The Tools for a More Intelligent Game

Acquiring a Lamborghini doesn't make you a racer, just as buying indicators doesn't make you profitable. An indicator is only a tool. Its effectiveness lies in the hands of the investor who wields it with discipline and a sound strategy.

But having access to institutional-grade tools that just work can transform your investing from a game of stressful guesswork into a systematic process for building wealth.

The market is engineered to create noise, confusion, and indecision. Most indicators only add to the problem. Our goal at MomentumX is to provide the antidote: a unified system that filters the noise, reveals the signal, and gives you peace of mind, not screen addiction.

In any competitive endeavor, second-level thinking requires you to ask two questions: Who am I playing against, and how am I going to win? The market is no different. The daily noise is a game dominated by high-frequency machines with advantages in speed and proximity—a game we refuse to play because the odds are not in our favor. Instead, if you cannot win the game, you change it.

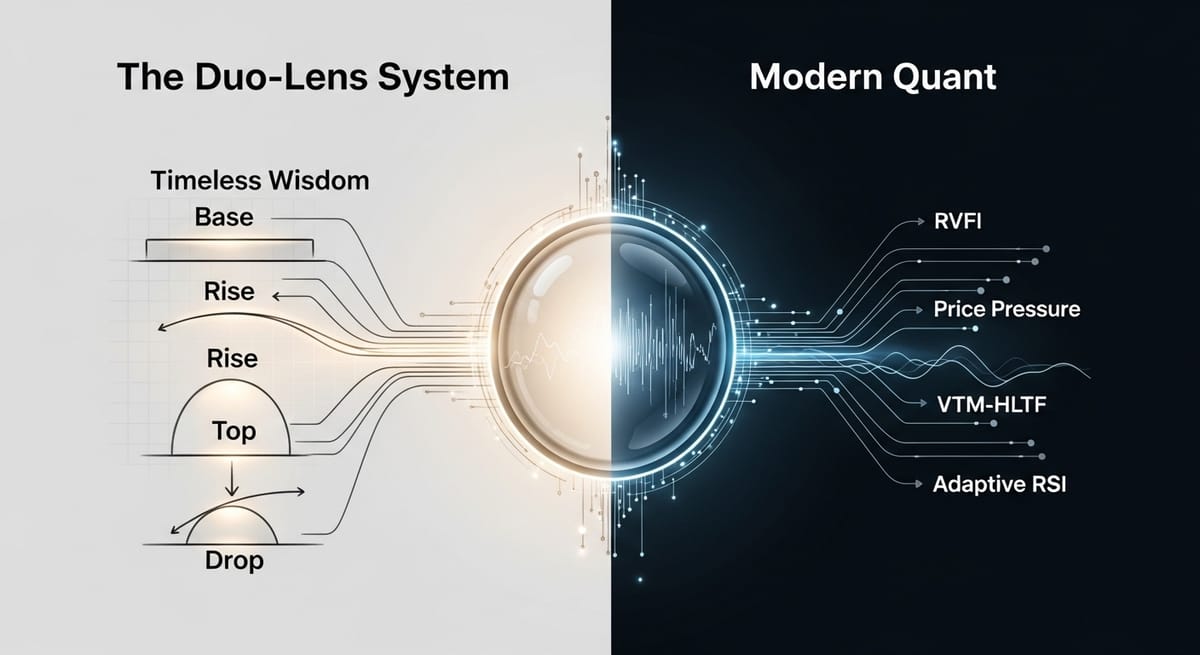

Our entire suite of proprietary indicators is built on this single philosophy. We step away from the noise and focus on higher timeframes where proven momentum math and patience provide a durable edge. Our 'Duo-Lens' system blends timeless wisdom with modern quant to do one thing with institutional precision: reveal the footprints of smart money, long before they become news.

This page details the tools we use to play a more intelligent game.

