Market noise is reaching a fever pitch. While first-level thinkers are paralyzed by headlines of a deepening UK economic crisis, a more powerful, actionable signal is emerging for those willing to listen.

A rare convergence of factors is creating one of the most compelling, counter-cyclical opportunities we've seen in years: an accelerating global bankruptcy trend, unprecedented distress in UK sovereign debt markets, and the severely depressed valuation of a market-leading company built to thrive in the chaos.

This is not a time for fear. It is a time for a clear-eyed, data-driven strategy. This guide provides the playbook for how to position for the economic turbulence ahead.

Hats off to fellow second-level thinker Alberto Alvarez at AAG Research, whose recent work helped us to get initial insight and perspective on this thesis. He highlights that while Manolete Partners' stock is down 85% from its peak, its core business KPIs are hitting record highs, signaling a major inflection point. His conviction is so strong he has made the company over 50% of his personal portfolio. His latest deep-dive is a must-read for anyone serious about this setup:

A Look Into My Portfolio: Why I Doubled My Investment in Manolete Partners.

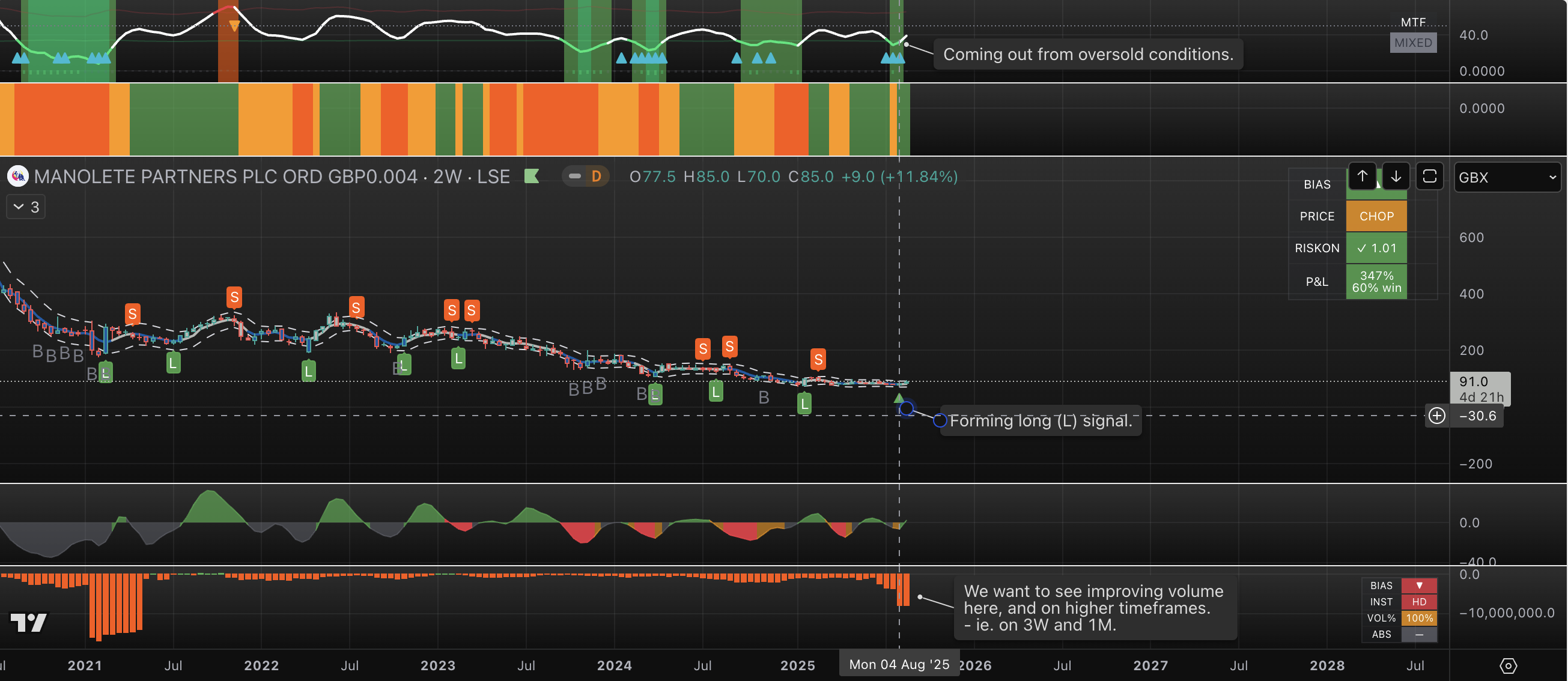

However, our process demands a confluence of both a powerful fundamental story and an irrefutable technical confirmation. While the "why" is exceptionally clear, the "when" is not. We are not yet investing. Our system requires specific data-driven triggers before we deploy capital, and MANO has not yet met these criteria. Our primary reasons for this patient, watchful stance are:

- The Technical Setup is Immature: Our proprietary volume indicators, which trace the institutional footprints, still show negative buying pressure. While a deep value base has formed, the transition from quiet accumulation to aggressive markup has not been confirmed by the data.

