The 3-Minute Alpha Brief

The Big Picture: Last week, we highlighted the brewing "dangerous illusion of strength" in the broader market, a policy-stretched liquidity cycle pushing indices to new highs. This week, the illusion gained $5,000,000,000,000 in tangible form: The "Big Beautiful Bill" is officially signed. Forget the noise about exact spending timelines. The undeniable arithmetic is clear: this monumental injection will significantly increase debt and money supply. This pushes markets to climb a "wall of disbelief"—a psychological trap where fundamentals appear to matter less as institutions are compelled to chase prices higher, creating a powerful feedback loop.

This immense liquidity, coupled with slowing jobs, tech hiring freezes, and public companies embracing crypto, signals one thing: asset values are primed to rise, even if some over-leveraged players face a reckoning. This environment, where the "Trump Put" belief reinforces chasing behaviors, is a classic late-cycle "trap." It reinforces our view: expect wealth disparity to widen, position to own more assets, and patiently await a Fed pivot for the true "alt season." Our process, focused on what's inevitable, not just what's visible, is your key.

The Lay of the Land (Our Updated Base Case)

- S&P 500: We remain in a melt-up trajectory, despite likely short-term pullbacks from current overbought conditions. This is a late-stage euphoria run-up, and we plan to enjoy the ride while keeping our eyes firmly on the exit. A broader Index forecast will follow later this week.

- NASDAQ (QQQ): Climbing in lockstep with the S&P 500, NASDAQ prices should continue their rise through July and August. While a short-term pullback is likely from daily and weekly overbought conditions, the 2-week and monthly charts show strong upward momentum.

- Commodities & The Great Rotation: This rotation into hard, tangible assets is no longer just a theory; it's our primary strategic theme in action, and we have been positioning accordingly. We encourage you to read our new research, "The Quiet Roar: Why Smart Money is Stacking Metals," linked at the bottom of this Alpha Report.

- Crypto (BTC/ETH): Our thesis remains unchanged: continue accumulating BTC and, especially, ETH, as it is much better positioned. While a short-term alt rally is possible, we advise waiting for an improving signal in the charts and a definitive Fed pivot before significantly adding to altcoin positions. We still assign a roughly 60% probability to a significant altcoin rally sometime in 2025. The institutional footprints are visible in Ethereum, where smart money is quietly accumulating ahead of an expected outperformance. The broader altcoin market is still painfully building its base—a necessary process that shakes out weak hands and sets the stage for a powerful rally later.

We encourage you to take a look at our latest opinion letter on the state of crypto here.

How We're Playing It (Portfolio & New Positions)

