Weekly Alpha Report: 24-08-2025.

A note to our founding members, especially those who found the signal before it was amplified: your early conviction and insights have been critical in sharpening our process. We appreciate your partnership.

The signal is being amplified. After a successful calibration phase with a private group, our flagship Alpha Report—previously a proprietary briefing—is now being integrated into our complete weekly research service for all subscribers.

This brings us to the most recent validation of that process: the new All-Time High in Ethereum. Congratulations to those who were positioned correctly. But as our framework dictates, an ATH isn't the end of the analysis; it's a trigger to look deeper. While the price is validating, market psychology is now far more important.

The 3-Minute Alpha Brief

The Big Picture: The smoke has cleared from the Fed's annual jamboree at Jackson Hole, leaving the market high on the fumes of dovish sentiment. Our short-term bullish stance is validated, but second-level thinking demands we look past the party.

The current Global Liquidity cycle is not only mature (now 34 months old) but is also starting to look remarkably like the mid-1980s cycle that ended in the 1987 Crash. Don’t panic yet... While the parallel is notable, our focus remains on the current data, not historical determinism.

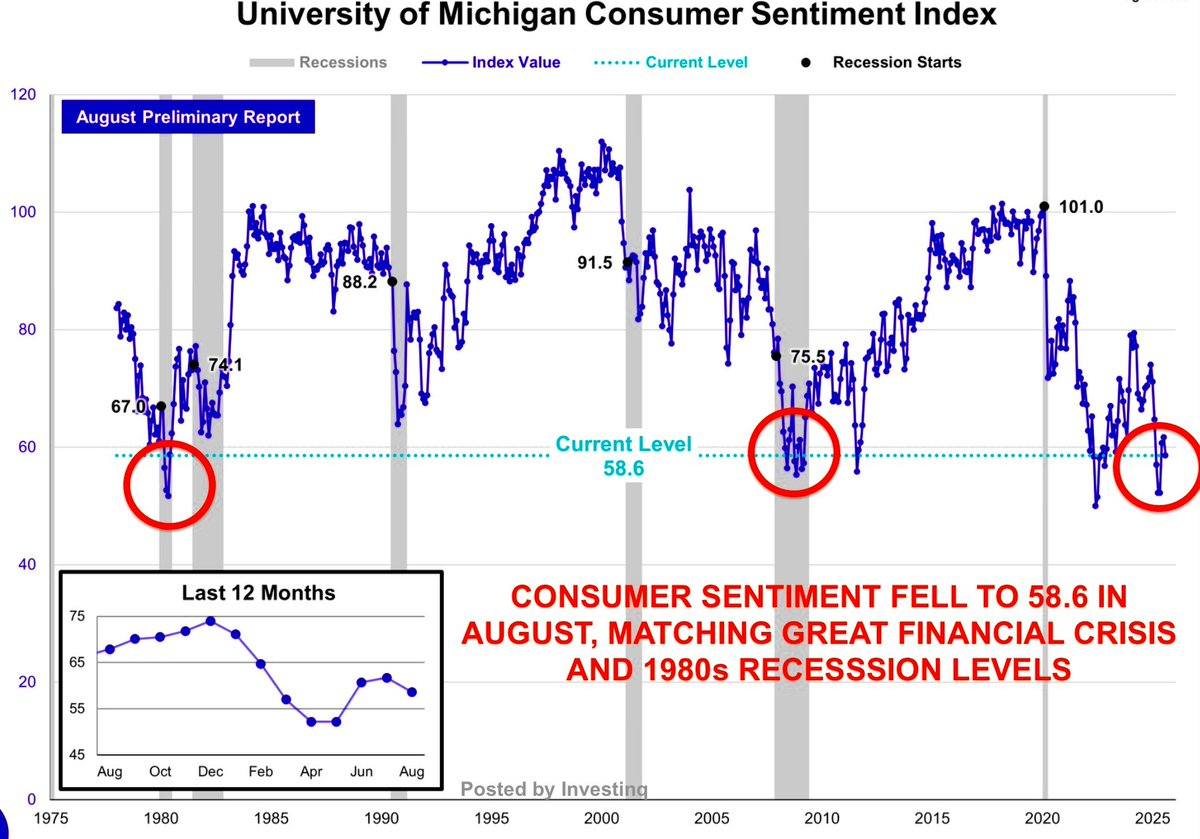

The message from the real economy is clear: things feel stagnant. Consumer sentiment down, sales are broadly slowing, and recently laid-off workers are hoping for re-entry at a 20% discount. Yet, profits for many businesses are up as AI and automation slash back-office costs. This is the core tension: a weakening consumer versus corporations optimizing for net income, not revenue.

Chairman Powell's statement from the event, citing a "shifting balance of risks," was the signal. First-level thinking heard a dovish tilt. Second-level thinking understands this is the Fed manufacturing justification for future rate cuts based on labor market risk, long before inflation hits its 2.0% target.

This creates a powerful, policy-driven tailwind for assets, even as the underlying economy softens.

This pivot is necessary because the real economy is already flashing yellow. Forget the mega-cap mirage; the underlying pulse for most businesses is a 4-6% contraction.

At this point we’re expecting a cut however the good news is now priced in. If anything there is likely bad news sometime in September which means you should really think about how much risk you’re currently carrying. Our charts are showing the signals - both on indexes and BTC.

We don’t think the cycle is over, nor do we think the S&P has peaked for the year. However, we wouldn’t just chase the highs since they typically lead to a correction – instead we are squarely focusde on buying generartional lows in select plays, while still anticipating that 70% chance for the alts rally post the pullback.

The Lay of the Land (Our Updated Base Case):

- S&P 500: The market is in a late-stage, policy-driven melt-up, fueled by the consensus expectation of Fed rate cuts. For the S&P 500, the path of least resistance remains higher, with any pullbacks expected to be shallow (5-7%) and viewed as dollar-cost averaging opportunities. An eventual run toward the 6,800-7,000 range is within the probabilities, though the primary objective is to outpace inflation, not to chase parabolic tops.

- Crypto Majors ($ETH/$BTC): The crypto cycle is far from over, as the retail-driven mania phase has not yet begun. Ethereum's recent All-Time High is a powerful confirmation of institutional arrival, validating our thesis that it will outperform Bitcoin as the preferred asset for new capital flows. However, historical patterns show a healthy and highly probable 10-20% "cool off" period is a standard feature after such a breakout; this is a reset, not a top. Our conservative end-of-cycle target for ETH remains in the mid-to-high $6,000s.

- The Altcoin Conundrum: The altcoins market presents a critical divergence. Our thesis was for crypto to front-run the Fed cuts, but only ETH got the memo; the altcoin market suffered a severe markdown. This was not a bug, but a feature: a necessary retail capitulation that washes out weak hands and forms the precondition for a true accumulation base. Our models continue to assign a 60-70% probability to an eventual alt season, though it will require a new narrative to ignite.

- The Path Forward & Market Sentiment: Looking forward, a September rate cut is now fully priced in. The market narrative will therefore shift from if the Fed will cut to why—focusing on economic weakness. Our signals confirm a corrective phase is imminent: a 5-7% pullback for the S&P 500, and an already-underway 15%+ correction for crypto, which appears to be front-running the cool-off.

The strategy is clear: exercise discipline, let the correction play out, and prepare to deploy capital into the generational lows we have identified.

An new 'State of Play' for Crypto update is coming soon. We will provide our full framework then.

This post is for paying subscribers only

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.