In our recent sector-wide briefing, "Beyond the Smoke" we detailed why the brutal 95% collapse in cannabis has created what we believe is a generational low. Our core thesis is that the market is at a major inflection point, where retail capitulation is being met by quiet, methodical accumulation from insiders and institutions, all ahead of high-probability federal catalysts that could re-rate the industry within 12-24 months. From that analysis, two names emerged as the most compelling ways to position for the coming cycle: GrowGeneration (GRWG) and WM Technology (MAPS). GRWG represents the pure "picks and shovels" play, whose technicals are already flashing a high-conviction, "risk-on" signal for immediate engagement.

MAPS, however, represents a different, perhaps more powerful, kind of opportunity. It is the sector's dominant technology leader, a profitable SaaS business with substantial cash generation, trading at a deep discount. While its technical engine has not yet fully ignited, its combination of extreme value and a complex founder-led drama makes it the preeminent contrarian play for the patient investor. This briefing unpacks that unique thesis and reveals why recent developments have actually strengthened rather than weakened the asymmetric opportunity.

Cannabis sector sentiment is in the gutter. Good. When the public gives up on a sector, it's our job to start paying attention. First-level thinking sees only the carnage of a multi-year bear market—a landscape scarred by price deflation, punitive taxes, and post-pandemic demand normalization.

This is where second-level thinking provides its edge. We must ask a more penetrating question: What is priced in?

In the case of WM Technology (MAPS), the market has priced in not just pessimism, but permanent despair. We believe this is a critical error. Beneath the surface of public hopelessness, a different game is being played—a calculated drama of founders, finance, and a potential take-private that the market has completely misread. While others are paralyzed by the narrative, we're focused on the arithmetic and the clear institutional footprints emerging from the wreckage.

The Narrative vs. The Arithmetic

The public story is simple: cannabis stocks are toxic. Licensed operators are being crushed by the IRS Section 280E tax provision, which can lead to effective tax rates of 70-90%, forcing them to pay taxes on gross profit. This, combined with mass oversupply and price deflation, has left the industry on its knees.

MAPS, as the leading online marketplace, has been punished alongside its clients, plunging from a post-SPAC high of $22 to today's price of around $1.12. This is the kind of brutal markdown that creates psychological exhaustion, shaking out weak hands and forming the foundation for a durable accumulation base.

