How to Make the stock market make money for you - guide.

Our Assets Dashboard and Positions Performance are available here: link

Executive Summary & Base Case

Our base case foresees a market slowdown, not a full-blown recession, defined by a structural rotation out of technology. We anticipate the S&P 500 will see new lows in April, with a model-projected decline of ~15% from the peak, driven by a US administration leveraging policy uncertainty to lower Treasury yields. The Nasdaq is expected to see a deeper correction, with the QQQ likely testing the 420–450 range.

Following this, a reversal is expected, with the S&P 500 positioned for new all-time highs, though tech indices may lag. We see a clear Accumulation phase building in commodities (metals, rare earths) fueled by infrastructure and defense spending. Our model assigns a ~60% probability of an altcoin rally in 2025, potentially beginning by mid-April. The prudent strategy is to maintain a defensive posture while tactically positioning for this rotation.

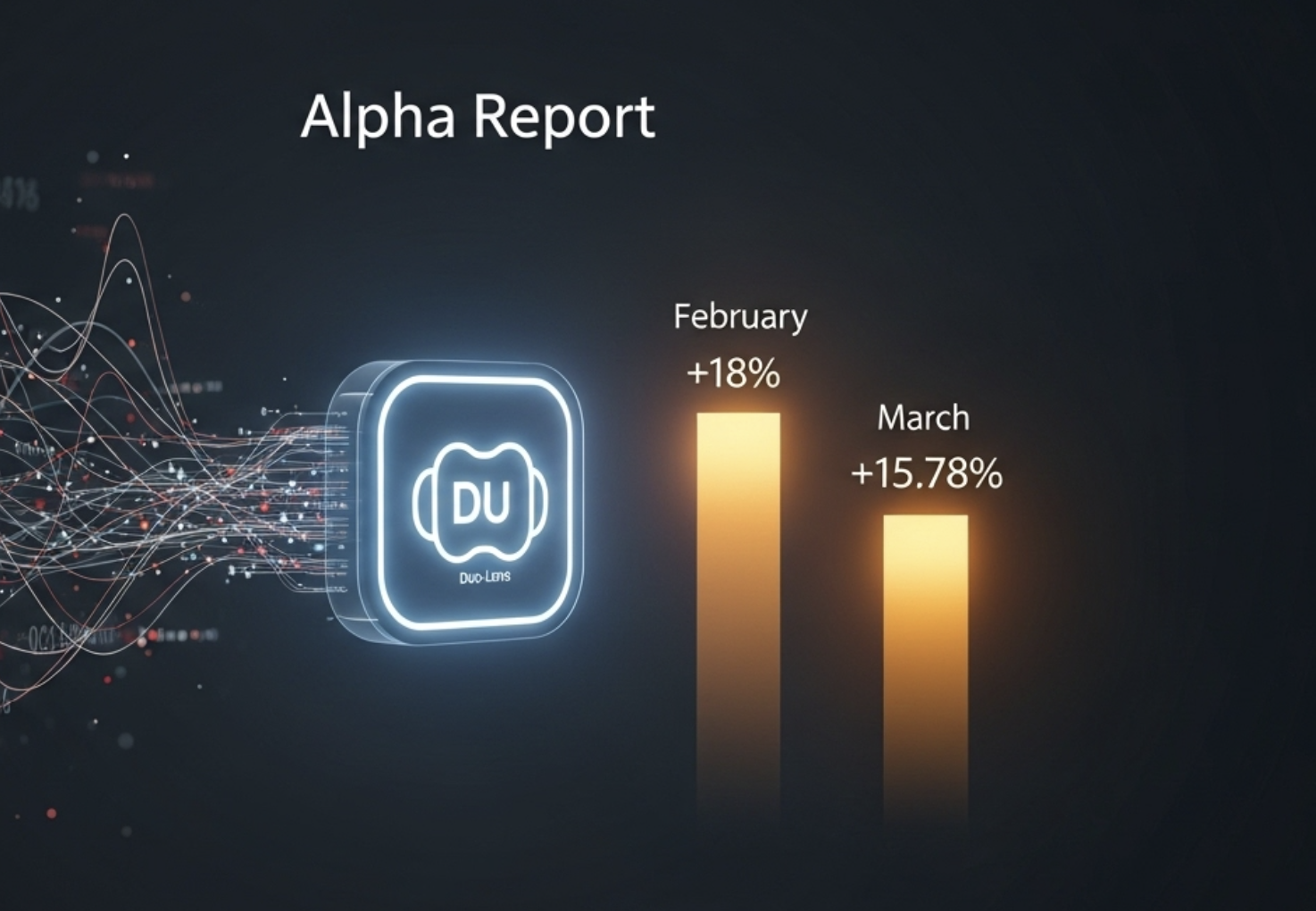

Portfolio YTD

As a matter of transparency, our year-to-date performance is reasonable. March returns dipped as BOIL and CORN failed to gain momentum. BABA remains a top performer, and our tactical SQQQ hedge helped offset underperformance elsewhere. We are actively considering adjustments to our commodity mix - reducing corn and natural gas.

Official start of portfolio tracking February 18.

Detailed Thesis & Market Structure

Part 1: The Topping Process in U.S. Equities

The historical adage to "buy the dip" in U.S. tech is facing an unprecedented challenge as the U.S. undergoes a necessary corrective "detox." Many investors remain fixated on a narrow selection of familiar names—a condition aptly described as “Bag-7-itis”—clinging to outdated strategies even as metrics like the CAPE ratio signal broader concerns.

This is not a sudden event but a sequential topping process confirmed by the data:

- July: Highs in Japan’s Topix and Microsoft.

- September: A peak in the high-yield bond index.

- December/January: Titans like Apple, Tesla, and finally Nvidia, lose momentum.

The clearly topping pattern in the MAG7-to-QQQ ratio chart validates this thesis.

Part 2: The Macro Drivers – A Policy-Induced Rotation

The primary driver of this environment is a significant pivot in monetary policy. The Federal Reserve has dramatically slowed its Quantitative Tightening (QT) program, slashing its Treasury runoff from $25 billion to just $5 billion per month. While maintaining its "higher for longer" rhetoric on rates (citing tariff-related inflation risks), this 80% reduction in QT is a clear signal of easing.