The Problem with Most Indicators (And Why We Built Our Own)

If you've spent any time in the markets, you've likely encountered the classic pitfalls of retail indicators. They are problems we have obsessed over solving.

- Problem #1: Analysis Paralysis. Too many indicators are like Twitter traders—all noise, no signal. The result is a cluttered screen of conflicting data that leads to analysis paralysis, freezing you with indecision precisely when clarity is needed most.

- Problem #2: The Speed vs. Accuracy Trap. Most indicators force you to choose between being fast (and getting chopped up by false signals) or being accurate (and showing up so late you miss the move).

- Problem #3: Retail Logic in an Institutional Game. Most indicators are built on a fatal flaw: they use retail logic. But in the market, retail often provides the exit liquidity for institutions. Using their tools is like bringing a knife to a gunfight. Our system is built on the opposite principle: trade with institutions, not against them.

The MomentumX Duo-Lens: Our Unfair Advantage

Our methodology is executed through a precise, institutional-grade hierarchy:

- The Investment Strategy Playbook: This is the top layer—the specific strategy for a given asset class and market condition.

- The Core Engine (Duo Lens): Each playbook is built around a single core engine: one of our three specialized

Duo Lensindicators (Base, Crypto, or Index). This engine is calibrated for that specific environment and is responsible for generating the definitive L (Long) and S (Short) signals. - The Supporting Indicators: We never act on a single signal in isolation. Conviction is built through confluence. Therefore, each core signal is validated by our suite of supporting indicators that provide the essential context on momentum, volume, and institutional flow.

This layered approach—Playbook → Core Engine (Duo Lens) → Supporting Indicators—is the foundation of our entire process. It ensures every action is backed by a complete, data-driven thesis.

Core Duo-Lens Engines

These are the foundational regime filters of our system. They are designed to tell you what "season" the market is in for a specific asset class, providing the high-level context and key signals necessary for any sound investment decision. Each is pre-configured and optimized for its specific strategy.

MXC Duo Lens Base The MXC Duo Base is a sophisticated momentum engine, precision-crafted for traditional markets (stocks, ETFs, commodities) to identify high-probability position and swing trading opportunities—not for day trading. At its core, dual Kalman filters intelligently adapt sensitivity for optimal signal quality in trending or choppy environments. This system integrates robust confirmation layers: a dual GMA risk-on/off system, RVFI volume-momentum analysis, squeeze detection, and proprietary phase analysis, all generating high-confidence signals.

MXC Duo Lens Crypto The MXC Duo Crypto is an advanced momentum engine rebuilt for the unique physics of 24/7 digital asset markets. It incorporates 24/7 volume normalization to account for continuous global trading, faster adaptive parameters calibrated for crypto's inherent volatility, and perpetual futures funding rate analysis as a critical layer of confirmation. It's engineered to distinguish real institutional flows from retail noise and navigate the liquidation cascades that define the crypto landscape.

MXC Duo Lens Index First-level thinking applies the same tools to every asset—a critical mistake. Indices play a different game: they trend longer, mean-revert harder, and demand a specialized approach. The MXC Duo Index is our institutional-grade system engineered for this unique battlefield, specifically optimized for index ETFs and their leveraged counterparts like TQQQ. Its adaptive engine is calibrated for the persistent trends of major indices, while incorporating critical safeguards against the sharp mean reversions and volatility decay that can devastate leveraged positions.

The Engine Room: Our Supporting Arsenal

Think of our Duo-Lens Core Engines as your strategic compass. But every master architect needs precision tools to execute the vision. This is our "Engine Room"—the proprietary arsenal that goes beyond mere signals to reveal the raw, unfiltered data that enables second-level thinking. They power the Duo-Lens, transforming market noise into the quiet footprints of smart money.

