THE PENDULUM SWINGS

In the investment world, the crowd is often seduced by the visible—current storage levels, weekly weather reports, and the prevailing sentiment of abundance that defined the last decade. But the "second-level thinker" looks past the immediate noise to the structural machinery grinding beneath the surface.

For the past ten years, the natural gas market was defined by a paradigm of scarcity of demand and an abundance of supply. Today, we are witnessing a violent swing of the pendulum to the opposite extreme. The "cheap gas" era, characterized by infinite shale growth and distinct regional pricing, has definitively ended.

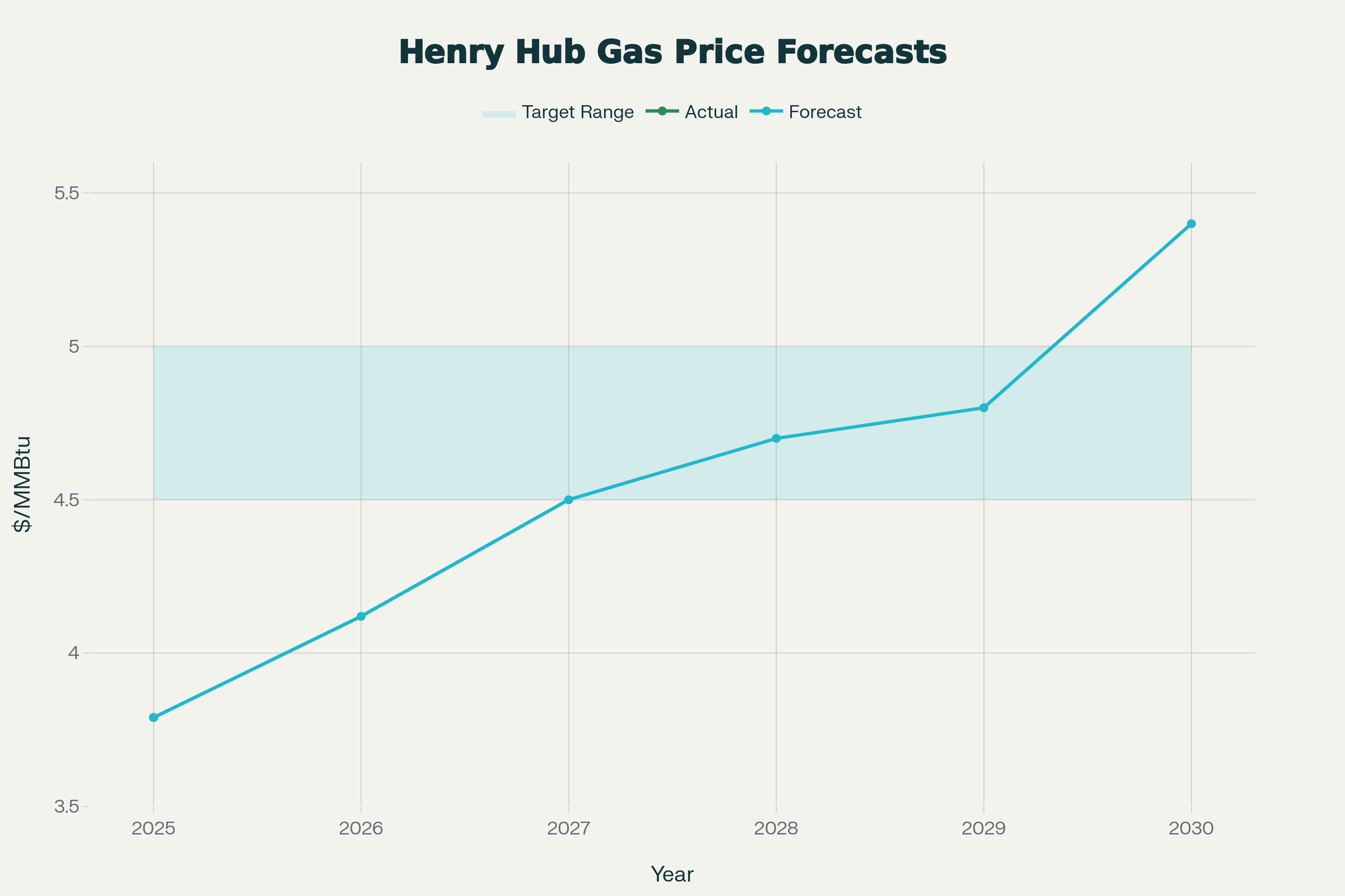

We are currently entering a profound structural transformation driven by a collision of forces: geopolitical realignment, the inelastic demand of the AI revolution, and a newfound capital discipline among producers. Our analysis suggests that Henry Hub prices are stabilizing into a new structural floor of $4.50–$5.00/MMBtu through 2026–2027, with a trajectory toward $5.40/MMBtu by 2030.

This is not a trade; it is a secular shift. And the most sophisticated operators in the industry—the insiders—are positioning themselves aggressively before the rest of the market wakes up.

PART I: THE MACRO THESIS — THE INVISIBLE CEILING

To understand the opportunity, one must accept that the North American natural gas market is no longer an island. It has become the "Transatlantic Bridge."

The Global Convergence Following the geopolitical rupture of 2022, the United States effectively replaced Russia as Europe's energy guarantor. We now supply approximately 69% of all LNG exports to the continent. This is a permanent structural shift that has synchronized U.S. Henry Hub prices with European benchmarks, permanently compressing the arbitrage spread.

Simultaneously, the Asian market is locking in supply with an urgency that signals deep-seated fear. In just the last six months, Venture Global has executed 7.75 MTPA of 20-year contracts with heavyweights like Tokyo Gas and Mitsui. When institutional buyers lock in pricing for two decades, they are not betting on a glut; they are hedging against a decade of scarcity.

The Quantitative Anchor: Why $4.50 is the Mathematical Floor While sentiment drives short-term pricing, physics drives the long term. The structural floor emerges mathematically around 2027. To accommodate the projected 19.5 Bcf/d of LNG feedgas demand, production in the Haynesville basin must grow from 15.2 to 16.5 Bcf/d. However, this growth faces a hard constraint: Permian associated gas growth is slowing from 2.3 to 1.6 Bcf/d because crude oil infrastructure is hitting physical capacity limits.

The math is inescapable: Haynesville drilling activity requires a $4.00+/MMBtu floor to break even; competitive drilling only accelerates at $4.50+. As demand growth outpaces injection capability, storage capacity margins narrow. Thus, the price floor settles near $4.50–$5.00/MMBtu by structural necessity, not demand speculation.

This post is for paying subscribers only

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.