The Tools for a More Intelligent Game

Acquiring a Lamborghini doesn't make you a racer, just as buying indicators doesn't make you profitable. An indicator is only a tool. Its effectiveness lies in the hands of the investor who wields it with discipline and a sound strategy.

But having access to institutional-grade tools that just work can transform your investing from a game of stressful guesswork into a systematic process for building wealth.

The market is engineered to create noise, confusion, and indecision. Most indicators only add to the problem. Our goal at MomentumX is to provide the antidote: a unified system that filters the noise, reveals the signal, and gives you peace of mind, not screen addiction.

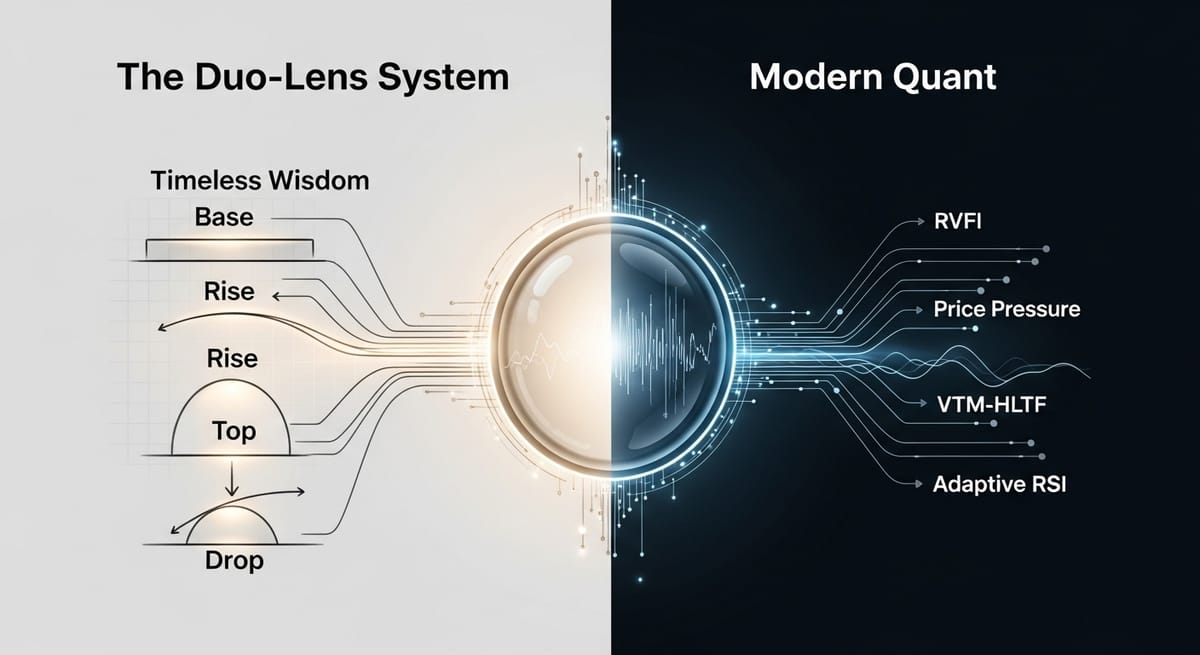

In any competitive endeavor, second-level thinking requires you to ask two questions: Who am I playing against, and how am I going to win? The market is no different. The daily noise is a game dominated by high-frequency machines with advantages in speed and proximity—a game we refuse to play because the odds are not in our favor. Instead, if you cannot win the game, you change it. Our entire suite of proprietary indicators is built on this single philosophy. We step away from the noise and focus on higher timeframes where proven momentum math and patience provide a durable edge. Our 'Duo-Lens' system blends timeless wisdom with modern quant to do one thing with institutional precision: reveal the footprints of smart money, long before they become news. This page details the tools we use to play a more intelligent game.

The Problem with Most Indicators (And Why We Built Our Own)

If you've spent any time in the markets, you've likely encountered the classic pitfalls of retail indicators. They are problems we have obsessed over solving.

- Problem #1: Analysis Paralysis Too many indicators are like Twitter traders—all noise, no signal. The result is a cluttered screen of conflicting data that leads to analysis paralysis, freezing you with indecision precisely when clarity is needed most.

- Problem #2: The Speed vs. Accuracy Trap Most indicators force you to choose between being fast (and getting chopped up by false signals) or being accurate (and showing up so late you miss the move). It's like choosing between a Ferrari with no brakes or a tank that tops out at 10mph. Our solution is like having both, with an AI that knows which one to drive for the current market conditions.

- Problem #3: Retail Logic in an Institutional Game Most indicators are built on a fatal flaw: they use retail logic. But in the market, retail often provides the exit liquidity for institutions. Using their tools is like bringing a knife to a gunfight. Our system is built on the opposite principle: trade with institutions, not against them.

