The 3-Minute Alpha Brief

The Big Picture: Markets are entering Q3 with risk appetite riding high, as US equities notch fresh records. This surface calm is being fueled by a perfect cocktail of seemingly good news: fading geopolitical risks, flickering progress on trade talks, and persistently dovish Fed tones that have pressed Treasury yields lower. It’s little wonder the Dow just posted its best week in months.

However, second-level thinking requires us to see this for what it is: a dangerous illusion of strength. This manufactured optimism is providing the ideal cover for the smart money to silently de-risk and take profits. This is classic late-cycle behavior, reminiscent of the 1986/87 period, where policymakers stretch a mature, 33-month-old liquidity cycle to its limits. The market is no longer pricing fundamentals; it's pricing the absence of immediate bad news, leaving it entirely dependent on a future Fed pivot—a pivot likely to be triggered only by the recessionary data everyone is currently choosing to ignore.

The Lay of the Land (Our Updated Base Case)

- S&P 500: The market is printing new all-time highs, and the champagne is flowing. We see this "final lap" extending into July and August as policymakers do everything they can to keep the music from stopping. Our charts confirm we are in a late-stage euphoria run-up, and we plan to enjoy the ride while keeping our eyes firmly on the exit.

- NASDAQ (QQQ): The NASDAQ is being dragged along for the party, but don't let that fool you. Beneath the surface, the real story is a quiet rotation. We are seeing institutional players use these euphoric highs to slip out the back door of the over-loved and overcrowded tech and AI leaders.

- Commodities & The Great Rotation: This rotation into hard, tangible assets isn't just a theory; it's our primary strategic theme in action. While others chase the final flicker of the tech flame, we are seeing clear accumulation in the assets that will power the next cycle: commodities, metals, and miners. We have been positioning accordingly.

- Crypto (BTC/ETH): Now, let's talk about where the real dislocation is. Crypto sentiment is in the gutter—the lowest we have seen in a long while. And between us base hunters, that's absolutely delicious. We assign a roughly 60% probability to a significant altcoin rally sometime in 2025. The institutional footprints are already visible in Ethereum, where smart money is quietly accumulating ahead of an expected outperformance. The broader altcoin market is still painfully building its base, a necessary process that shakes out weak hands and sets the stage for a powerful rally later.

How We're Playing It (Portfolio & New Positions)