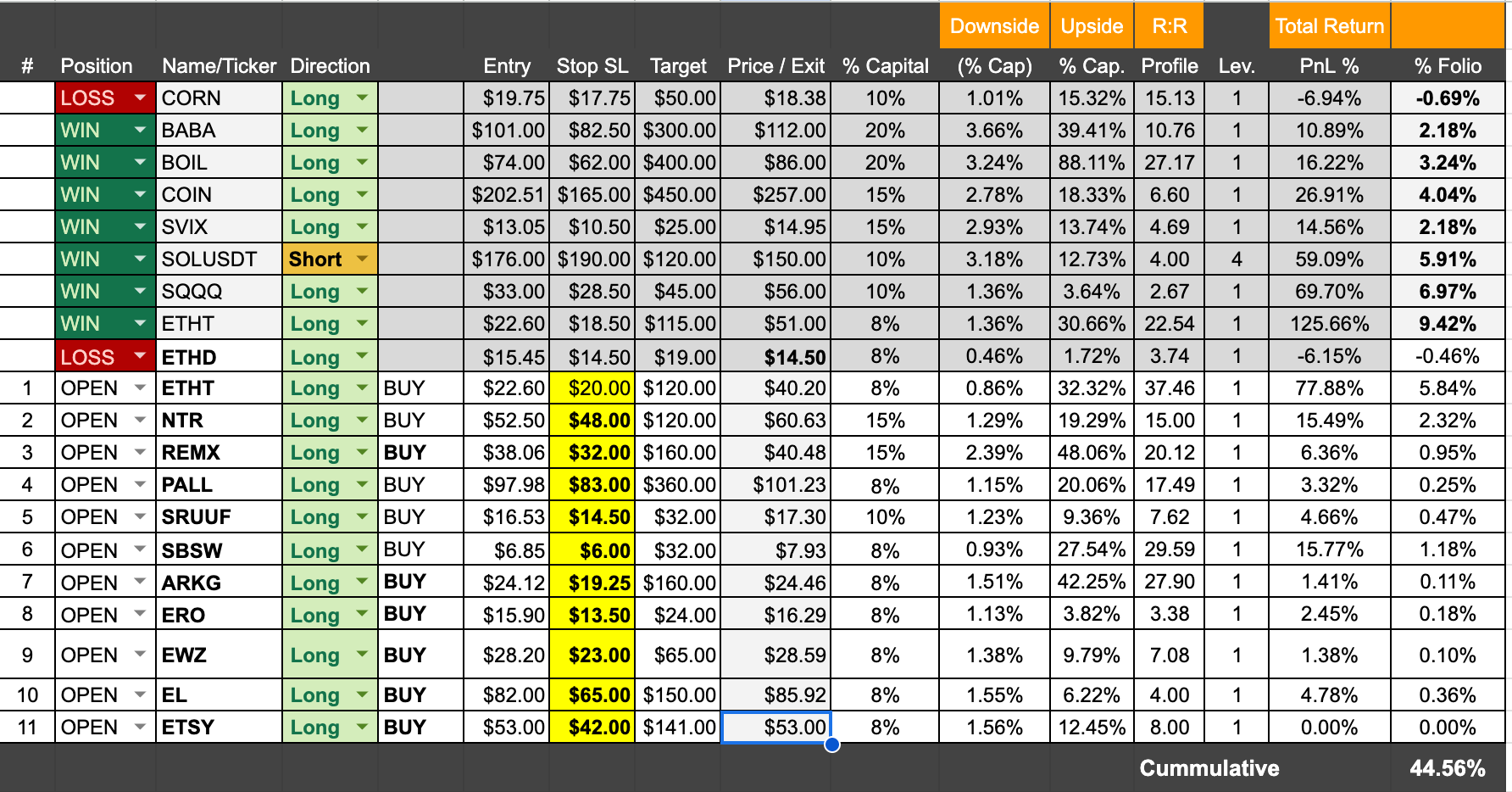

- YTD Summary: Our process continues to deliver, with our portfolio showing a respectable 44.5% year-to-date return. The recent light correction in ETH was a minor, healthy dip. As mentioned, we expect July to be a rewarding month as our core theses play out, even though we may see a short-term pullback this or next week from overbought index conditions.

- Our leveraged Ethereum play (ETHT) remains a top performer, where we prudently took 50% profits on June 13th. We also closed our ETHD hedge at a minor loss, a disciplined move as BTC and ETH momentum may continue their climb, rather than experiencing the deeper pullback we initially hedged for. Meanwhile, our "Great Rotation" basket of metals and mining is performing well, though we anticipate a potential pullback from its aggressive recent run since our entries.

- We've initiated one new key position this week to further diversify our portfolio from metals. We are now fairly set at 10 positions and are unlikely to add many more new names. Our focus shifts to adding to existing high-conviction plays (after initial 40% entries) on confirmation signals, using our proven 40%/40%/20% scaling plan. We will, of course, continue to publish new interesting names, and for our followers, this is for your discretion, or potential rotation if we see stronger momentum elsewhere.

- ETSY: We've entered a 40% position at $53. After several years of what we call a "hand-crafter's base," our system confirms smart money accumulation. We believe this is the early innings of Phase 2 (Rise), and we've shared our detailed publication on ETSY at the end of this Alpha Report.

**Review new positions and updated stop loss prices in the table below. Strong buys are highlighted in bold. We have updated several Stop Loss targets from last week, so please update your portfolio accordingly. Beyond that, let's watch and get ready to add more capital to our winners.

Actionable Takeaways (Tips for the Week):

- For our Starter & Conservative Investors: Continue riding this euphoria wave, but be prepared for potential short-term pullbacks from overbought conditions. We anticipate a market top in late August or even Fall and will signal clearly when to reposition into key defensive names.

- For our Engaged & Aggressive Investors: The plan is working. The primary focus is timing the crypto rally; we still see a 60% likelihood for an Altcoin rally and will share specific names. Continue buying ETH now or on any pullback. We'll update you on ETH/ETHT ETF signals when we have confirmation to add more capital. This is where outsized gains are likely to emerge as part of a final, blow-off top for the broader bull cycle. Patience here will be handsomely rewarded.

- For our Aspiring Quants: The core stance remains consistent. As mentioned, we are developing fascinating new indicators for spotting accumulation patterns, which we plan to share soon. The current market is a perfect laboratory for these tools.

Part 2: The Deep Dive

Charts of the Week:

Special Topic: The Arithmetic of Inflation & Your Future Returns

No surprise here: if you're not an asset holder, now's the time to become one. With an anticipated $5 trillion flowing into the system over the next two years, asset prices are directionally destined to climb.

Let's break down the "Big Beautiful Bill" and its core impact:

More Fiscal Fuel, Less Nitty-Gritty for Most While the bill's fine print offers niche benefits like tax-free tips (up to $25,000), a $1,000 child benefit, and increased SALT deductions (to $40,000) benefitting higher property tax payers, these individual items won't move your wealth needle much. Businesses get 100% write-offs for equipment and research. The real story, as always, is the macro impact of pure money printing.

