While many investors see China through a lens of fear—tariffs, regulation, and geopolitical tension—our process compels us to see it through a lens of data. China in late 2025 is at a rare inflection point, defined by powerful undercurrents like the historic narrowing of the A-H share premium and the geopolitical shockwave of the DeepSeek AI breakthrough.

Fear creates opportunity, but only a disciplined, adaptive process can tell if that opportunity is real. This briefing is a look inside our workshop. It’s an illustration of how we apply our foundational protocol and enhance it to navigate this complex market.

Our Protocol: The Anatomy of an Edge

Our entire investment philosophy is built on a repeatable, five-step protocol designed to filter market noise and isolate the signal of institutional action.

- The Hunt: We begin by identifying assets in a multi-month or multi-year basing stage (Phase 1).

- The Footprints: We then detect quiet accumulation—periods where volume pressure builds without significant price moves.

- The Confirmation: We cross-reference the chart data with insider and institutional buying.

- The Setup: As a base matures, we often sell puts to generate income while we wait.

- The Strike: On a definitive buy signal, we scale into the position with our disciplined 40-40-20% protocol.

For a market as complex as China, this core protocol requires additional layers of analysis to manage risk and identify true conviction.

Critical Enhancements for the Current China Environment:

- DeepSeek Validation Filter: We must now screen for companies that directly benefit from China's "Sputnik moment" for AI, which has validated its tech self-sufficiency strategy. This includes AI model developers and cloud infrastructure providers.

- Southbound Flow Validation: The unprecedented US$100+ billion in southbound capital flows into Hong Kong in H1 2025 is a primary conviction indicator. Our process must now incorporate daily southbound buying pressure and a focus on H-share liquidity.

- Geopolitical Risk Assessment: Every China position must be stress-tested against US-China tensions, technology export controls, and potential tariff escalations.