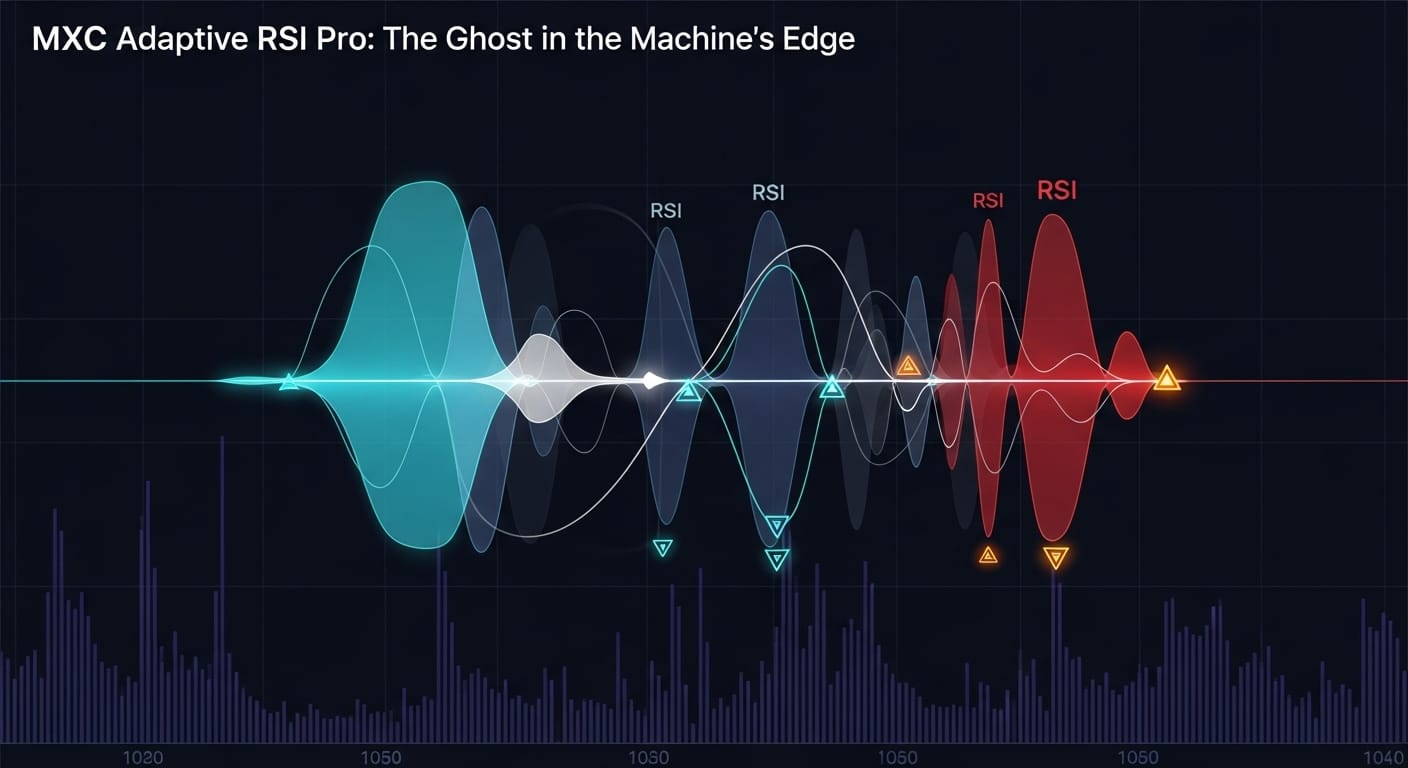

MXC Adaptive RSI

Standard RSI is a rigid tool for a fluid market—a flawed premise. The MXC Adaptive RSI is engineered to think. It adapts to the market regime in real-time, dynamically adjusting its calculation length and applying a sophisticated smoothing cascade. Its true edge lies in its multi-layered analysis: a volume-weighted calculation reveals institutional footprints, while multi-timeframe confluence validates the signal against asymmetric, volume-adjusted thresholds. The result is momentum with context and conviction.

