A note from the MomentumX team,

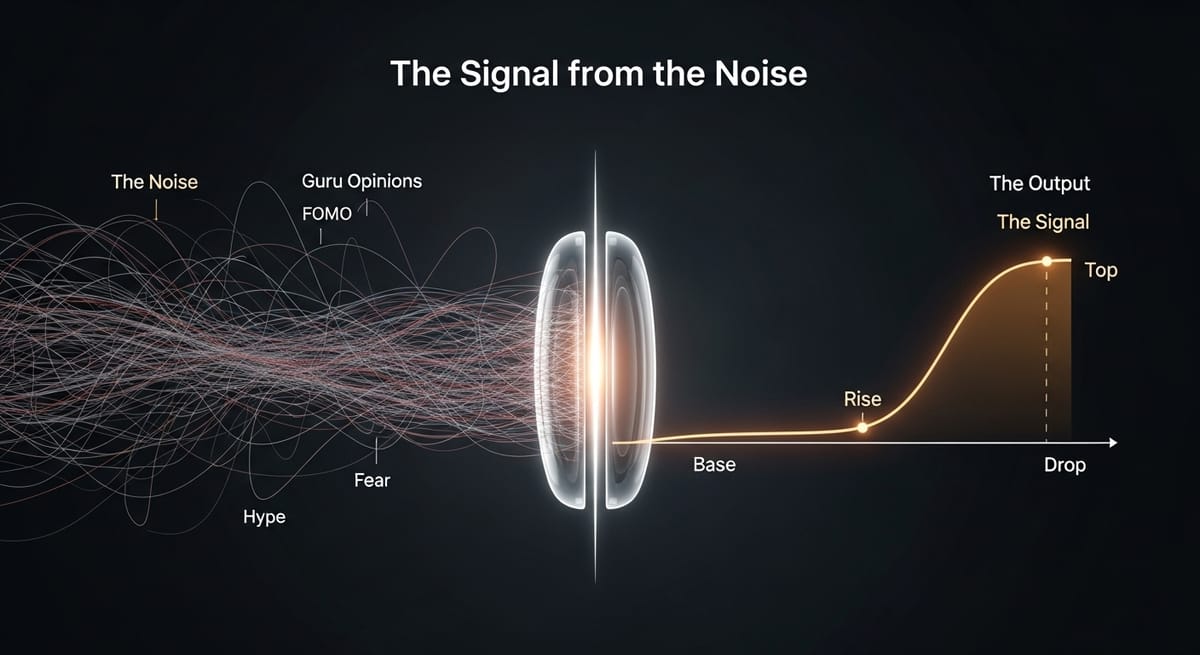

I’m going to ask you to do something simple. Forget everything you think you know about trading. Forget the noise, the gurus, and the 24/7 stream of headlines designed to make you feel like you’re always a step behind.

For the next few minutes, let’s talk about what actually works. Let’s talk about how to listen when the market whispers its plans, long before it shouts the news to the public. This isn’t a guide for Wall Street quants in their glass towers; it’s a conversation for the intelligent investor who simply wants to grow their capital without losing their sanity.

Let’s begin.

The Thought Experiment That Changes Everything

Imagine I gave you a time machine set for December 2022. The world is bearish, and experts are predicting a long winter. What do you buy?

In hindsight, the answer is obvious: you’d buy NVIDIA at around $150, just before the AI mania turned it into a legend. You'd buy Bitcoin around $16k, at the point of maximum despair.

Our entire purpose at MomentumX is to give you the clarity of hindsight, in real-time.