The Hunt & Confirmation: A Live Walkthrough

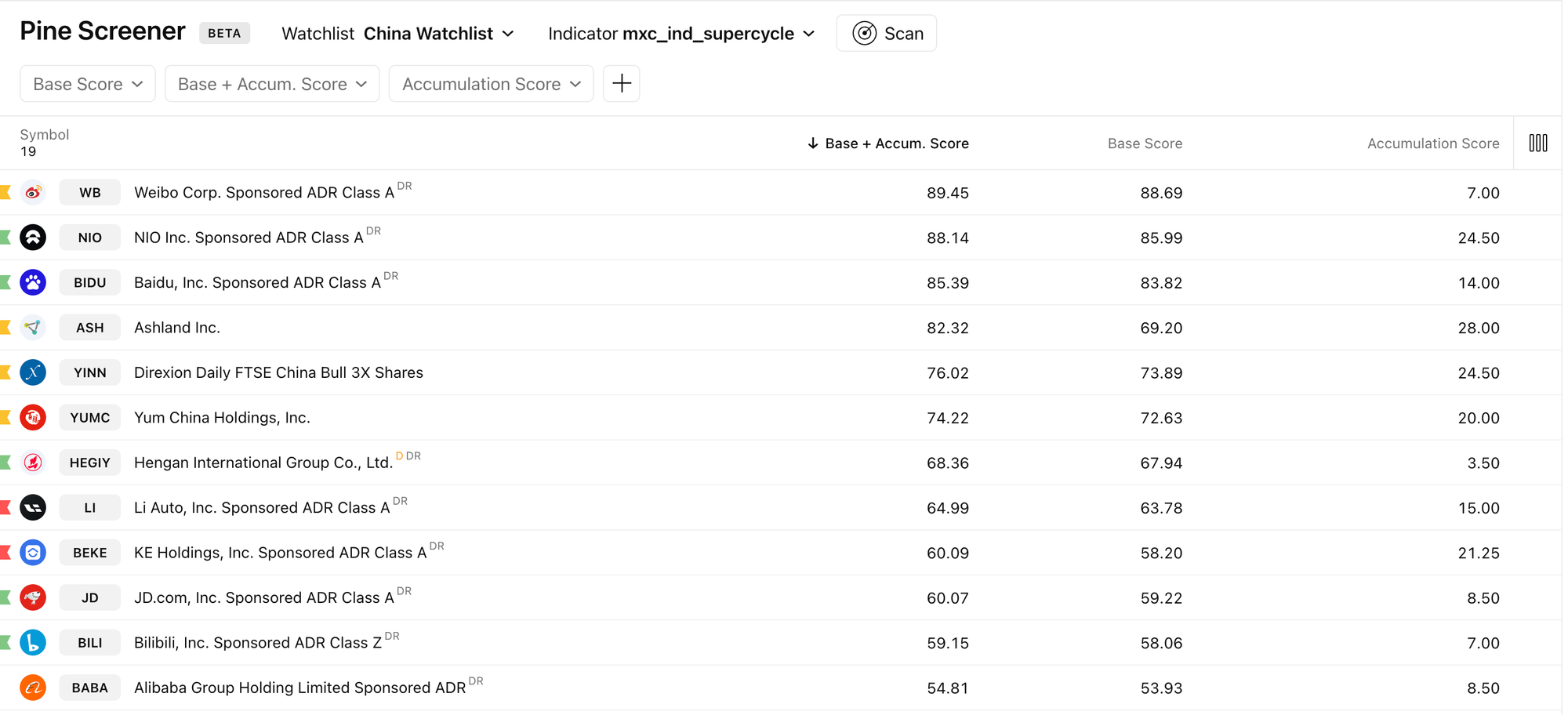

Applying our enhanced framework, we re-scan the market. Our initial quantitative screen provides the following top 12 candidates.

Enhanced Analysis & Final Shortlist:

Applying our filters, we narrow the list. BABA, BILI , JD and BEKE are eliminated due to low basing + accumulation scores. Next, we apply our qualitative and strategic checks. This analysis yields our final shortlist:

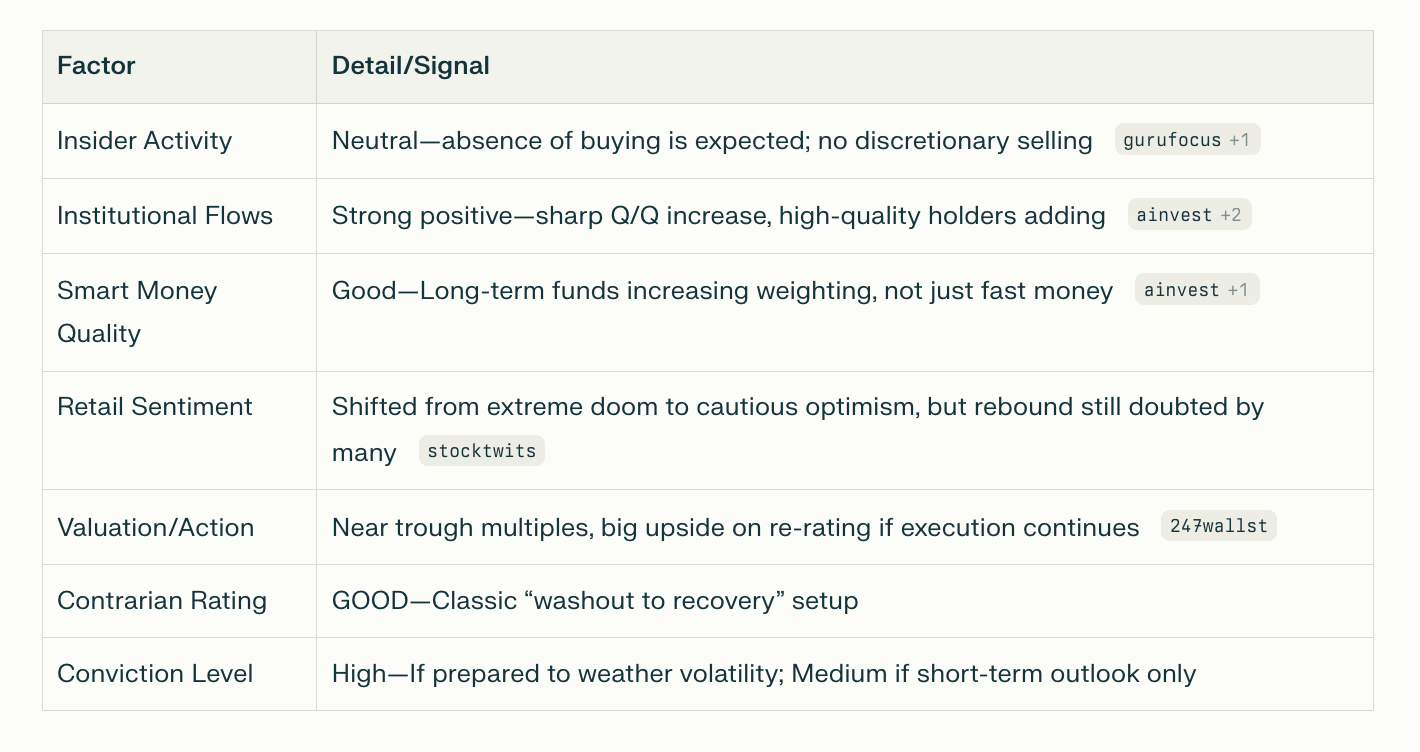

NIO (NIO Inc.): High conviction. The stock has a pristine base structure and shows strong signs of both insider and institutional accumulation.

