Alpha Report: Consolidated Market Analysis

Blitz Summary and Base Case

In just two weeks, market dynamics have shifted dramatically—a reminder that while periods of calm can last for extended periods, sometimes a decade's worth of change can unfold in mere weeks. This volatility compels us to revisit our previous base case. In this rapidly evolving environment, traditional timelines no longer apply, and our strategy must remain both vigilant and adaptable.

Base Case Scenario: Our central expectation is not for a full-blown recession, but rather a period of significant market correction and economic slowdown, with a clear rotation away from technology.

- The S&P 500 is expected to test lower levels, potentially declining towards the 4,140-4,500 range (a 25-30% total drawdown), likely finding a bottom in April as policy uncertainty takes its toll. A temporary bounce near the 4,800 level is possible, but distinguishing it from a durable bottom will be challenging.

- The Nasdaq may experience a more pronounced decline, with the QQQ potentially testing the 385-405 range.

- The US administration appears focused on managing national debt, employing strategic ambiguity and aggressive trade tactics to influence yields. The risk remains that threading this needle fails, potentially escalating to a broader global downturn.

- The housing market has shown signs of topping. In contrast, Accumulation is building in commodities (copper, palladium, nickel, rare earths), driven by infrastructure and defense spending.

- We assign a ~60% probability to a significant altcoin rally sometime in 2025, but near-term downside seems likely first. Our revised view suggests Bitcoin could test the $70k-74k area and Ethereum the $1,300-$1,500 zone as part of a necessary basing process.

Key Takeaways

- For conservative investors: A defensive stance remains prudent. As the correction deepens beyond 10-15%, preserving capital in cash or quality bonds is sensible. US long bonds (TLT, TMF) are in a basing phase, and we expect a clearer buy signal in the coming months... or rotation into tangible assets.

- For aggressive investors: Maintaining a tactical short hedge on the Nasdaq (e.g., via SQQQ) while positioning for the rotation into commodities, metals, and miners aligns with emerging trends.

- For crypto readers: Signals suggest Bitcoin may be nearing a local bottom, which invites a cautious readiness to pursue select opportunities in well-positioned altcoins as a rebound takes shape, potentially by late April.