- Ownership Concentration Risk: A significant portion of the company's ownership is concentrated in a few hands. This presents a unique risk profile. We require a clear, high-volume breakout to confirm broad market participation is underway before committing capital.

- Our Protocol is More Risk-Averse: We admire high-conviction investing, but our system is engineered to be more conservative. We are designed to enter after a base is fully confirmed and the new uptrend has begun. Probabilities, not passion, guide our decisions.

With that said, the setup remains compelling. The following playbook outlines the macro storm, the ideal vehicle, and the exact technical signal we are waiting for to execute.

Step 1: Reading the Macro Signals (The "Why")

Forget predicting GDP. The most honest data is screaming a clear message: corporate distress is accelerating.

The UK Epicenter 🇬🇧: The signals of distress are flashing red. UK company insolvencies are holding at record highs, even higher than during the 2009 financial crisis. The primary driver of Manolete's profitability—larger company insolvencies, or "administrations"—are now making a comeback after being suppressed by post-COVID government relief measures. This is the fuel for Manolete's engine.

The Global Contagion 🌎: This isn't just a British problem; the economic reckoning is widespread. U.S. corporate bankruptcies have surged to their highest levels since the 2010 post-crisis recovery, surpassing even the peaks seen during the COVID pandemic. The trend is global, sustained, and undeniable.

This widespread distress isn't the risk; it's the raw material for a generational opportunity.

Step 2: The Unassailable Operator (The "What")

In this environment, you don't bet on a recovery; you bet on the cleanup crew. Our system has flagged Manolete Partners (AIM: MANO) as the purest play on this theme.

Manolete stands uniquely positioned to capitalize. With an unassailable market position (a 67% market share) and a >90% case completion rate, its business model is brilliantly counter-cyclical.

- Profit from Crisis: As companies fail, MANO acquires or funds the legal claims, turning widespread economic pain into a pipeline of high-return opportunities.

- Provide Essential Services: They provide essential liquidity to the UK's strained insolvency system, ensuring creditors can recover value that would otherwise be lost.

This is a rare chance to invest in a business that offers both protection from and immense profit potential during the coming economic reckoning.

Step 3: The Technical Setup (The "When")

Here is where decisive patience meets opportunity. The fundamental story is crystal clear, but our process demands technical confirmation.

- The Base Formation 📊: The chart for MANO is a thing of beauty. After a punishing 85% decline from its 2020 peak, the stock has carved out a textbook Phase 1 (Accumulation) Base. The volatility has been compressed, and the psychological exhaustion is palpable. This is the quiet foundation where smart money builds its positions.

- The High Alert Stance: The setup is delicious, but the trigger has not yet been pulled. While fundamental conviction is exceptionally high, for now, we are watching with intent, finger on the trigger, but not yet buying. Our process demands discipline; a premature entry is an unnecessary risk.

- The Impending Trigger 🔥: The window for optimal entry is narrowing. As the macro reality becomes undeniable, the market will be forced to reprice MANO. We are waiting for a single, data-driven signal: a decisive breakout above the base's resistance on a high-volume surge (at least 50% above the 50-day average). This event will be our irrefutable confirmation that the quiet accumulation is over and the powerful Phase 2 (Markup) has begun.

The quietest charts often precede the loudest breakouts. The boredom you see in a multi-year base is the market coiling a spring for a massive move.

The Game Plan & What's Next

The convergence is clear. The vehicle is identified. The technical pattern is mature. The asymmetric risk/return profile is exceptionally attractive, with a downside cushioned by a rock-bottom valuation and an upside fueled by a macro-tidal wave of opportunity.

The board is set. We are on high alert, waiting for the data to give us the green light to act. In a future briefing, we will unpack the broader insolvency landscape to reinforce our understanding of MANO’s unassailable market position. The most critical follow-up, however, will be the time-sensitive 'Daily Edge' alert the moment our technical trigger is activated.

Stay vigilant. This is how you play a more intelligent game.

Disclaimer: This research is for informational and educational purposes only and does not constitute investment advice. Securities involve a high degree of risk. Investors should conduct their own independent due diligence or consult a licensed financial adviser before making any investment decisions.