Sharpen your momentum signals. Learn more about Adaptive RSI.

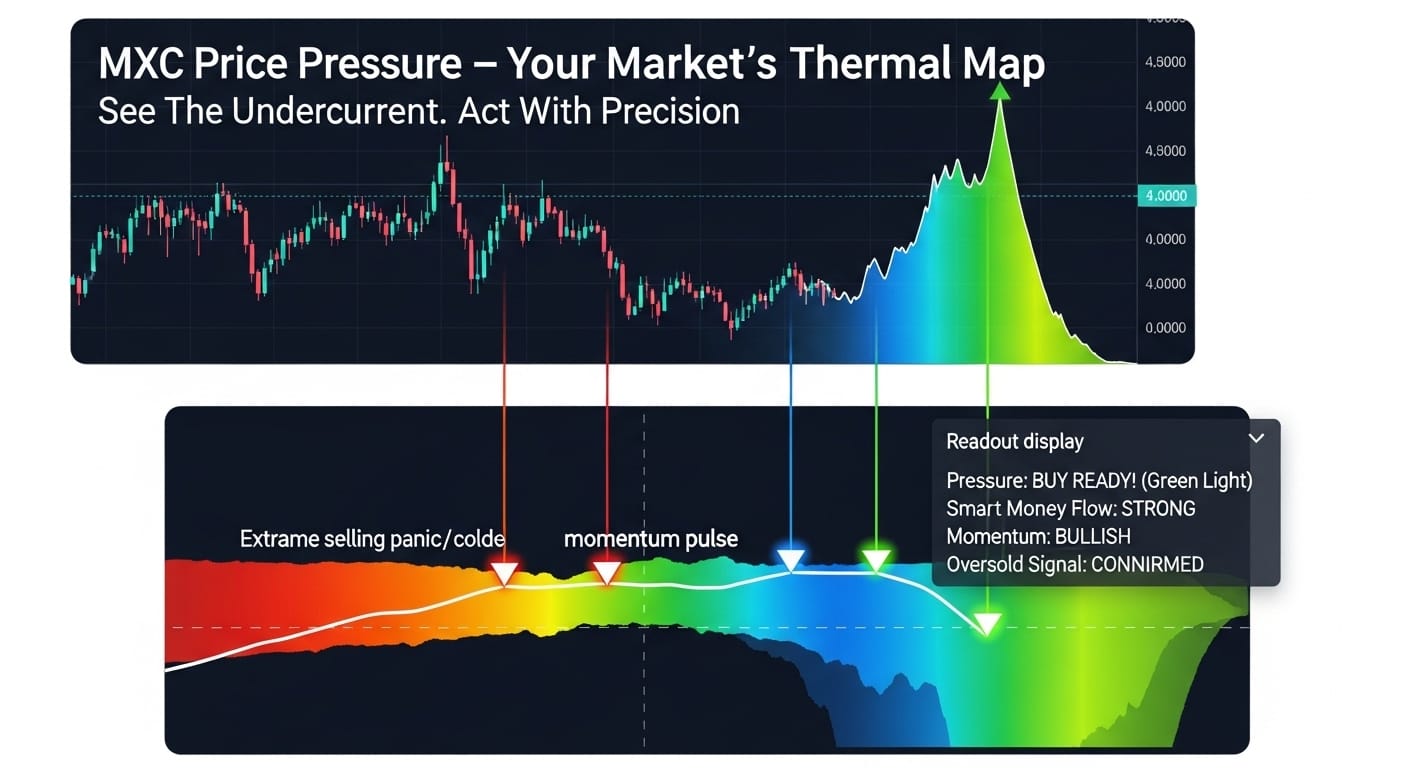

MXC Price Pressure

Chasing one-dimensional momentum is a first-level game. The MXC Price Pressure indicator was engineered for second-level thinking. It's an institutional pressure detection system that synthesizes three distinct factors—MACD momentum, an Adaptive RSI/SAR trend filter, and Order Flow Imbalance (OFI) scoring—into a single, unambiguous reading. We don't just see momentum; we see the institutional force behind it.