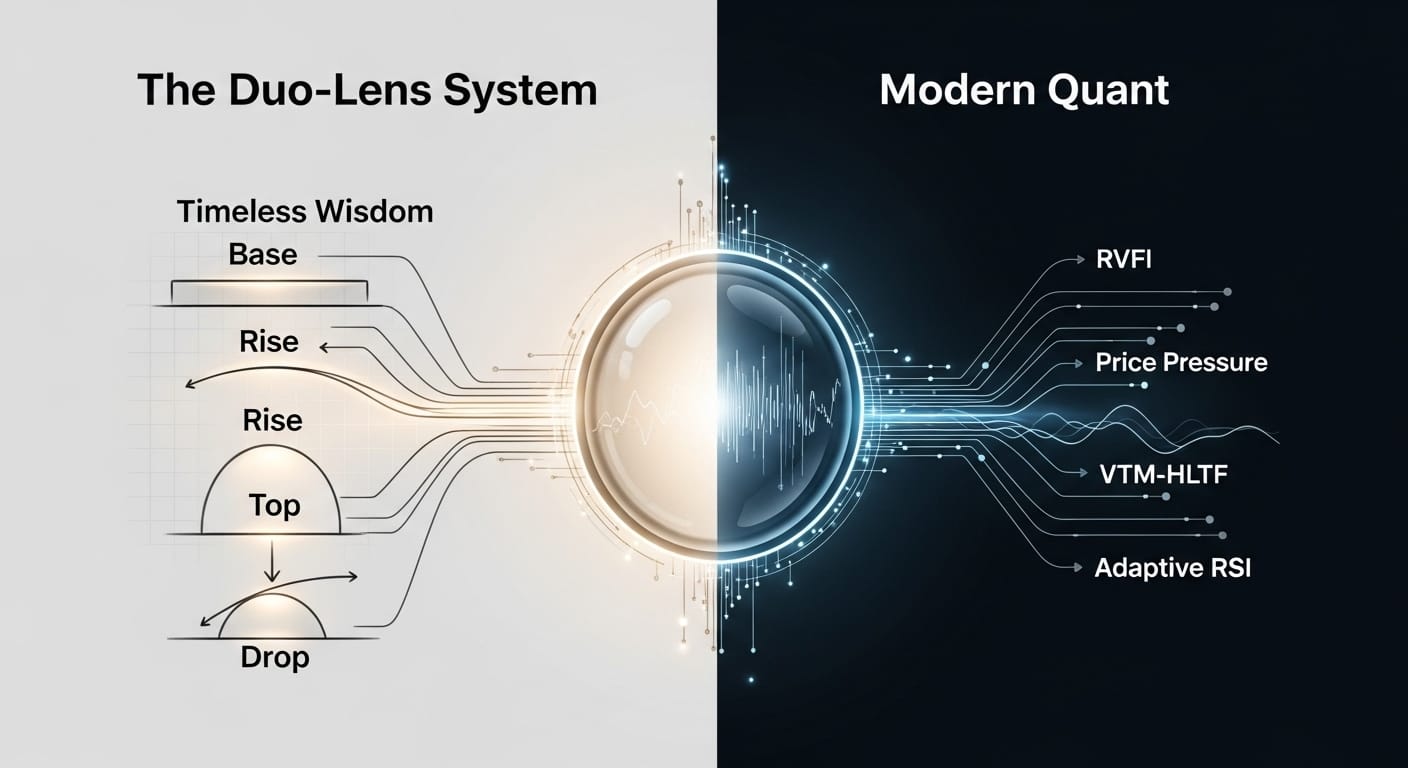

We don’t own a time machine. But our Duo-Lens system, which combines timeless patterns with modern math, flagged these institutional accumulation zones in the dead hush before the crescendo. It’s not magic; it’s a process. A process of filtering out the noise to see the one thing that matters: what the smart money is doing with their capital.

As the great Ted Warren said,

“The public buys the most at the top and the least at the bottom.”

Our job is to be there at the bottom, waiting patiently with the institutions.

Right now, as you read this, the next NVIDIA is quietly building a base. The question isn't whether the opportunity exists—it always does. The question is whether you have the tools to see it and the discipline to act.

The Three Paths

And Why Most Lead to Ruin

In the grand game of wealth creation, most people follow one of three classic paths. Let’s look at them with clear eyes:

- Buy & Hold: This works beautifully for a broad index like the S&P 500, which quietly cleanses itself by swapping losers for winners. But for single stocks? It’s a game of luck. You’re betting on finding the next Amazon instead of the next Pets.com.

- Value Investing: The theory is elegant: buy a dollar for fifty cents. The practice is subjective and messy. "Value" is often a mirage, and cheap stocks have a nasty habit of getting cheaper. The hardest question is one value investors hate to answer: at what point are you simply wrong?

- Trend & Momentum: This is the path of radical objectivity. It doesn't ask "why," it asks "what," "when," and "how much?" It never catches the exact bottom or top, but instead aims to capture the powerful, profitable “meat” of the move. It has a built-in, non-negotiable exit when the facts change.

Extensive research shows that a simple, rules-based momentum approach can crush other strategies. So why doesn’t everyone do it? Because it feels wrong. It requires you to buy high and sell higher. It sounds too simple to be smart. And it will test your discipline in choppy markets.

As Howard Marks would say, the biggest investing errors are almost always psychological. Even a perfect system fails if you can’t follow it when it feels uncomfortable.

The MomentumX Advantage: Our Three Upgrades

We stand firmly on that third pillar of Trend & Momentum, but we’ve added three critical, institutional-grade upgrades that turn a good idea into a powerful edge.