Overall Contrarian Rating and Conviction

Conclusion: NIO shows a strong contrarian setup: institutional “smart money” buying after peak pessimism, improving business performance, and valuation support. The shift is not fully priced in—reward potential is high for risk-tolerant, patient investors.

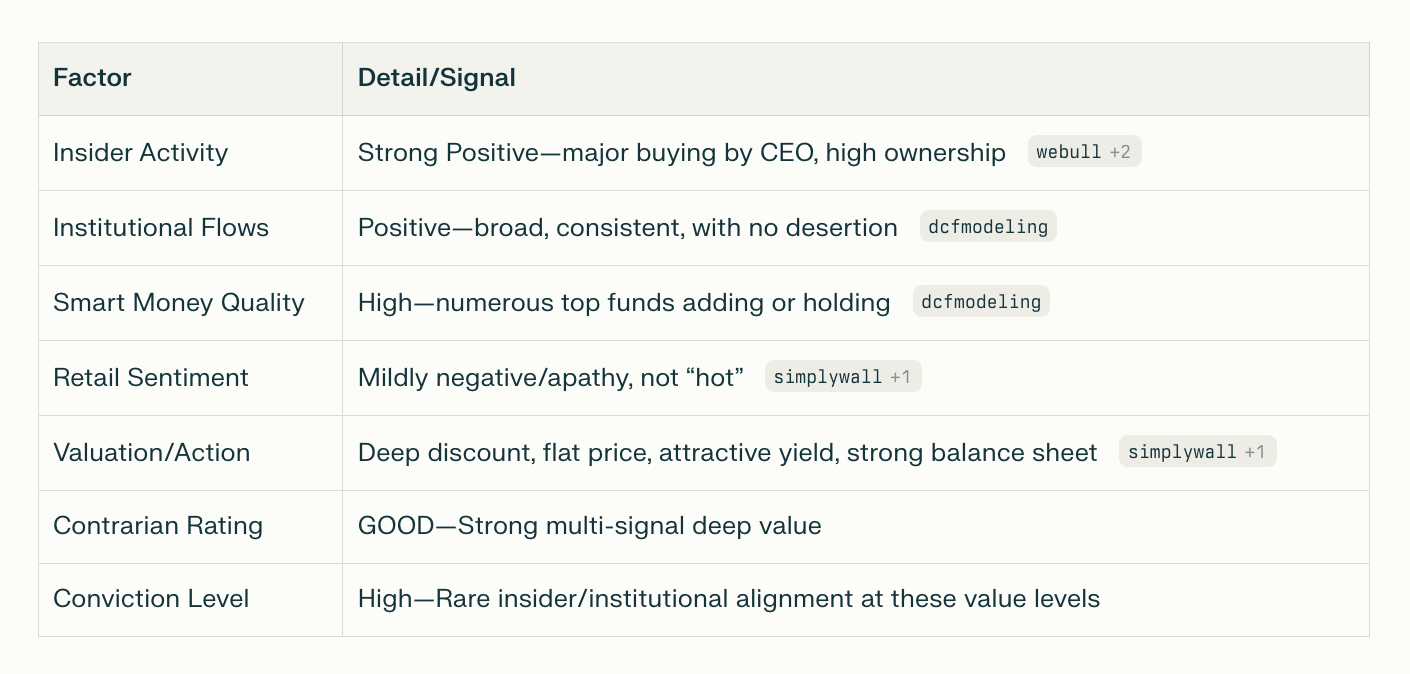

HEGIY (Hengan International Group): High conviction. A solid retail play that combines a strong technical base with verified insider and institutional buying.

Overall Contrarian Rating and Conviction

Conclusion: HEGIY is one of the purest deep-value, “smart money plus management” opportunities in China staples—a rare blend of high insider conviction, fund support, and attractive valuation with an apathetic, underappreciated retail base.