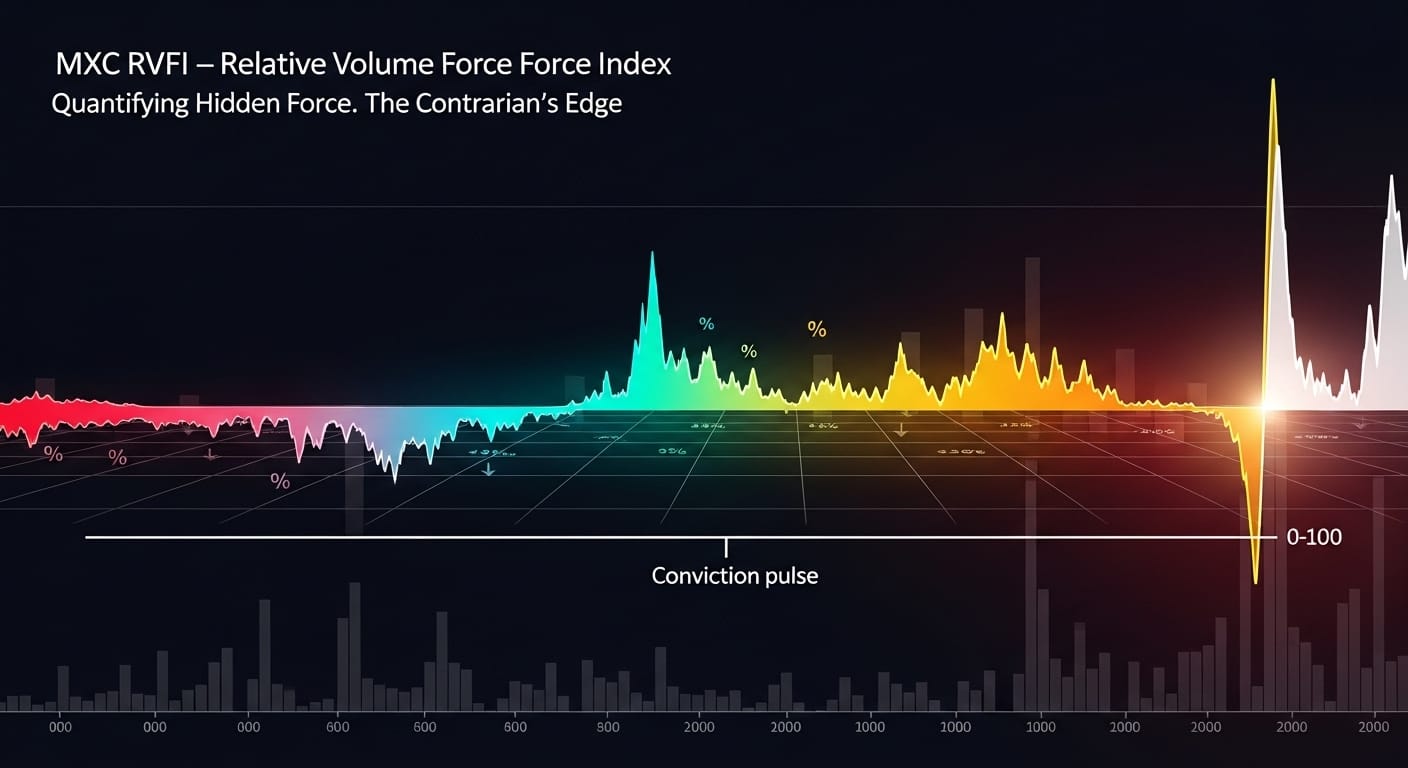

MXC RVFI - Relative Volume Force Index

The MXC RVFI is an institutional-grade volume-momentum oscillator that combines adaptive parameter selection and statistical analysis to identify high-probability momentum shifts. It excels at detecting early bullish reversals, providing critical timing on high-conviction setups where an asset emerges from oversold conditions with a sharp increase in momentum.