The Quick Math on Impact: Where Your Capital Should Be Collecting a few thousand "US tokens" from the bill isn't life-changing money. The real game is positioning for what this fresh wave of liquidity will inflate. Let's look at what history whispers:

Since COVID (2020), total US government debt jumped from $27 trillion to $37 trillion (a 37% increase). M2 money supply expanded from $15.4 trillion to $21.9 trillion (a 42% increase). In the same period:

- The S&P 500 soared over 100% (from ~3,100 to ~6,300 points).

- Median home prices rose 31% (from $320,000 to $420,000), even amidst rising interest rates.

- The crypto market cap exploded over 1,000% (from $300 billion to $3.3 trillion).

- Stated inflation collectively hit 25-30%.

What does this historical telemetry tell us?

- Crypto: Historically, it benefits most from money printing, though current market caps mean even larger flows are needed for dramatic moves.

- Housing: Tends to mirror money supply increases almost 1:1.

- S&P 500: Shows a roughly 2.5x leverage factor compared to money supply expansion.

Put That Together: The Future Value of Your Capital If you're still holding significant cash, it's becoming an increasingly dangerous position, unless it's earmarked for specific, immediate purchases. For compounding wealth, you're better off as an asset holder.

Let's run the numbers on this incoming $5 trillion:

- A 13% increase in total debt ($5T on $38T).

- A 22% increase in M2 money supply ($5T on $21.9T).

- Taking the average, we're looking at a 16-17% increase in money supply over the next couple of years (compared to 37-42% in one year during COVID).

This implies some exciting potential outcomes over the next two to three years (being conservative here, my friends):

- S&P 500: Could reach around 8,500 points (~40% increase, mirroring the 2.5x leverage) - most likely after a dip this late summer or late fall (on recession or fears)

- Median Home Price: Could hit the high $400,000s, perhaps $485,000 (15-20% increase, in line with money printing) - this is 2 years out, short term we see a slow down in housing - and will write on it a separate opinion piece.

- Crypto Market Cap: Could well exceed $6 trillion, assuming the weak hands have been shaken out. And we hope to see a new wave of innovation in crypto on the backs of it.

Pretty wild stuff, but that's what the numbers say. Unsurprisingly, we won't be selling anything soon. Have no worries about those emotional down days or months. And remember, patience isn't just a virtue in base building—it's the whole ballgame! Whether it takes two years or four, the money is coming, and you have multiple avenues to position yourself based on your risk profile.

Rates – The Only "Wild Card" (Still Bullish) The singular wild card in this deck is the trajectory of interest rates between now and the end of the current Presidential term. We see this playing out in four probable ways:

- Rates flatlining for 12-18 months: Unlikely.

- Modest rate cuts to ~3.75% within 12-18 months: Good Chance.

- Significant rate cuts to 3% or less in 12-18 months: Good Chance.

- Panic mode cuts to 1%, signaling severe economic distress: Unlikely.

As you can clearly see, most of these outcomes lean decidedly bullish. With inflation at 2.5% and current rates at 4.3%, there's a significant positive spread, giving ample room for cuts without reigniting rampant inflation immediately. The political pressure on Powell, and the likelihood of a leadership change if cuts aren't enacted, makes a reduction in rates a high-probability outcome. While a return to 1% rates feels illogical since that would generate high inflation again, a reduction to 2.5% seems a more probable floor, balancing risk-free rates with inflation and avoiding the political difficulty of justifying a "free money" environment again.

This is exciting stuff, my friends. The stage is set!

Part 3: From the MXC Research Desk

For the modern investor who wants to connect the dots between our weekly tactical updates and our analysis and long-term strategic views, here are our most recent in-depth research publications - related to ETSY and Metals/Mining plays.

The Quiet Roar: Why Smart Money is Stacking Metals (While You're Not Looking)

The commodity supercycle is here, fueled by AI, electrification, infra & defense. While markets focus elsewhere, deep structural deficits in copper, lithium, palladium, and REE are brewing. Our brief identifies undervalued miners where smart money is quietly positioning for asymmetric returns.

Etsy: Handcrafted Opportunity?

Etsy ($ETSY) isn't just rebounding; it's entering a high-probability Phase 2 markup. Our data confirms smart money's quiet accumulation and a defined short squeeze setup. This contrarian opportunity, optimized for precision and patience, offers an asymmetric path to profit.

Performance Dashboard

Our Performance Dashboard is your complete playbook. It tracks every asset on our radar — whether we're holding it or watching for an entry—and displays the critical data we use to make decisions, including its current asset phase and our quantitative score.

Between us base hunters, talk is cheap — results are everything. The portfolio tracker below gives you a clear look under the hood. We use the True Time-Weighted Rate of Return (TWRR), which is just a fancy way of saying we measure what matters: the pure performance of our investment decisions, stripping away the distorting effects of when cash comes in or out. It's the most honest way to keep score, and we wouldn't have it any other way.

Disclaimer: MomentumX Capital is not a registered investment advisor. All content is for research and educational purposes only and should not be considered personalized financial advice. Please do your own research and consult with a qualified financial professional before making investment decisions. Past performance does not guarantee future results.