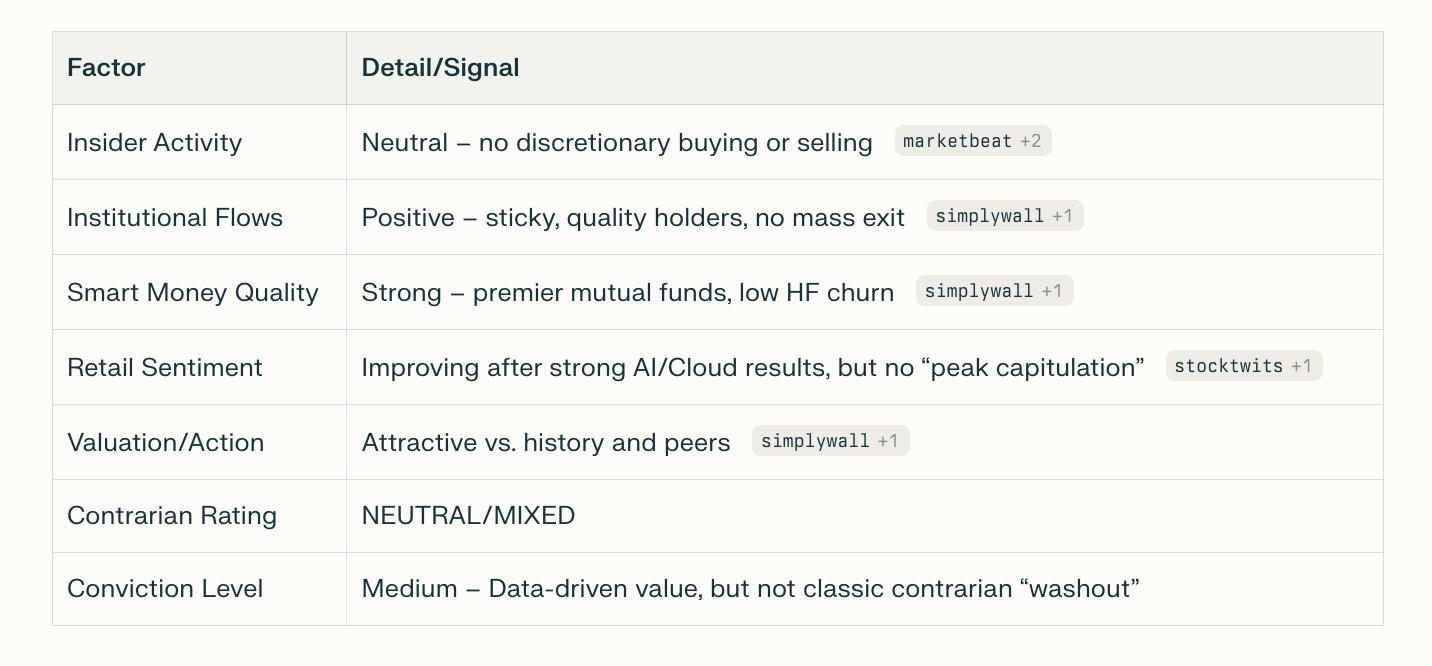

BIDU (Baidu, Inc.): Medium conviction. The base structure and early signs of interest make this a top setup to watch. Insider and institutional accumulation are reasonable and growing. As a core AI player, it aligns with our DeepSeek filter.

Overall Contrarian Rating and Conviction

Conclusion: BIDU offers a compelling “smart value” setup for patient investors, with the rare combination of sector leadership, sticky quality ownership, balanced sentiment, and clear earnings momentum—but it lacks a classic “contrarian capitulation” dynamic at present.