The RVFI excels at detecting early bullish reversals, providing critical timing on high-conviction setups.

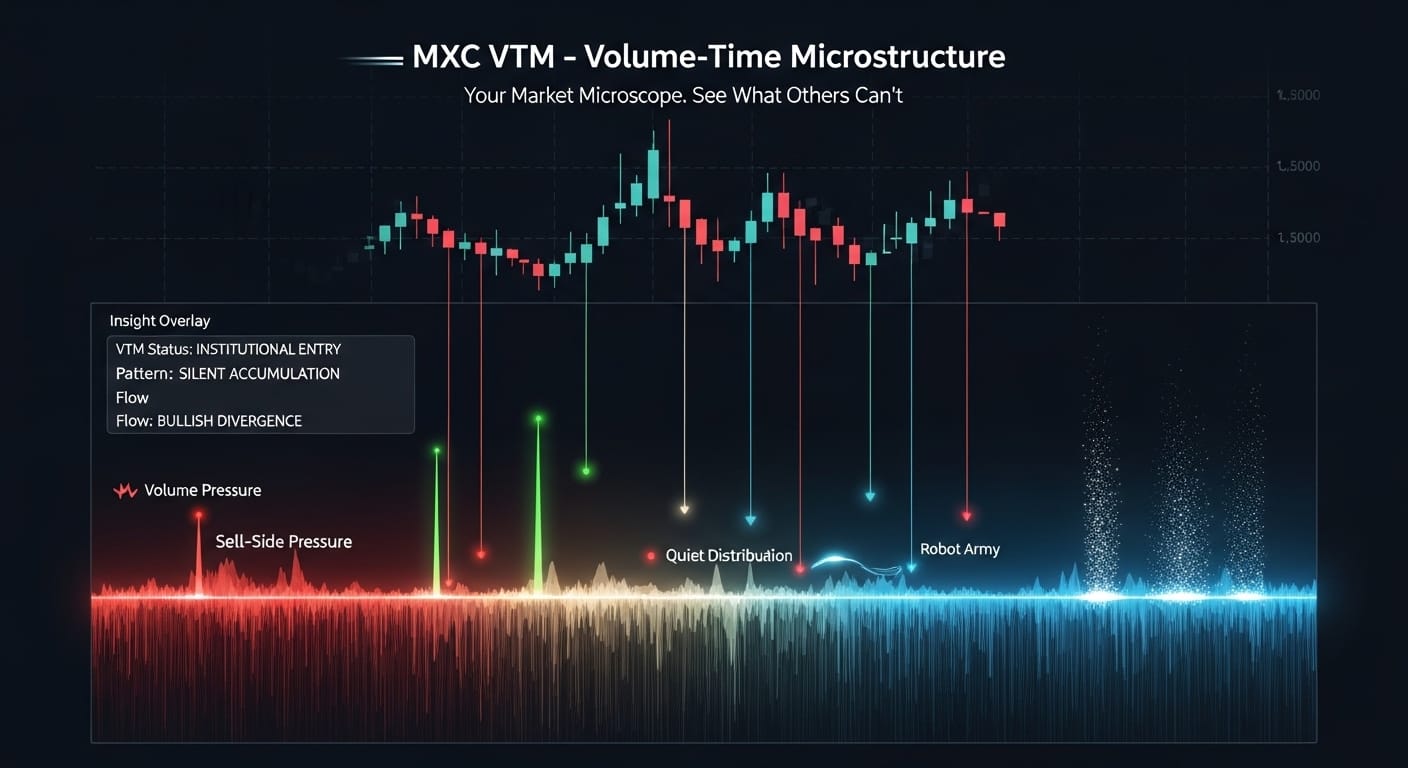

MXC VTM - Volume Timeframe Microstructure

While traditional volume indicators offer a blurry, sampled view, the MXC VTM provides a microscopic analysis of the tape. It's a groundbreaking microstructure engine that processes 100% of lower timeframe candles within each bar, ensuring no institutional footprint is missed. Its core algorithm uses volume-weighted pressure to automatically identify five distinct institutional fingerprints, allowing us to see the real battle for control within every candle.