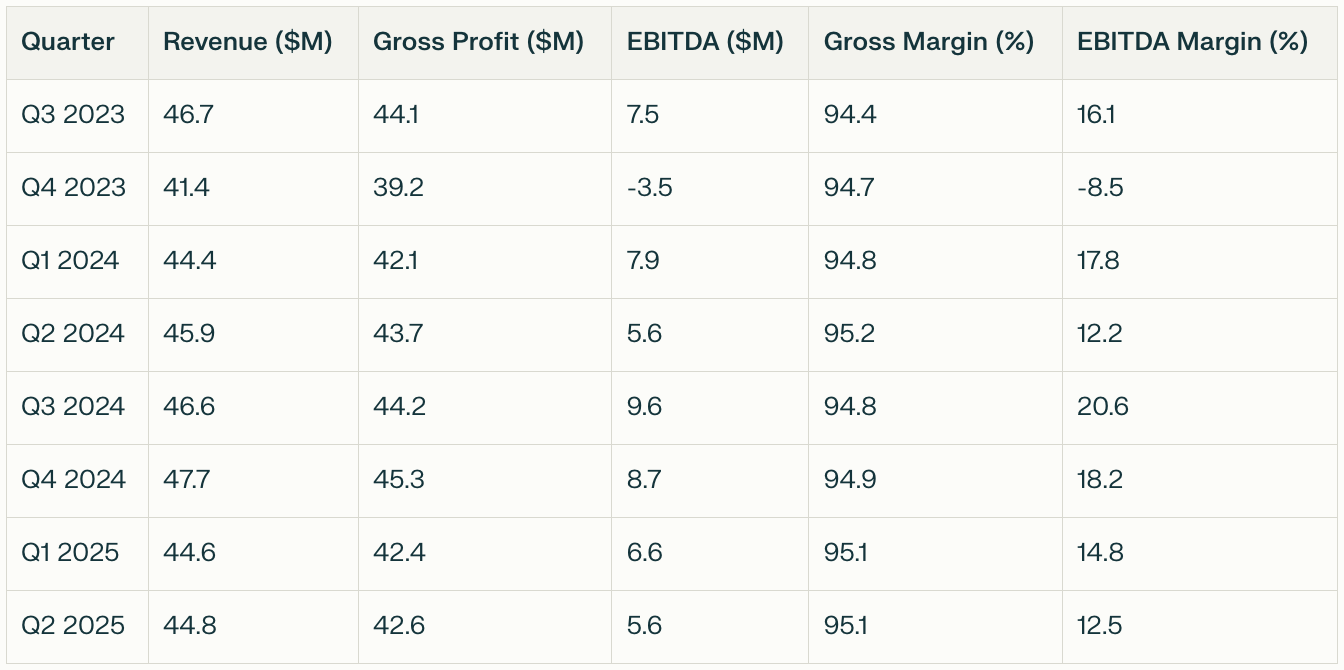

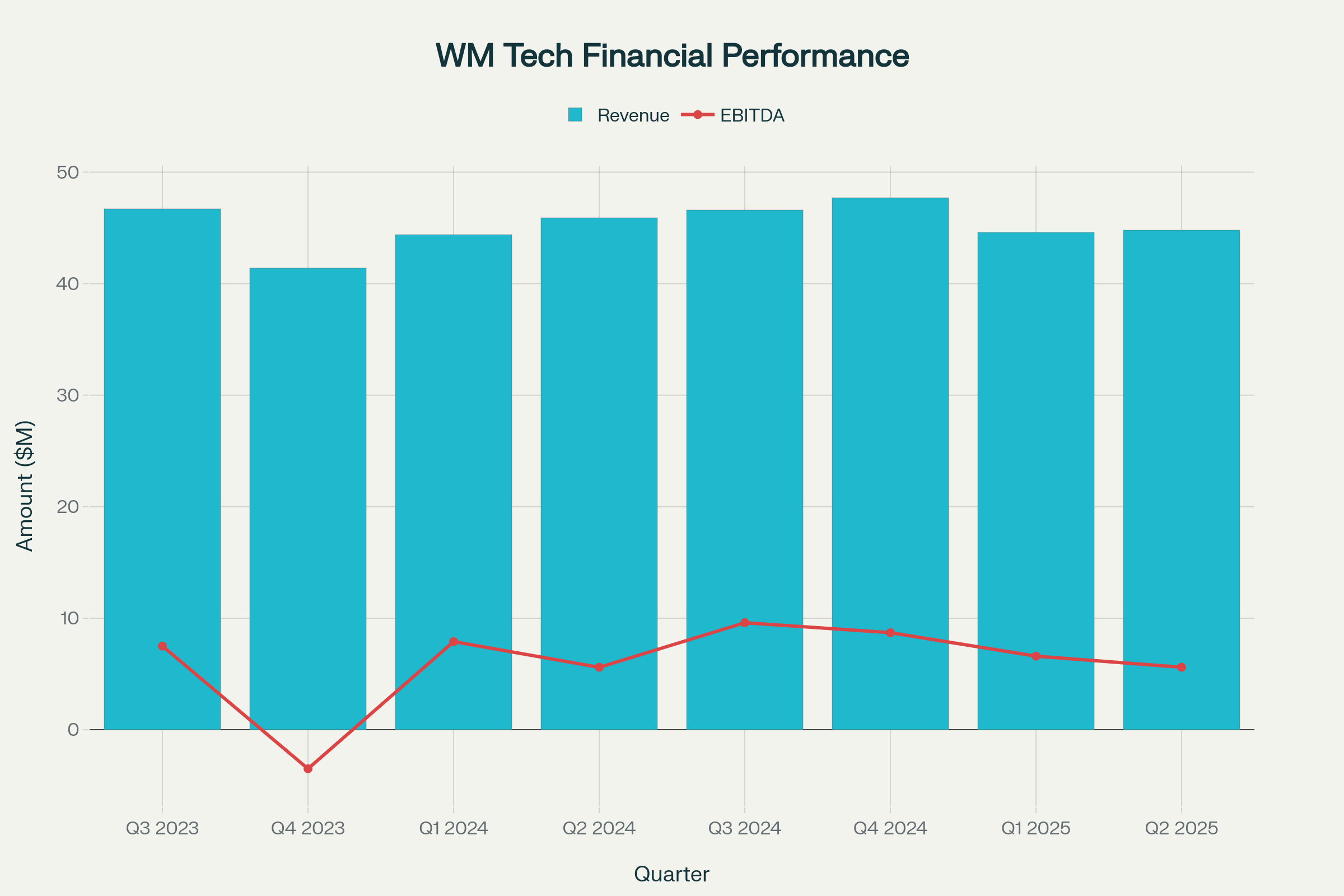

Now, let's look at the arithmetic. Unlike its clients, MAPS is a technology business that doesn't "touch the plant" and is therefore not subject to Section 280E. Despite the industry turmoil, its business has stabilized:

Financial Performance Analysis

Unpacking the Smart Money's Playbook

A cheap stock can always get cheaper. The real signal—the one that tells us the odds are shifting—is the behavior of the founders. And their playbook is whispering secrets that reveal a masterclass in strategic maneuvering.