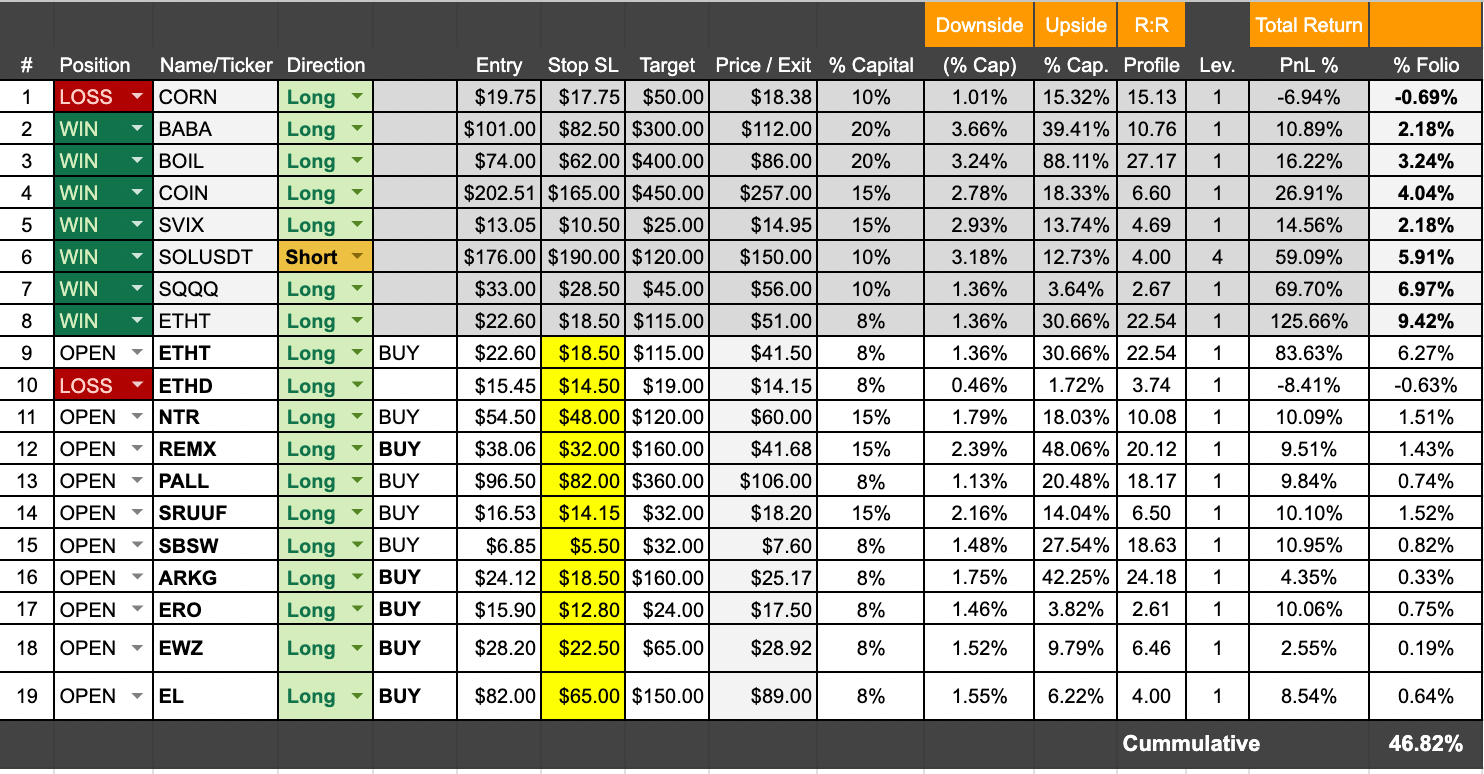

- YTD Summary: Our process continues to deliver, with our portfolio showing a respectable 43% year-to-date return. The recent light correction in ETH was a minor, healthy dip. We expect July to be a rewarding month as our core theses play out.

- Key Positions & Trades: Our top performer remains our leveraged Ethereum play (ETHT), where we prudently took 50% of our profits off the table on June 13th. We are holding ETHD as a tactical hedge, waiting for cycle confirmation to redeploy. Meanwhile, our "Great Rotation" basket (SBSW, PALL, U.U, ERO) is firing on all cylinders.

- Our Newest Strategic Bets: We've initiated several new positions, scaling in to capture what we believe are high-conviction setups:

- Estée Lauder (EL): We've entered a 40% position at $82. After a two-year pit stop, our system confirms the smart money (including Michael Burry) is accumulating, and the markup phase is green-lit.

- Ero Copper (ERO): We've initiated a 40% position at $15.90. This is a direct play on the structural copper deficit, a theme we detailed in our latest research.

- Palladium (PALL) & Brazil (EWZ): We've added to our contrarian plays, entering PALL at $98 and EWZ at $28.12. Both represent deep value and maximum pessimism—our favorite combination.

- ARKG: A 40% position at $24.10. The genomics sector was left for dead, and after a multi-year base, it is quietly showing signs of institutional accumulation once again.

**Review new positions and updated stop loss prices in the table below. Strong buys are highlighted in bold.

Actionable Takeaways (Tips for the Week):

- For our Starter & Conservative Investors: Ride this euphoria wave with both hands on the wheel, but be ready to take the next exit. We anticipate a market top in late July or August and will signal clearly when it's time to reposition into a few key defensive names.

- For our Engaged & Aggressive Investors: The plan is working. The primary focus now is timing the crypto rally. This is where the next opportunity for outsized gains will likely emerge as part of a final, blow-off top for the broader bull cycle. Patience here will be rewarded handsomely.

- For our Aspiring Quants: The core stance is the same, but get ready. We are working on some fascinating new indicators for spotting accumulation patterns, which we plan to share with you soon. The current market is a perfect laboratory for these tools.

Part 2: The Deep Dive

Chart(s) of the Week:

Chart of the Week: A Textbook Case of Quiet Accumulation

Alright, let's pull up a chart that gets my inner pattern-hunter excited. Between us base hunters, the Estée Lauder (EL) setup is a thing of beauty—a textbook example of what we look for when we talk about divorcing a narrative from the data.

For the past two years, the first-level story on EL has been one of operational headwinds and market struggles. The price action reflects this pessimism; the stock was left for dead, languishing in a deep, multi-year base. This is the kind of setup that causes most investors to lose interest and sell out of sheer boredom.

