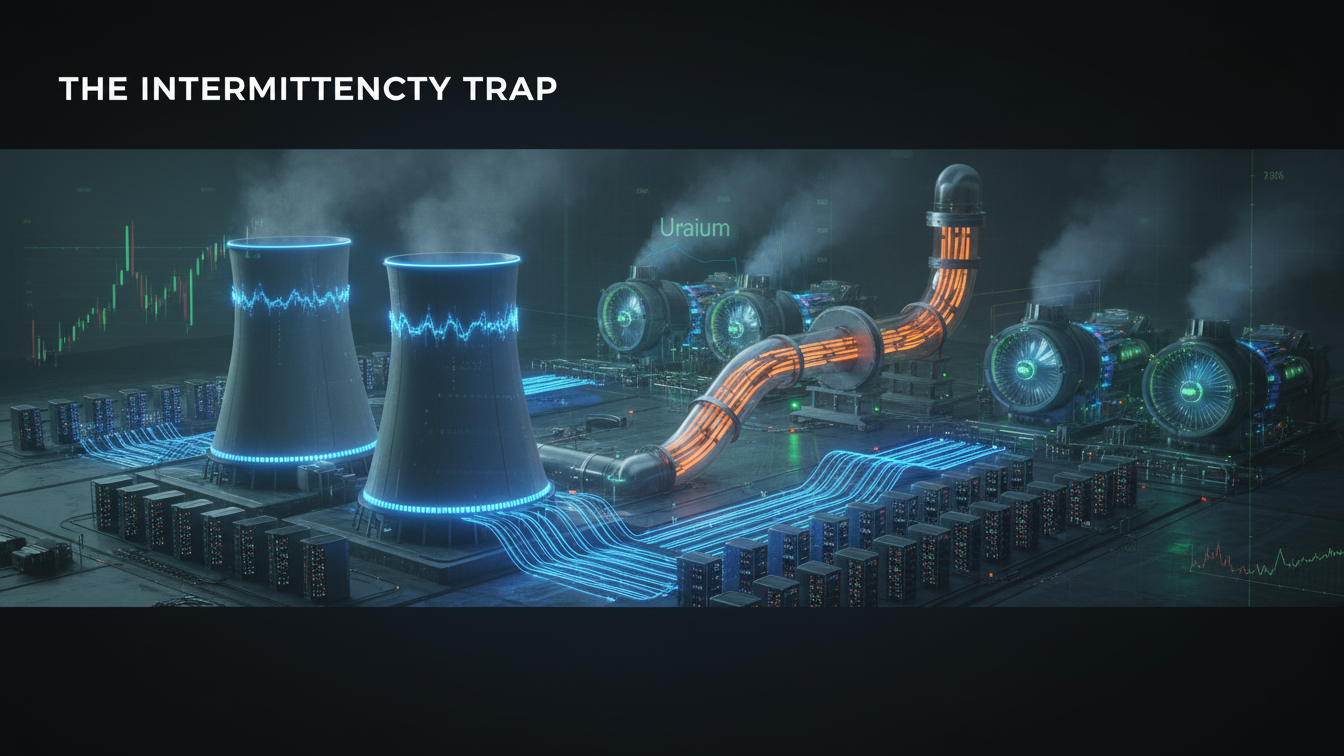

THE INTERMITTENCY TRAP

The nuclear energy sector is undergoing a structural realignment from a mature, commodity-like business into a high-growth infrastructure play driven by artificial intelligence's insatiable demand for 24/7 baseload power. Unlike previous nuclear revivals built on environmental mandates alone, this cycle is economically compelled. The Antagonist is the physical limit of weather-dependent energy.

Natural gas is the bridge; nuclear is the destination. Natural gas plants provide the fast, flexible power for AI data centers—deployable in 3–4 years—that wind and solar cannot match for $100B compute clusters. While gas manages the immediate build-out, long-life nuclear baseload with secure fuel supply captures the enduring economics. The inflection is 2–3 years away; slow, relentless accumulation is the edge.

Hyperscalers (Amazon, Google, Microsoft, Meta) are committing $10B+ to nuclear infrastructure because they are now absorbing technology risk to secure decades of guaranteed power. For institutional investors, the most compelling returns will not accrue to reactor manufacturers competing in a winner-take-most race, but rather to suppliers controlling bottleneck inputs with durable pricing power: uranium miners, enrichment providers, and steam turbine manufacturers.

Key Catalysts:

- Data center power demand growing at 65% CAGR through 2028

- Global uranium supply deficit accelerates 2027–2029 (market inflection); structural deficits become self-evident by 2032–2035

- HALEU enrichment capacity remains a constrained domestic monopoly until 2028+

- Federal bipartisan support backed by $27B in capital

- Roboticization of facilities eliminating historical safety objections

Overview video for those on the go:

As outlined in our companion publication, “THE $4.50 RECKONING: The End of Cheap Natural Gas,” the era of structurally cheap gas is over; Henry Hub is resetting to a $4.50–$5.00/MMBtu floor as LNG exports, AI-driven baseload, and producer capital discipline collide. In that framework, natural gas becomes the bridge fuel for hyperscalers, while nuclear—anchored by secure fuel supply and 60+ year asset lives—emerges as the destination for 24/7 AI infrastructure.

This post is for paying subscribers only

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.