The Public Signal: In December 2024, founders Doug Francis (now CEO) and Justin Hartfield tabled a non-binding proposal to take the company private at $1.70 per share. The June 2025 strategic withdrawal citing "external factors" appears to have spooked the market, with the stock's current price implying near-zero deal probability.

The Hidden Signal: First-level thinking sees the withdrawal and assumes the deal is dead. Second-level thinking asks: Who benefits from this delay? We believe the strategic withdrawal was necessitated by a critical legal misstep that has inadvertently strengthened shareholders' position rather than weakened it.

The Tell-Tale Timeline: The evidence reveals a sequence that creates unforced constraints on founder behavior:

- October 2024: Founders entered confidentiality agreement regarding "possible negotiated transaction"

- November 7, 2024: Mr. Francis named permanent CEO and granted massive equity package (~5.2% of company) with performance targets at $3.25 and $5.00 per share and extremely friendly Change-in-Control provisions

- December 17, 2024: Take-private proposal at $1.70 per share—49% below the lowest performance target

- June 23, 2025: Strategic withdrawal citing "external factors"

This sequence creates what corporate lawyers recognize as a textbook conflict of interest that fundamentally constrains the founders' future options.

The Compensation Trap: A Legal Straightjacket

The founders appear to have inadvertently created binding constraints that work in shareholders' favor:

Fiduciary Duty Trap: The board-approved performance targets at $3.25-$5.00 established an official assessment of value creation potential. Any take-private offer significantly below these levels invites SEC scrutiny for breach of fiduciary duty.

The Delaware Standard: Management buyouts must meet enhanced "entire fairness" scrutiny. The stark discrepancy between compensation targets ($3.25-$5.00) and the initial buyout price ($1.70) creates a prima facie case for inadequate consideration that would be difficult to defend in court.

SEC Enforcement Risk: Recent regulatory enforcement around management buyout conflicts shows zero tolerance for self-dealing transactions that disadvantage minority shareholders, particularly with such obvious optics issues.

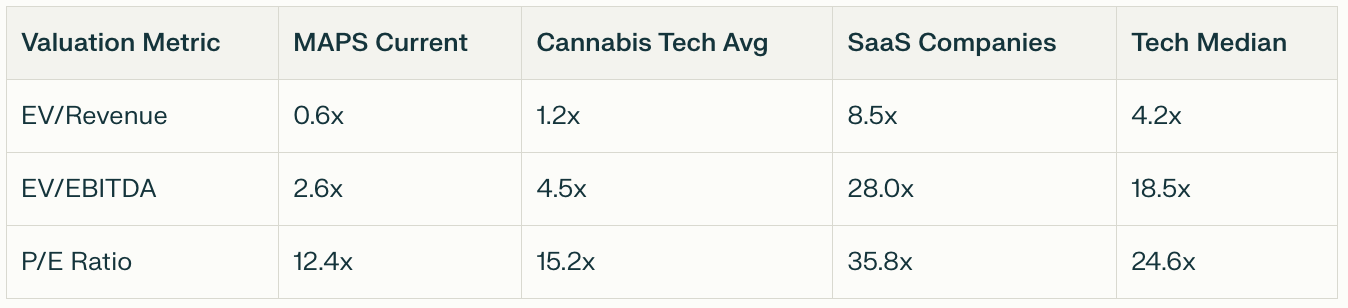

The Valuation Anomaly: Extreme Discount to Technology Peers

MAPS currently trades at valuations typically reserved for distressed situations:

This extreme discount exists despite MAPS maintaining:

- Market leadership in cannabis technology

- Recurring revenue model with high switching costs

- Regulatory advantages (not subject to 280E)

- Strong unit economics with 95% gross margins

A Deliciously Enhanced Asymmetric Bet 🎲

The compensation misstep has transformed this from a simple take-private arbitrage into one of the most compelling asymmetric opportunities we've encountered. The founders have legally constrained themselves into offering shareholders significantly higher consideration.