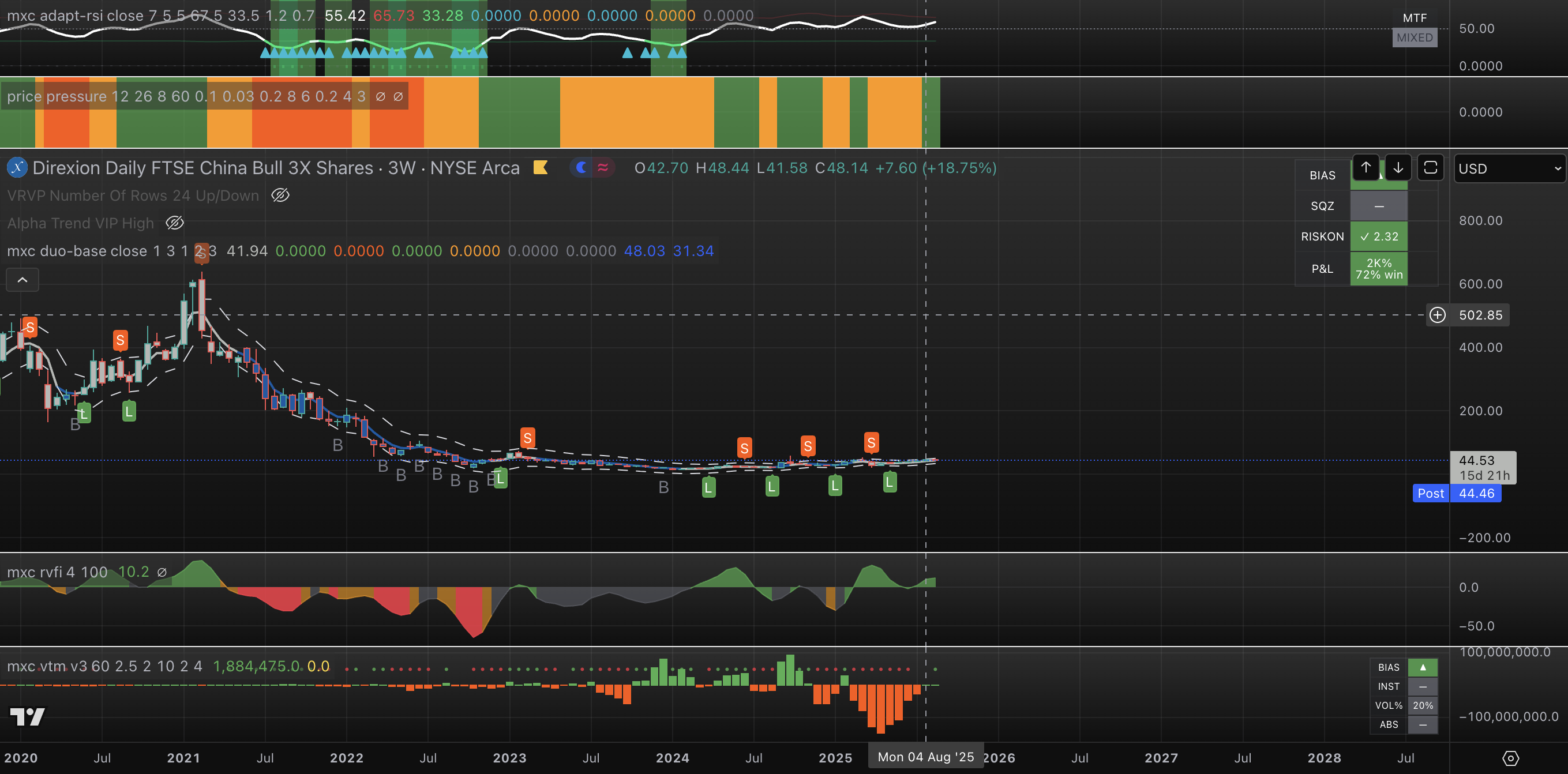

YINN (3X Leveraged China ETF): A potent tactical weapon. While ETFs lack insider data, the strong chart, high accumulation score, and robust YTD performance (48.2%) make it a compelling way to play a broad market move, provided risk is tightly managed.

A Note on Value Traps: Why Weibo (WB) Was Excluded

A key part of our process is filtering out technically attractive charts that are fundamentally flawed. Weibo (WB), despite its best-in-class basing score (92), is a textbook example of a potential value trap, leading to its exclusion from our final shortlist.

While the chart appears to be a "coiled spring," its underlying business faces significant structural headwinds. Revenue growth is stagnant, with a 0.29% decline in fiscal 2024, and the company operates in a fiercely competitive digital advertising landscape under heavy regulatory scrutiny. Furthermore, despite some insider buys from the lows, net institutional flows over the past 12 months have been negative, with outflows ($200.13M) exceeding inflows ($162.15M).

Our process demands that a technical signal be validated by fundamental strength. In WB's case, the weak growth prospects and net institutional selling pressure are significant red flags. This is a classic "cheap for a reason" scenario, where the low valuation reflects deserved market skepticism rather than hidden value. Until there is evidence of a real operational turnaround, the risk of a false breakout is too high for a high-conviction position.