But this is precisely where the second-level thinking begins. While the crowd was looking away, the smart money was quietly going to work. Let's look at the institutional footprints:

- The Quiet Absorption: While the public has been selling, institutions have been methodically absorbing every share they can. Over the last 12 months, we’ve seen a net inflow of nearly $1.5 billion ($5.86B in inflows vs. $4.41B in outflows). That isn't random noise; that's a clear, deliberate signal.

- Broad-Based Conviction: This isn't just one or two funds making a bet. We're seeing broad participation on the buy-side. With 559 institutional buyers versus only 422 sellers, the trend is undeniable: conviction to own EL is growing among the world's largest pools of capital.

- The Contrarian's Tell: But here’s the detail that really makes this pattern whisper its secrets. In the first quarter of this year, Michael Burry’s Scion Asset Management doubled its stake, making EL its only long equity holding after liquidating the rest of its portfolio. When a legendary value investor known for his bearish outlook makes such a concentrated, high-conviction bet, we are compelled to pay very close attention.

This is precisely the kind of data-driven, second-level insight that triggered our buy signal. The depressed price provided the margin of safety, but the unmistakable footprints of institutional accumulation gave us the conviction to act. This isn't a guess; it's a calculated position based on observing what the smartest players are doing, not what the headlines are saying.

Copper Miners Breakout - see our research on it.

The chart for Copper Miners ETF (COPX) show a masterclass in market structure. Having completed a powerful, multi-year Phase 1 (Accumulation), both has decisively entered Phase 2 (Rise/Mark-Up) on strong, healthy volume. This is a broad, confirmed, sector-wide shift.

