After a brief period of strategic silence, our focus has been laser-sharp on the evolving crypto landscape, diligently recalibrating our strategic positioning. This is a concise briefing for our disciplined followers on where the chessboard stands—and where we anticipate the next major moves.

Liquidity Is King, Always.

The fortunes of digital assets, like any market worth playing, are inextricably linked to the grand tapestry of global liquidity cycles. While the immediate money supply appears contained, the stage is undeniably being set for a significant expansion. Consider the escalating geopolitical tensions and the looming promise of massive fiscal injection—that anticipated "$5 Trillion Big Beautiful Bill" is no small change. It’s simply a matter of when, not if, policymakers will be compelled to inject fresh liquidity into the system. Historically, such environments haven't just acted as a tailwind; they’ve been a gale force for risk assets, and crypto is very much in that boat.

Our Two-Tiered Strategic Approach: Precision over Prediction

We believe in a surgical approach to the market, and our two-tiered strategy reflects this conviction:

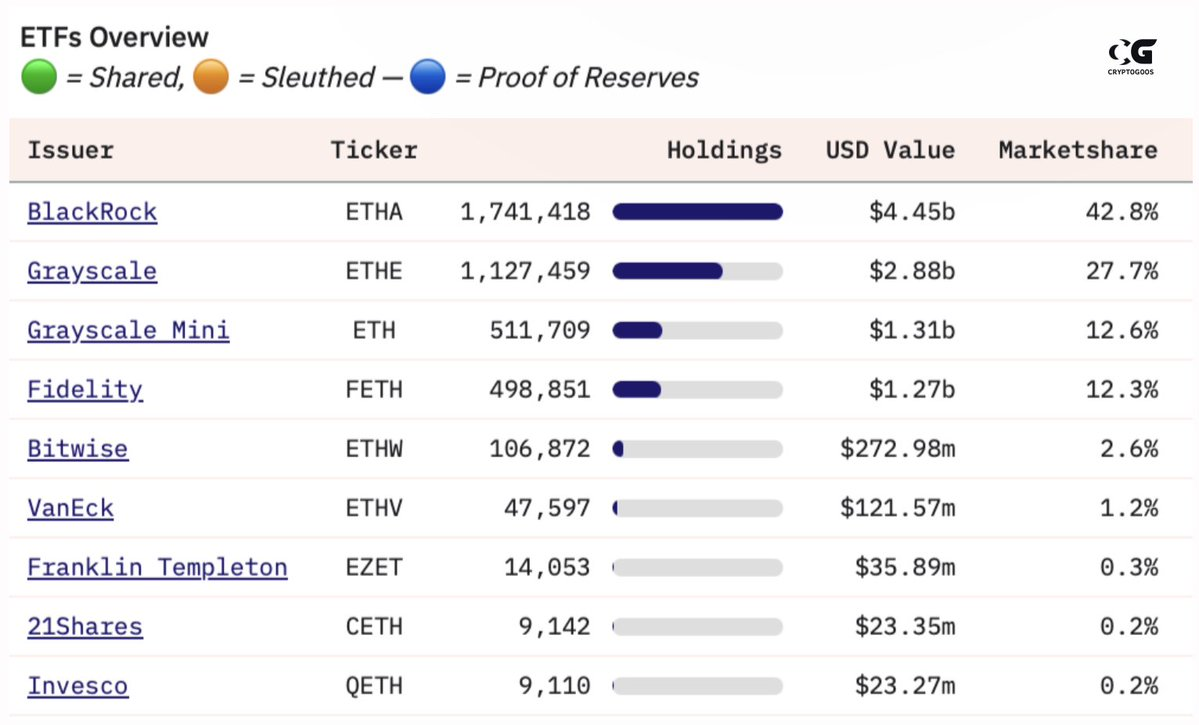

- Core Holdings: The Unassailable Pillars. Institutional capital, the true smart money, continues its methodical consolidation around the only two digital assets boasting robust network effects and, crucially, a semblance of regulatory clarity: Bitcoin and Ethereum. This isn't just a foundation; it’s the bedrock of any disciplined crypto portfolio. And let's be explicitly clear: Ethereum is currently exhibiting compelling signs of deep institutional accumulation, firmly cementing its position as our preferred core holding. This is textbook Phase 1 (Accumulation) playing out, a quiet absorption of supply that most are simply missing. Indeed, as we've seen, players like BlackRock are generating immense fees from simply holding crypto, a trend we expect to continue with ETH, regardless of transient retail sentiment.

- Altcoin Opportunity: The Asymmetric Bet. For those seeking outsized, cycle-driven gains, our gaze is intently fixed on the altcoin sector. The single most pivotal metric here—our unfiltered leading indicator for broader altcoin market health—is the OTHERS/BTC ratio. Currently, this ratio is not merely oversold; it’s deeply oversold on multi-week timeframes, with sentiment plumbing historic lows. Far from being a cause for irrational panic, these are precisely the conditions that so often precede major cyclical bottoms. The probability is rising that we are far closer to a significant turning point than conventional wisdom suggests. However, it bears repeating: significant altcoin moves are largely contingent on a definitive Fed pivot – whether that's Powell being replaced, an end to Quantitative Tightening, lower rates, or some strategic combination thereof, signaling a broader loosening of financial conditions.