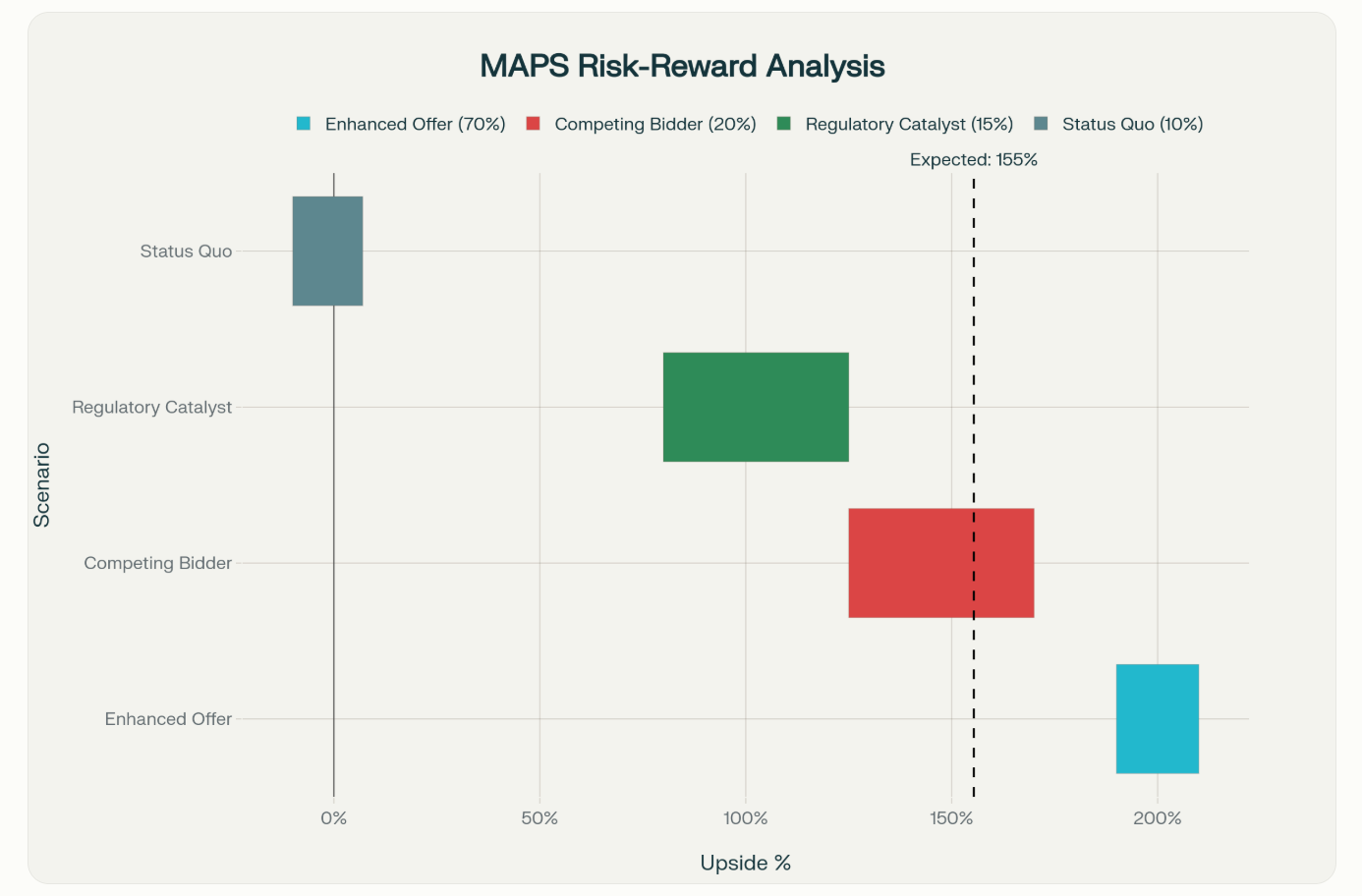

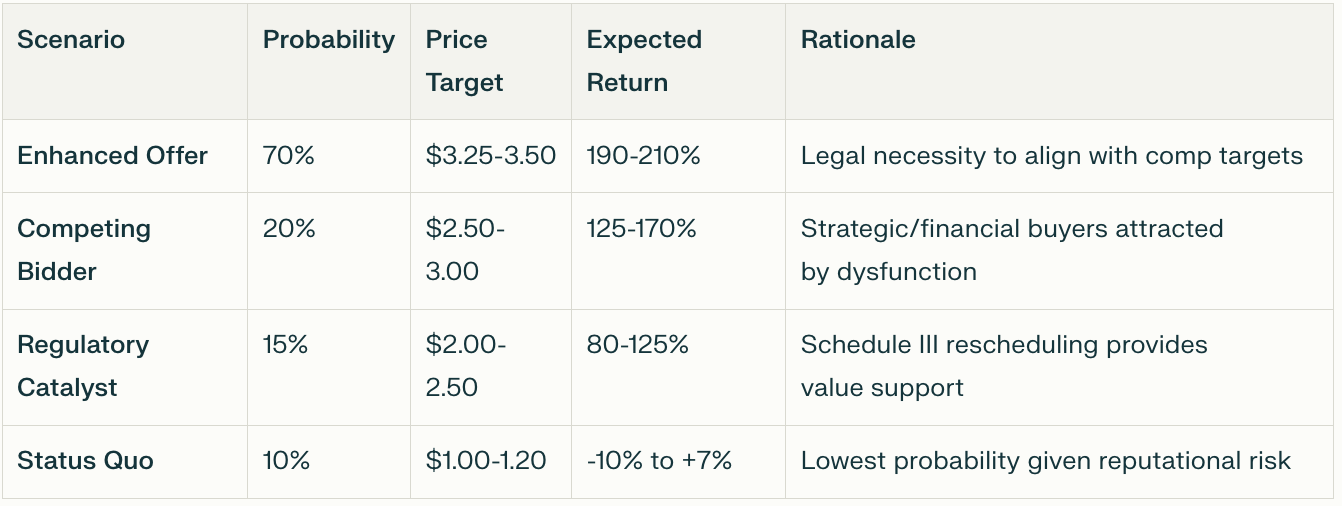

Scenario A - Enhanced Offer (Probability: ~70%): Any future definitive offer must credibly address the compensation conflict to avoid governance and legal issues. This suggests a price floor around $3.25-$3.50 to align with established performance benchmarks. From current levels, this represents 190-210% upside.

Scenario B - Competing Bidder (Probability: ~20%): The governance dysfunction may attract opportunistic strategic or financial