The MomentumX Duo-Lens: Our Unfair Advantage

Our entire suite of indicators is built around our core Duo-Lens philosophy. This isn't just a collection of tools; it's a framework for seeing the market with institutional clarity. It combines timeless wisdom (the "what") with modern quantitative analysis (the "when").

Core Duo-Lens Indicators

These are the foundational regime filters of our system. They are designed to tell you what "season" the market is in for a specific asset class, providing the high-level context necessary for any sound investment decision. Each is pre-configured and optimized for its specific domain.

Indicator | Market Focus | Typical Holding Period | Special Features |

|---|---|---|---|

mxc_duo_crypto | Cryptocurrencies | Days, Weeks to 2-3 months | Duo-Lens: Ted Warren's phases adapted for the digital asset space, with advanced noise reduction & momentum algorithms. |

mxc_duo_tradfi | TradFi ETFs, Commodities | Weeks, to 12-24 months | Duo-Lens: Ted Warren's framework evolved, with momentum metrics tailored by asset type and timeframe for maximum relevance. |

mxc_duo_index | Indexes (Direct or Leveraged) | Weeks, to 2-6 months | Trio-Lens: Combines the evolved Ted Warren algorithm with a tailored momentum engine and a suite of leading macro indicators. |

The Engine Room: Our Supporting Arsenal

These are the proprietary tools that power the Duo-Lens, providing the raw data and second-level thinking that gives our system its edge.

- RVFI (Relative Volume Force Index) This is our institutional footprint detector. The RVFI moves beyond simple volume analysis to measure volume-weighted price force vectors. Its sophisticated 'momentum-toward-zero' scoring system gives you an undeniable edge by identifying the subtle, often invisible, periods when smart money is quietly building or exiting positions—before the news breaks.

- Price Pressure Momentum is the engine of any great trend. Our Price Pressure indicator is a proprietary composite, blending the best elements of classic oscillators into a single, unambiguous measure of trend strength and quality. It confirms the story that RVFI is telling us.

- VTM-HLTF (Volume-Time Multi-Frame) This is our microscope. The VTM-HLTF decomposes volume across multiple timeframes to detect institutional fingerprints hidden within the candles. It marks the specific bars where smart money is actively accumulating or distributing, giving us a granular view of their operations.

- Adaptive RSI Standard indicators use static "overbought" or "oversold" levels, which are useless in a strongly trending market. Our Adaptive RSI dynamically adjusts these thresholds based on recent price action, providing context-aware momentum signals that are relevant to the market's current character.

Why This Matters Now

While others chase meme coins and AI chatbots, smart money is quietly accumulating the assets that will define the next major cycle. The question isn't whether you need better tools to see what they're doing. The question is whether you'll get them before or after the next big move has already happened.

By combining these indicators, we move from ambiguity and noise to signal and clarity. We are not predicting; we are observing what the most powerful market participants are doing and positioning ourselves accordingly. This is the heart of playing a more intelligent game. It's how you stop reacting to the news and start positioning for what's inevitable.

<Provide all educaiton on indicators here>

A Note on Macro: The Only Data That Matters

Macroeconomic forecasting is a fascinating subject. It's the source of endless debate at dinner parties and on the internet. It is also, for the most part, a low-return endeavor.

The trouble with grand macro predictions is their long time horizons. By the time a forecast is proven wrong, everyone has forgotten it was ever made, and the forecaster has moved on to a new story. This brings me to a crucial point of second-level thinking. When it comes to the vast, complex machine of the global economy, I find there are two kinds of participants: those who admit they cannot predict its future, and those who haven't yet realized they can't either.

I choose to go a step further and focus only on the data that pays. I learned the hard way that prices precede narratives, not the other way around.

Show me the price, and I will tell you the news that is about to break.

If the chair of the US Federal Reserve, with access to more data than anyone on the planet, chooses to be "data-dependent" in their decisions, then shouldn't we, as humble market participants, adopt the same discipline? We should focus not on predicting the data, but on reacting to it as it is reflected in asset prices.

Instead of getting lost in the noise, we believe the state of the world can be understood by observing just three key variables:

- The Bond Market: The true state of liquidity.

- Equities (S&P 500): The real measure of risk appetite.

- Metals and copper - where smart metal traders give you a sense where ther economy is going before the market learns about it.

- The World's Reserve Currency (USD): The reality of global capital flows.

- Market breadth, volatility and put call ratios - that can give early leading signals before the price reacts.

These are the only 5 macro and leading market variables you will ever need. They tell us the story that matters, grounded in reality, not fiction.

As a bonus we are including an aggregate market leading indicator we had the pleasure on learning from and collaborating with @IamAdamRobison and @Kerberos007 and several other prominent hedge fund adivsors - this leading indicators is the 5 macro leading market variables we outlined above.

When you have time we encourange you to listen to Adam Robinson 3 key podcasts that influenced us and lead to a collaboration.