See the whispers in the candles. Explore MXC VTM granular view.

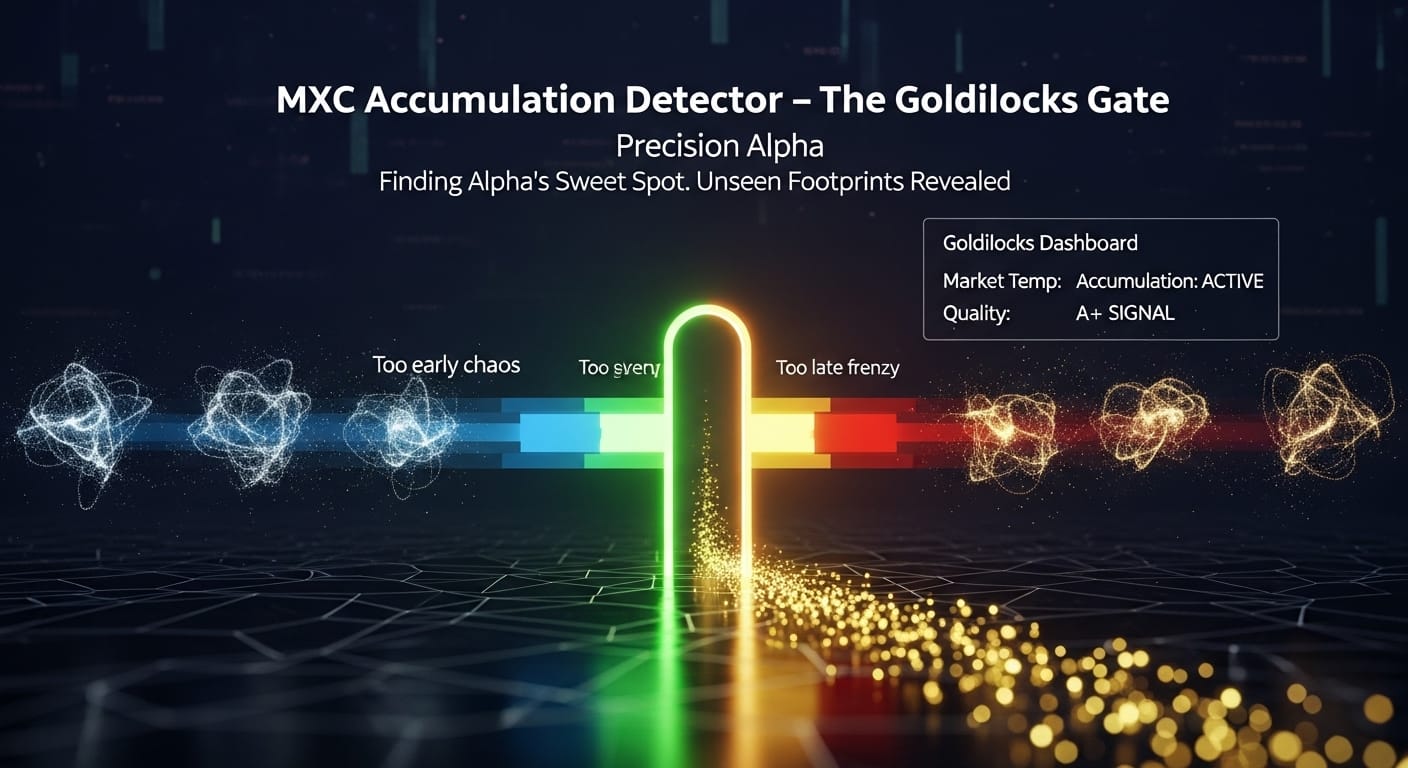

MXC Smart Money Accumulation

First-level thinking chases price. We hunt for footprints. The MXC Accumulation indicator is our institutional-grade smart money detection system. It synthesizes Williams VIX Fix volatility extremes with a deep multi-timeframe microstructure analysis to identify when sophisticated traders are quietly building positions. Its 100-point scoring system, adaptive filters, and A+ to C quality grades provide a quantifiable edge in detecting sustained institutional buying before the major move begins.

Discover the "Goldilocks zone" for bottoms. Dive into the Accumulation Detector.

A Note on Macro: The Only Data That Matters

Macroeconomic forecasting is a fascinating subject. It is also, for the most part, a low-return endeavor. The trouble with grand macro predictions is their long time horizons. By the time a forecast is proven wrong, everyone has forgotten it was ever made.

This brings us to a crucial point of second-level thinking. When it comes to the vast, complex machine of the global economy, there are two kinds of participants: those who admit they cannot predict its future, and those who haven't yet realized they can't either.

We focus only on the data that pays. We learned the hard way that prices precede narratives, not the other way around. Instead of getting lost in the noise, we believe the state of the world can be understood by observing five key variables:

- The Bond Market: The true state of liquidity.

- Equities (S&P 500): The real measure of risk appetite.

- Metals and copper: Where smart traders give you a sense of where the economy is going.

- The World's Reserve Currency (USD): The reality of global capital flows.

- Market breadth, volatility and put/call ratios: Early leading signals before price reacts.

These are the only macro and leading market variables you will ever need. They tell us the story that matters, grounded in reality, not fiction.

Access to our proprietary MXC Macro Leading Signals is available to our Engaged Investor and Aspiring Quant members.

Why This Matters Now

