reset

- Part 2: MicroStrategy Strategic Vulnerability Assessment

I. THE CAPITAL STRUCTURE TRAP: A FORENSIC AUDIT

1. The "Volatility Subsidy" (The Convertible Debt Stack)

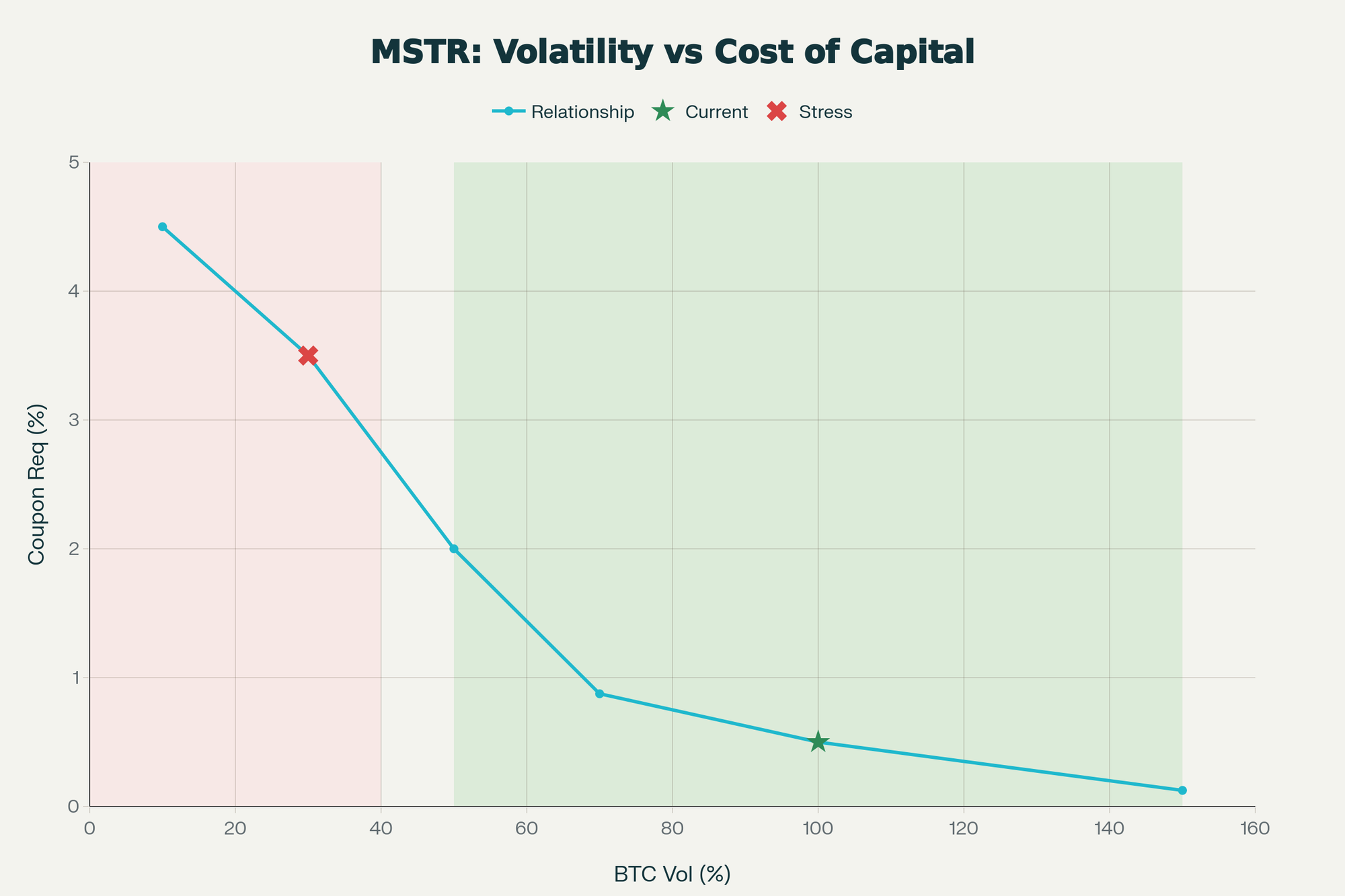

The $8.2 billion in convertible notes sitting on MSTR's balance sheet is not debt in the traditional sense; it is a Volatility Short. The weighted average coupon of 0.4% is an anomaly subsidized by the option market. Bondholders accepted near-zero interest because they were purchasing a "call option" on MSTR's wild volatility (100–160% annualized). They are arbitrageurs, not lenders.

The Risk: Volatility Normalization

As Bitcoin matures and institutional adoption deepens over the next 3–5 years, its volatility will structurally compress. If implied volatility drops to 20–30%, the option value in MSTR’s debt evaporates. Bondholders will no longer subsidize the company; they will demand credit-risk coupons of 3.5–4.0%.

- The Cascade: This triggers a shift in annual interest expense from ~$33M to ~$287M. This 8x multiplier destroys the accretive issuance model.

The Counter-Thesis: The Volatility Persistence Paradox

Intellectual honesty demands we ask: What if we are wrong? If Bitcoin remains a "Wildcat Asset" with volatility permanently above 60%, MSTR’s engine continues to hum. In this scenario, the 0.4% coupons remain viable. However, this scenario implies Bitcoin fails to become a global reserve asset (which requires stability). Thus, the Bull Case for MSTR’s structure is implicitly a Bear Case for Bitcoin’s adoption. You cannot have both global adoption and wild volatility forever.

This post is for paying subscribers only

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.

![DAT Sector Reset Part 2: [Micro]Strategy, The Bitcoin Treasury Paradox](/content/images/size/w1200/2025/12/Whisk_89ec8117d0e5c8fb9514ddb6e2b6b0fadr.jpeg)