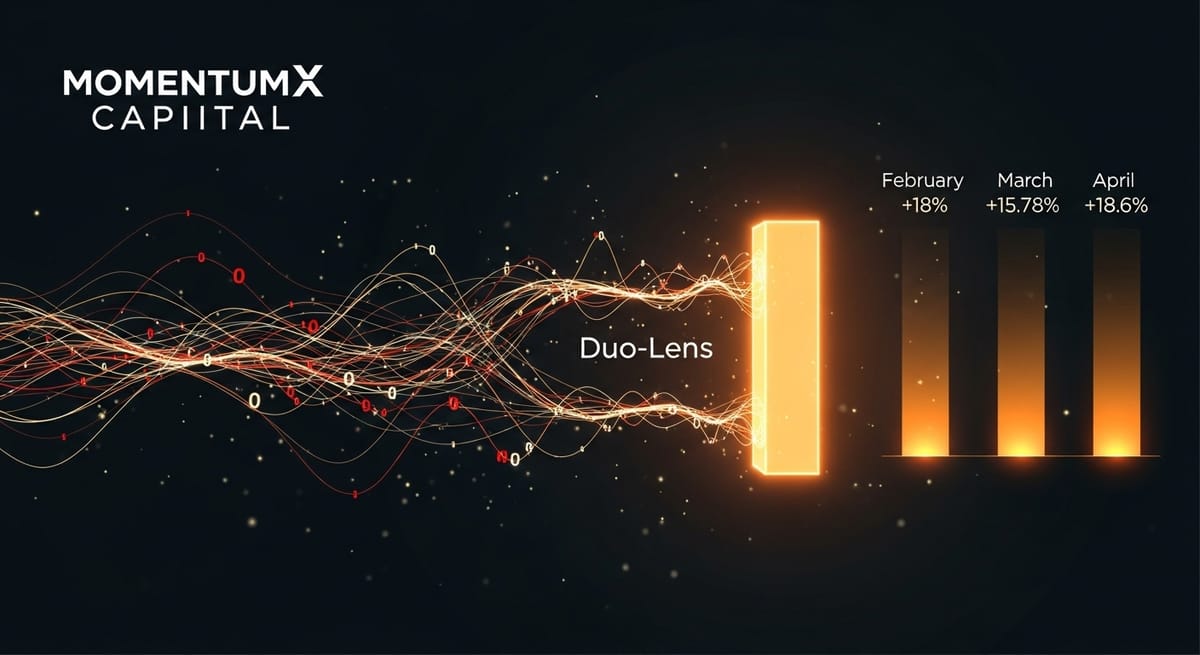

Portfolio YTD

Our year-to-date performance is reasonable. March's returns dipped slightly as BOIL and CORN did not exhibit the expected positive momentum. BABA remains a top performer, and our SQQQ hedge helped offset underperformance elsewhere. We anticipate natural gas may reclaim momentum and are actively considering adjustments to our agricultural commodity exposure - however we may remove both of them - as we see a high potential from other / better strategically plays.

How to Make the Stock Market Make Money for You - Investor Guide

Performance from February 18, 2025 - Performance Dashboard

Our Assets Dashboard and Positions Performance are available here: link

Detailed Market Thesis

Into the Wood: Deeper Uncertainty

As we survey the current market landscape, it is clear we have just ventured deeper into the uncharted woods. While we might have brushed past a fleeting, short-term bottom after this Sunday's sell-off, this is not an escape hatch. Increased volatility is poised to act as a "brakes-on-the-icy-road" scenario, momentarily halting any upward momentum. The underlying trend remains decidedly bearish until decisive fiscal measures and negotiations redraw the map.

A presidential push for tax cuts and a debt ceiling increase introduces additional layers of risk; should these initiatives fail, the potential for a swift recession looms large. Furthermore, tariffs are being used strategically to compel international counterparts back to the negotiation table. The prevailing wisdom here is one of cautious patience.

The Tariff Tango

The market appears poised for a prolonged tug-of-war over tariffs. Our earlier assumption of a dovish Fed pivot has proven wishful; the central bank's stance remains unyielding. The administration's signaling suggests a preference for a drawn-out struggle to sustain pressure and refinance debt at lower rates. Our base case anticipates this impasse will endure for at least six months.

The potential chain of events is as follows:

- The administration's hardline approach will outlast any fleeting notions that tariffs are a temporary nuisance.

- As fatigue sets in, a shift in sentiment may gradually create buying opportunities, potentially near the end of April.

- A critical indicator will be the Fed’s tone. Hints of accelerated rate cuts or an abrupt end to QT might signal a forced recalibration—a precursor to a market bottom.

- With GDP anticipated to decline roughly 3%, confirmation of a technical recession (two consecutive negative readings) may coincide with the market bottoming out, suggesting cautious accumulation could be warranted even before an official announcement in mid-May.

Recalibrating Expectations: Traditional & Digital Markets

S&P 500: A Back-of-the-Envelope Reckoning Our earlier thinking of a ~15% decline now appears insufficient. Persistent policy uncertainty requires a recalibration of our models. Wall Street forecasts of robust growth now seem relics of a different market mood. Revisiting the fundamentals, if we apply a rough 10% haircut to EPS estimates (to $230-$250) and anticipate multiples contracting to the high teens (e.g., 18x), we produce a valuation range closer to 4,140-4,500. This isn't precision forecasting, but an attempt to gauge a more plausible range under duress. The surge in retail buying on Friday near the 4,800 level is interesting, as it fits the classic pattern of providing liquidity for exiting institutional investors.

Crypto: TradFi Pressures Create Opportunity As stated in our last report, we believe the structural crypto bottom is likely in. However, the extended pressure on traditional markets into mid-April may also affect cryptocurrencies, creating an opportunity for astute investors to begin accumulating select, well-positioned coins. The significant proliferation of coins this cycle—and liquidity concerns from scams—warrants a very selective approach.