While others chase meme coins and AI chatbots, smart money is quietly accumulating the assets that will define the next major cycle. The question isn't whether you need better tools to see what they're doing. The question is whether you'll get them before or after the next big move has already happened.

By combining these indicators, we move from ambiguity and noise to signal and clarity. We are not predicting; we are observing what the most powerful market participants are doing and positioning ourselves accordingly. This is the heart of playing a more intelligent game. It's how you stop reacting to the news and start positioning for what's inevitable.

Our Core Strategies: The Blueprints for a Better Game

Our entire philosophy is codified into a suite of definitive strategy playbooks. While the full library is available to members, we provide demo access to our three cornerstone strategies to demonstrate the power and discipline of our process.

Each playbook is a complete, institutional-grade framework for playing a more intelligent game in a specific market.

1. Capital Cycle: Base & Catalyst

Our core contrarian strategy for identifying deep value opportunities in individual assets poised for a major catalyst.

- Live Results: View Performance Dashboard

- View the Playbook

2. Index: Leveraged Accumulation

A long-term wealth compounding strategy using leveraged ETFs to capture the primary trend in major US indices.

- Benchmark Since 2010: TQQQ +44,838% - Demo Access

- View the Playbook

3. Crypto: Riding The Primary Trend

A tactical, long/short approach to actively compound capital by capturing the multi-month swings in BTC and ETH.

- Benchmark Since 2010: BTC +855,190% - Demo Access

- View the Playbook

From Theory to Execution

These playbooks are the blueprints of our system. Dive deeper into our institutional-grade framework by exploring the complete Knowledge Base, where you'll find the definitive guides for all our strategies and proprietary indicators.

Your journey to playing a more intelligent game starts here.

When you are ready to move from theory to execution, subscribe to gain full access to our signals and begin positioning with a true probabilistic edge.