Simultaneously, the administration appears focused on bringing the 10-year Treasury yield down towards 3.5% to facilitate debt rollovers. The Fed’s strategy of maintaining MBS runoff while slowing Treasury runoff aims to lower Treasury yields while keeping mortgage rates steady, effectively cooling the housing market. Indeed, the homebuilders ETF (XHB) have shown the signs of a topping pattern and started a drop phase.

This policy mix is actively encouraging a rotation from frothy equities and housing into hard assets and commodities.

Now moving on, the declining dollar will be compelling investors to reconsider their allocations.

Hard assets—whether precious metals, or other tangible investments—are rising in appeal as they offer a hedge against currency devaluation and inflation. From a conservative perspective, this evolving scenario reinforces the need for diversification and cautious, disciplined positioning.

We believe it is a signal to recalibrate away from over-concentration in high-flying tech or mainstream equities and to place greater emphasis on assets that possess intrinsic, enduring value.

Part 3: Forward-Looking Scenarios & Key Levels

Traditional Markets: Historical analysis from Warren Pies at 3FOURTEEN shows that ~60% of market corrections exceeding 10% deepen to a 15% decline. Our base case aligns with this, anticipating a 15-25% correction for the Nasdaq and S&P 500. Key structural levels to watch are ~5000 on the S&P 500 and the 420-450 zone on the QQQ. Despite this near-term pressure, extreme pessimism among Fund Managers suggests a sharp rebound is likely following the correction. While we expect 2025 to finish on a high note, this rotation may be the beginning of a longer-term bear market in tech and a new secular bull market in commodities.

Digital Assets: We believe the structural crypto bottom is in, as a full retest of the prior cycle's high is rare. However, near-term policy-driven volatility could create a final dip, presenting an opportunity for accumulation. Our model assigns a ~65% probability of a rally into the summer versus a ~35% chance of a deeper corrective test. The proliferation of new coins this cycle demands extreme selectivity. We anticipate Bitcoin will likely remain below $100K this year as liquidity shifts into a broader altcoin rally.