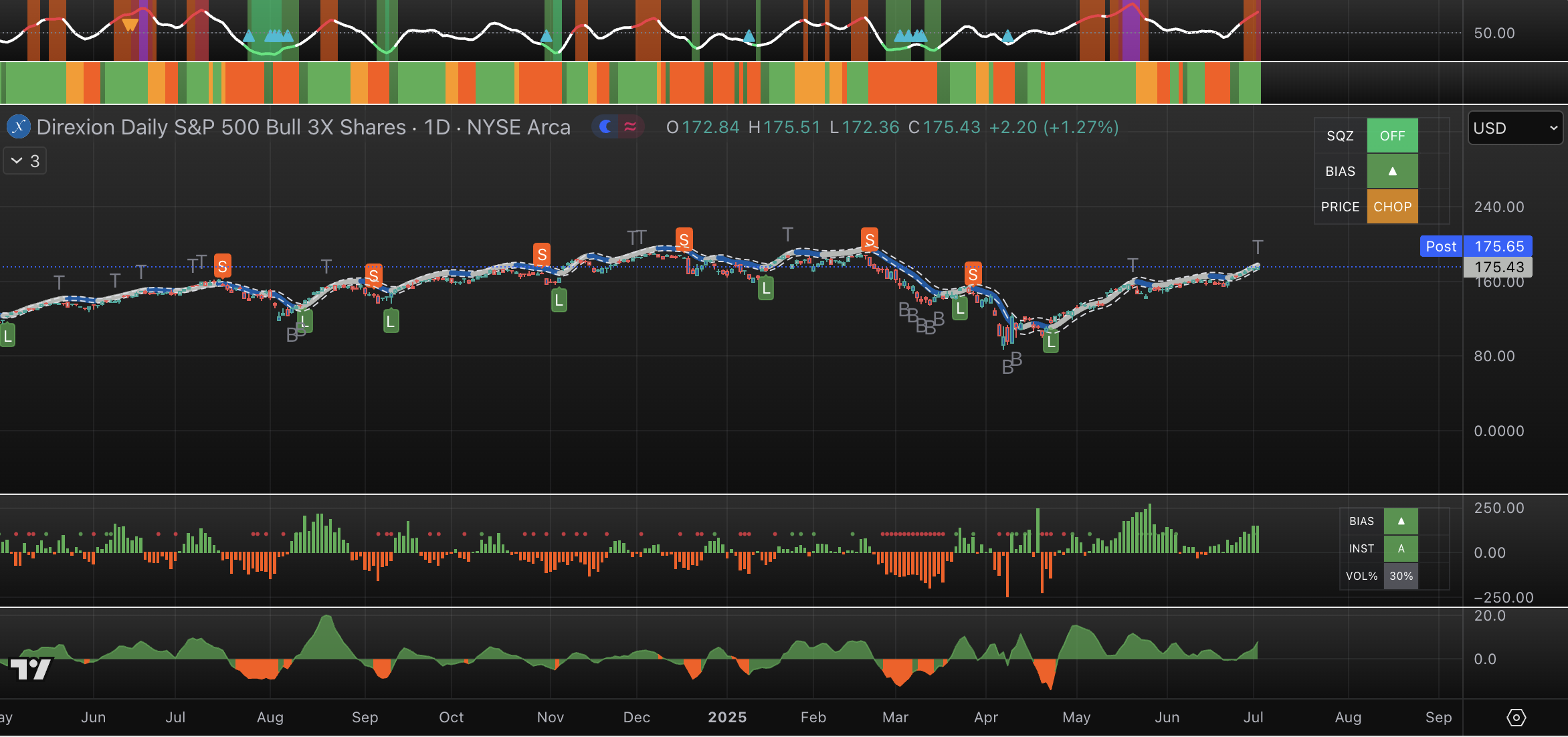

The Equity Melt-Up (TQQQ & SPXL)

Let's be clear: the "final lap" in equities has more fuel than many think. Driven by accommodative policymakers, a cheaper dollar, and the global liquidity we've been tracking, this rally is showing strength on both high and low timeframes. Our buy signal on April 22nd put us in a perfect position for this run.

A quick note on the charts: the patterns in the S&P 500 (SPY/SPXL) and the NASDAQ (QQQ/TQQQ) are nearly identical at the moment. To keep our analysis clean and focused, we'll use the SPXL chart as our primary proxy for the broader equity market's euphoric run.

Our stance is simple: if you're holding the index, you keep holding it. The momentum and volume support a move higher into July and August. We will signal immediately at the first sign of weakness, but for now, we ride the trend with our eyes wide open, fully aware that this is a policy-driven rally, not a new, fundamentally-driven bull market.

The Crypto Accumulation (BTC & ETH) and bottomg on alts (OTHERS/BTC)

Now, let's turn to the more delicious setup. While equities are having their euphoric party, the crypto market is coiling the spring.

Bitcoin is doing exactly what a market leader should do: ranging at its all-time highs and absorbing supply, potentially setting up for its next major breakout.

However, the real story—the one that has our full attention—is the clear strength in the ETH/BTC ratio. This confirms our thesis that Ethereum, after months of quiet institutional accumulation, is poised to strongly outperform.

Therefore, our plan is this: we continue to accumulate ETH and ETHT incrementally, using this period of relative quiet to build our core position. We are now patiently watching for a confirming buy signal on the 2-day and 3-day charts to deploy more significant capital.

Concurrently, we are intensely monitoring the OTHER/BTC ratio. While not a certainty, we believe this ratio is the most reliable leading indicator for a potential shift in risk appetite toward high-beta altcoins, and its trajectory will heavily inform our decision to increase exposure to that segment of the market.

The heavily oversold conditions and bottom signals on 3W hft is a positive sign that - there sitll more room for downtrend - but we may be not far.

We will alert you the moment those signals flash.

Part 3: From the MXC Research Desk

For the modern investor who wants to connect the dots between our weekly tactical updates and our analysis and long-term strategic views, here are our most recent in-depth research publications - related to Copper and EL.

The Copper Conundrum: Why Structural Scarcity is Overruling Slowdown Fears

While first-level thinkers are paralyzed by recession fears, the copper market is screaming a story of structural scarcity. A multi-decade supply deficit, confirmed by a powerful breakout in miners, signals the start of a new bull market. This is a masterclass in positioning for what's inevitable.

Estée Lauder - From the Pit Lane to the Main Straight

After a 2-year pit stop, our system confirms Estée Lauder (EL) has re-entered the race. A high-volume breakout validates our base analysis and institutional telemetry. The markup phase is green-lit, and our execution protocol is active. This is where engineering meets acceleration.

Performance Dashboard

Our Performance Dashboard is your complete playbook. It tracks every asset on our radar — whether we're holding it or watching for an entry—and displays the critical data we use to make decisions, including its current asset phase and our quantitative score.

Between us base hunters, talk is cheap — results are everything. The portfolio tracker below gives you a clear look under the hood. We use the True Time-Weighted Rate of Return (TWRR), which is just a fancy way of saying we measure what matters: the pure performance of our investment decisions, stripping away the distorting effects of when cash comes in or out. It's the most honest way to keep score, and we wouldn't have it any other way.

Disclaimer: MomentumX Capital is not a registered investment advisor. All content is for research and educational purposes only and should not be considered personalized financial advice. Please do your own research and consult with a qualified financial professional before making investment decisions. Past performance does not guarantee future results.