buyers who can offer minority shareholders a "clean" transaction without conflict issues. Cannabis tech consolidation is accelerating, and MAPS remains the market leader.

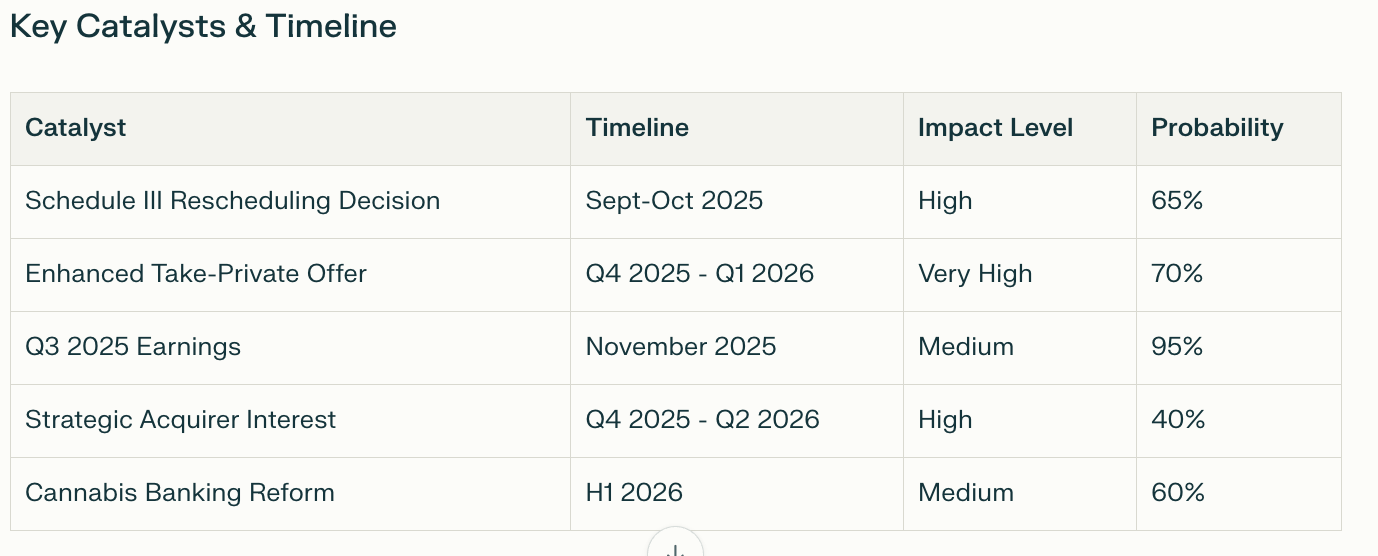

Scenario C - Regulatory Catalyst Boost (Probability: ~15%): Schedule III rescheduling (with Trump administration actively considering the decision) could provide fundamental value support for a higher offer while eliminating 280E tax burdens for clients, potentially boosting MAPS' take-rate economics.