Strategic Positioning for Late 2025

This refined analysis leads to a clear strategic playbook for navigating the market ahead of the pivotal October Fourth Plenum, which will set the stage for the 15th Five-Year Plan. Our focus shifts from broad sectors to a tiered "Alignment" scoring system, prioritizing themes with strong policy tailwinds and compelling technical setups.

- Tier 1 Priorities (Core Thesis):

- AI & Robotics: The heart of the thesis, validated by the DeepSeek breakthrough and an 18% CAGR outlook. This directly aligns with our position in

BIDU. - Advanced Manufacturing: Benefitting from "anti-involution" policies and the broader push for tech self-sufficiency. This underpins our thesis on high-tech producers like

NIO.

- AI & Robotics: The heart of the thesis, validated by the DeepSeek breakthrough and an 18% CAGR outlook. This directly aligns with our position in

- Tier 2 Opportunities (Tactical Plays):

- Domestic Consumption & Personal Care: While awaiting broader stimulus, select companies with resilient demand are attractive. This thesis supports our position in

HEGIY, a leading company in the personal hygiene products sector.

- Domestic Consumption & Personal Care: While awaiting broader stimulus, select companies with resilient demand are attractive. This thesis supports our position in

- Underweight (Sectors to Avoid):

- Legacy Platforms: We are underweight legacy digital advertising and traditional e-commerce platforms that face significant structural and regulatory headwinds.

Conclusion: An Illustration of an Evolved Process

The purpose of this briefing is to illustrate our evolved process in action—showing how we filter a complex universe like China down to a handful of actionable ideas. A final decision to deploy capital would, of course, require the deeper fundamental and quantitative validation reserved for our core portfolio positions.

That said, the signal is becoming clear. China in late 2025 is not a market for simple templates; it is a market for adaptive, disciplined processes. The convergence of the DeepSeek AI breakthrough, A-H premium compression, and impending policy clarity creates a rare opportunity. Success requires a focus on AI-aligned, H-share listed companies, timed ahead of key policy catalysts.

This is how we play a more intelligent game.

Disclaimer: This research is for informational and educational purposes only and does not constitute investment advice. Securities involve a high degree of risk. Investors should conduct their own independent due diligence or consult a licensed financial adviser before making any investment decisions.

Appendix and Glossary

1. The A-H Share Premium Narrows

This is a powerful signal about where China's own money is flowing.

- What it is: Many large Chinese companies are listed in two places: as A-shares on mainland exchanges (like Shanghai) primarily for Chinese citizens, and as H-shares in Hong Kong, which are open to global investors. Historically, A-shares have traded at a significant price premium over their H-share counterparts for the same company. The "A-H premium" is the size of that price gap.

- What's happening: That premium has shrunk to a five-year low. Mainland Chinese investors are now pouring unprecedented amounts of money into the cheaper H-shares in Hong Kong through a system called the Stock Connect. In the first half of 2025 alone, these "southbound flows" exceeded US$100 billion.

- Why it matters: This isn't just a technical detail; it's a structural shift in capital allocation. It signals that China's own savvy investors see better value and opportunity in the globally-facing Hong Kong market. For an outside investor, this means the historical "H-share discount" is disappearing, and following these massive southbound flows can provide a strong liquidity tailwind.

Think of it like two identical houses for sale, one in a members-only country club (A-shares) and one on the public market (H-shares). For years, the country club house was much more expensive. Now, the club members are rushing to buy the public one, signaling that's where they see the real value.

2. The DeepSeek AI Breakthrough

This is the "Sputnik moment" that validates China's entire technology strategy.

- What it is: On January 20, 2025, a Chinese company released an AI model called DeepSeek R1. This model demonstrated capabilities that rivaled the world's best, like OpenAI's GPT-4, but was reportedly developed for a fraction of the cost ($5.6 million vs. $100 million).

- What's happening: This event sent a geopolitical shockwave through the tech world. It triggered a massive, single-day market cap loss of nearly $600 billion for NVIDIA as investors suddenly questioned the permanence of U.S. dominance in AI. It proved that Beijing's long-term strategy of tech self-sufficiency was working.

- Why it matters: It transforms the China investment thesis. The story is no longer just about a potential economic recovery. It's now about a structural technology leadership play. This event has unlocked domestic confidence and capital, creating powerful policy tailwinds for companies aligned with China's AI ambitions, from cloud providers to hardware developers.

Think of it as a small, independent car company suddenly unveiling a new engine that's just as powerful as a Ferrari's, but ten times cheaper to build. The world is instantly forced to re-evaluate who the future leaders of the auto industry will be.