Level 3: Engaged Investor, TradFi Native

A Strategic Briefing by Tiger Quant, with Cyclical Analysis from Fox the Strategist

The prevailing narrative has been one of persistent gloom, citing slowing global growth and manufacturing weakness. First-level thinking accepts this and stays away from industrial commodities. But this brings us to a crucial point of second-level thinking: who are you playing against, and what is your edge?

We refuse to play the game of predicting global GDP. Instead, we play the game of observing what smart money is doing and measuring the underlying pressures in the physical market. The story of copper is no longer about a simple fear of recession. It is rapidly becoming a story of acute, structural scarcity.

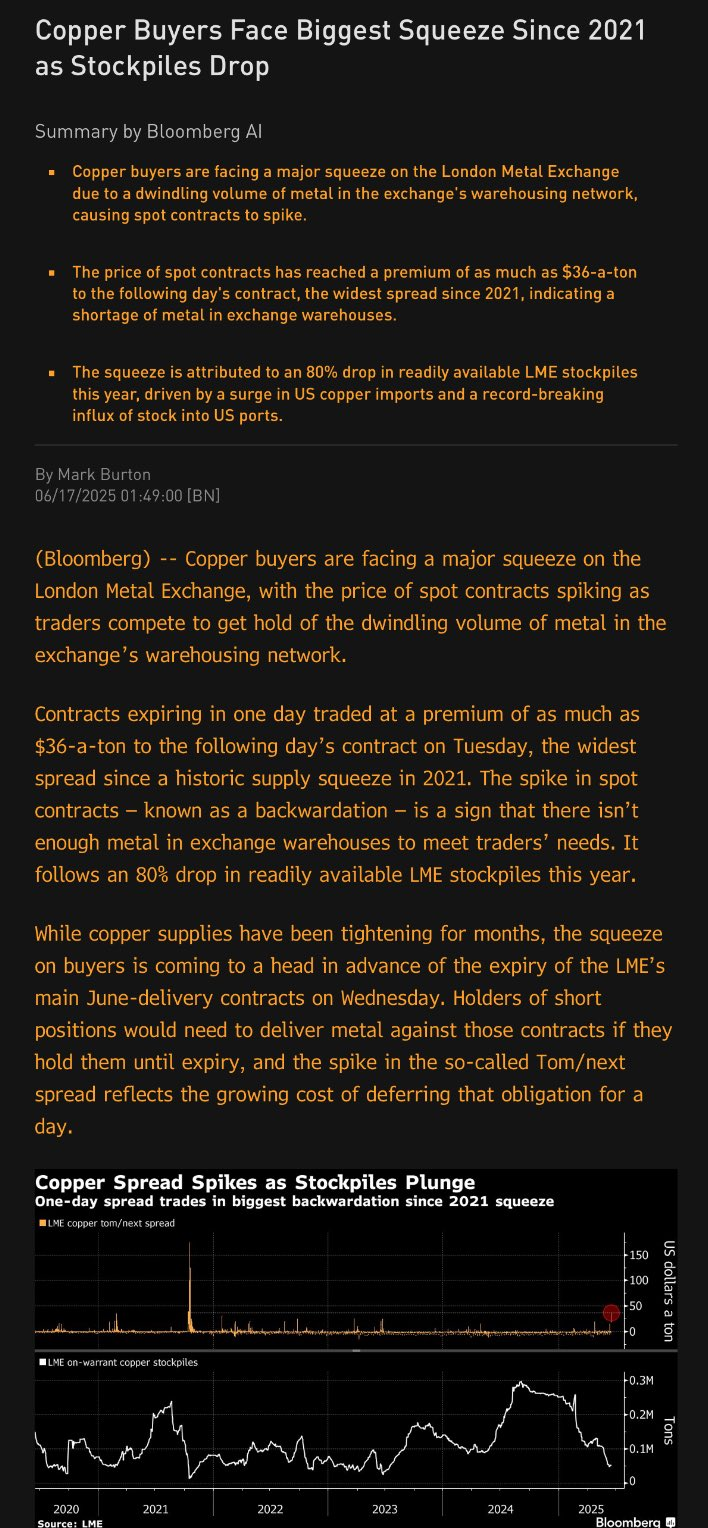

The London Metal Exchange (LME) recently moved to tighten regulations on large bullish positions. This is not a move made in a vacuum. It is a direct response to a market under immense strain, where physical inventories dwindle to near-historic lows. This resilience is the market whispering its plans. While the crowd is paralyzed by the "what if" of a slowdown, they are ignoring the "what is" of a supply-and-demand imbalance that is reaching a critical tipping point.

The second, and more telling, is coming from the boardrooms of the miners themselves. The resources sector is deeply undervalued, igniting a wave of strategic consolidation. When smart corporate capital begins acquiring assets aggressively, it is a clear sign that they see deep value the wider market is missing.

The Confluence of Catalysts: Why Copper, Why Now?

Our core philosophy is to trust data over narratives. The data reveals a powerful confluence of a long-term, structural deficit colliding with an immediate, aggressive market awakening.

1. The Long-Term "Why": A Generational Supply Deficit

The recent wave of M&A in the mining sector is a direct response to a simple, brutal arithmetic problem: a widening, structural, and long-term copper supply deficit. Recent industry analysis quantifies this chasm with stark clarity:

- Today (2024): The market is already in deficit.

- Medium-Term (Late 2020s): The deficit is projected to explode to over 5 million tonnes.

- Long-Term (2035): The problem becomes a crisis, with a forecast deficit of over 14 million tonnes—a staggering 42% of projected demand.

This isn't a cyclical inventory issue; it is a structural chasm. This long-term reality is precisely why smart corporate capital is scrambling to acquire existing assets today.

2. The Short-Term "When": The Market Awakens

The market is finally reacting to this inescapable reality. Our Duo-Lens system confirms the tide is turning:

- Lens 1 (Timeless Wisdom): The charts of both Copper Futures ($HG) and the Copper Miners ETF (COPX) show a masterclass in market structure. Having completed a powerful, multi-year Phase 1 (Accumulation), both have decisively entered Phase 2 (Rise/Mark-Up) on strong, healthy volume. This is a broad, confirmed, sector-wide shift.

This post is for paying subscribers only

Subscribe now and have access to all our stories, enjoy exclusive content and stay up to date with constant updates.