Scenario D - Status Quo (Probability: ~10%): Given reputational and legal risks, abandoning the process entirely seems least likely. The founders' credibility and the board's effectiveness would be permanently damaged.

Probability-Weighted Scenario Analysis

Expected Value: $3.36 (200% return)

The Unpriced Catalyst: Schedule III Rescheduling

The founders are ultimately playing for a generational prize—the potential reclassification of cannabis to Schedule III. President Trump's August 2025 confirmation that his administration is actively considering rescheduling, with a decision expected "over the next few weeks," represents a near-term catalyst that could:

- Eliminate 280E tax burden for cannabis operators, unleashing marketing spend

- Enable higher take-rates for MAPS on transactions

- Remove compliance barriers for strategic acquirers

- Justify premium valuations through normalized business operations

Strategic Acquisition Potential: MAPS represents a lucrative acquisition target for leading technology and e-commerce companies, particularly following reclassification of cannabis to Schedule III. The regulatory normalization would eliminate compliance concerns for mainstream tech acquirers while providing:

- Established market leadership in growing cannabis tech sector

- Proven SaaS business model with recurring revenue

- Regulatory expertise and compliance infrastructure

- Customer relationships across cannabis value chain

The Technical Setup

While fundamentals drive our core thesis, early accumulation patterns and buy signals are emerging on our 2-week timeframe charts. We're monitoring for confirmation at higher timeframes to validate the technical foundation for the anticipated move higher.

Strategic Positioning & Risk Management

This is not a bet on hype; it is a value-oriented position in a profitable technology business where management has inadvertently created legal constraints that favor minority shareholders. The founders' compensation misstep has transformed potential downside into defined upside floors.

Investment Thesis Summary

The margin of safety now includes:

- Legal price floors from compensation conflicts ($3.25+ to avoid governance issues)

- Profitable business fundamentals (positive EBITDA, market leadership, 95% gross margins)

- Regulatory option value (Schedule III rescheduling potential)

- Strategic acquisition potential (mainstream tech buyers post-rescheduling)

- Time arbitrage advantage (patient capital while impatient sellers exit)

Position Sizing Guidelines

Given the enhanced risk-reward profile with multiple paths to significant appreciation, MAPS merits a meaningful portfolio allocation (3-5% for aggressive portfolios, 1-2% for conservative approaches) for investors comfortable with:

- Event-driven complexity and legal/regulatory dynamics

- Patient capital deployment over 12-24 month timeframes

- Sector-specific risks inherent in cannabis investments

- Founder governance issues and potential conflicts

Risk Factors to Monitor

- Regulatory delays on Schedule III rescheduling

- Competitive pressure from traditional tech entrants

- Customer concentration risk among cannabis operators

- Management execution amid governance distractions

- Broader market conditions affecting risk appetite

Conclusion: The Contrarian's Edge

While others are still licking their wounds from the last cycle, we are positioning for the next one. The founders' strategic misstep has inadvertently created exactly the type of asymmetric opportunity that sophisticated value investors seek—a situation where management has constrained itself into delivering higher returns to shareholders.

The market has given us a rare opportunity to buy fear at prices that don't reflect the enhanced probability profile. What appeared to be thesis destruction has revealed itself as thesis validation through second-level analysis.

Key takeaways:

- Extreme sector pessimism has created generational entry points

- Founder compensation conflicts establish legal price floors above current levels

- Multiple catalysts provide various paths to significant appreciation

- Regulatory tailwinds from likely Schedule III rescheduling

- Strategic value for mainstream tech acquirers post-normalization

The setup offers 200%+ expected returns with 90% probability of scenarios generating substantial gains. For investors capable of patient capital deployment and comfortable with cannabis sector dynamics, this represents a compelling asymmetric opportunity.

This is how you play the long game. This is how you win.

Disclaimer: This research is for informational and educational purposes only and does not constitute investment advice. Securities involve a high degree of risk. Investors should conduct their own independent due diligence or consult a licensed financial adviser before making any investment decisions.