- We Start with the Base. Before we even think about momentum, our system identifies institutional accumulation using Ted Warren’s four-phase framework. We hunt for quality bases where smart money is quietly building positions.

- We Use Advanced Math to Confirm. We don’t guess when a base is ready. Our proprietary momentum and volume indicators (like RVFI) confirm that institutions are in control, giving us a green light for entry and a precise way to size our position.

- We Have Two Layers of Risk Control. Our system is designed to get us out before the crowd panics. We have automated alerts that flag when institutions are starting to sell (distribution), allowing us to protect capital and lock in profits.

Think of it as timeless wisdom multiplied by modern math. This is the bridge between main street simplicity and institutional edge.

For a deeper dive into the specific tools mentioned, you can explore our full Indicator Guide.

Our entire philosophy is built into our proprietary indicators. By blending Ted Warren's market cycle wisdom with modern quantitative analysis, our Duo-Lens system is engineered to filter market noise and provide a definitive signal.

Our Non-Negotiable Pre-Flight Checklist

Before we deploy a single dollar of capital, an idea must pass our codified "Ted Warren Compliance Checklist." If any of these are a "no," we simply wait. Patience is our rarest and most valuable asset.

- Is the Base Quality High? (Score ≥ 60/100) The chart must be quiet, with low volatility and decaying volume.

- Are Institutions Accumulating? (RVFI > 0.5) Our indicators must show clear evidence that smart money is buying.

- Is Momentum Positive? The underlying price pressure must be positive across multiple timeframes.

- Is the Market Context Favorable? We check for major external events (like earnings) that could disrupt the pattern.

Only when we have four green lights do we proceed to our entry protocol—a structured 40-40-20 method that scales into a position as it proves itself. And we never average down. Ever.

Your New Operating Rhythm: 15 Minutes to Peace of Mind

The modern market is engineered for your exhaustion. We offer the antidote: a disciplined process that gives you back your time.

This isn't about being glued to charts for hours. It's about focused, high-leverage activity. Your new operating rhythm is built around two key touchpoints:

- The Daily Check-In (Less than 15 minutes): This is your morning coffee ritual. Open the MomentumX Performance Dashboard, check for critical alerts, and see if any positions need managing. In 99% of cases, the answer will be "no." You simply close your laptop and get on with your life, confident that your capital is compounding in silence.

- The Weekly Strategic Review (30 Minutes): This is where the real work is done. Once a week, you'll review our Alpha Report, analyze new high-potential setups with your toolkit, and prepare your moves for the week ahead.

That’s it. A few minutes a day for management, and one focused session per week for strategy. This is how you trade screen addiction for the peace of mind that comes with a proven, institutional-grade process.

We have developed a separate detailed guide for Crypto Native (recovering Degen investors who are looking to capture crypto returns)

Full Circle: A Case Study in Patience (ARKG)

Let me end with a story about a chart, because it perfectly illustrates the two sides of this entire game. Let's travel back to May 2021. The party for innovation stocks was in full swing, and ARKG was the guest of honor. The headlines were breathless. But while the crowd was popping champagne, our indicators told a different story. We saw the unmistakable, data-driven footprints of institutional distribution—the smart money was quietly tiptoeing out the back door. We knew the music was about to stop.

That was a crucial lesson in risk management.

But here is where the story comes full circle. As of today, after years in the wilderness, ARKG is quietly building a beautiful accumulation base with a quality score over 60. The market has forgotten it. And the smart money is beginning to whisper its plans again.

We are not buying yet. We are watching. We are waiting for our system to give us the definitive signal that the "Rise" phase is beginning. The same discipline that got us out near the top is the same discipline that keeps us patient at the bottom.

This full-circle journey is the heart of our philosophy. The question isn't whether these opportunities exist—they always do. The question is whether you have the tools to see them and the temperament to act.

We didn’t create this system to be an oracle. We created it to be a repeatable process that tilts the odds of success dramatically in your favor. You are going head-to-head with the brightest minds and fastest machines in the world. Our philosophy is simple: don't compete with them on their terms. Use a different kind of arbitrage—the arbitrage of patience, discipline, and a deep understanding of market history.

If this philosophy resonates with you, the door is open.

Your Journey Starts Here

To learn more, we encourage you to listen to our 15-minute podcast and take the first step on the path to becoming an Investolator.

Podcast

For Experienced and Engaged Investors:

Dive deeper into our institutional-grade framework by exploring the complete Knowledge Base, where you'll find the definitive guides for all our Strategy Playbooks and Indicators. When you are ready to move from theory to execution, subscribe to gain full access to our signals and begin positioning with a true probabilistic edge.

For New Investors:

Free Course: Becoming a Modern Investolator.