Macro Backdrop & Market Sentiment: Reading the Room

Traditional finance is indeed experiencing a late-cycle euphoria rally as summer unfolds, but it would be naive to assume crypto will remain sidelined for long. The Federal Reserve’s pathway, though often opaque, requires only a modest policy shift to re-ignite risk appetite across the entire spectrum of assets.

While the possibility of further downside in altcoins—a final, painful capitulation to truly flush out the last remaining weak hands—is certainly not zero, the probability of a durable bottom is unequivocally rising. We are still observing heavy negative volume on higher timeframes, which mandates caution, but the underlying narrative, as Howard Marks would remind us, is now so overwhelmingly pessimistic that it sets the stage for a contrarian opportunity.

The Treasury Bill Standard: Washington's New Patron

Now, here's where it gets truly fascinating, weaving in with our existing macro insights. While most of the market is focused on the Fed's dance, a new, seismic shift is underway in the plumbing of government finance. President Trump and Treasury Secretary Scott Bessent have orchestrated a "sweeping stablecoin framework" that will fundamentally alter how Washington funds itself.

This isn't just a technicality. This new legislation requires dollar-backed digital tokens to be fully collateralized with U.S. Treasury bills. Think about that for a second. The crypto economy, born from decentralized ideals, is now being conscripted to "underwrite Washington’s cash flow". We're talking an estimated $2–$3 trillion in net demand for T-bills in the next 12–18 months – arriving precisely as the Fed’s emergency liquidity facilities fade to zero.

This is "market ju-jitsu" at its finest, using crypto's demand for legitimacy to funnel massive capital into U.S. debt markets. The implications are profound. As crypto prices rise, more stablecoins are issued, leading to more Treasury bill purchases. This, in turn, helps stabilize government financing, bolstering confidence and potentially stoking further speculative demand.

It's a "positive feedback loop" – bullish until it isn't, as one hedge fund manager quipped. Skeptics rightly question the "structural fragility" of depending on speculative crypto flows to fund government operations. Indeed, "when the government starts depending on crypto flows to fund its operations, you better pray the flows don’t reverse".

This isn't a sign of acute crisis, mind you; markets are buoyant, stocks are at all-time highs. Yet, Washington is employing "crisis-era mechanics". This is "the kind of thing you do when you’ve run out of conventional tools, or want to get ahead of a problem you can’t say out loud".

What does this mean for us, the astute Investolators? It’s another powerful argument for the continued expansion of liquidity, albeit from a new, potentially volatile source. This "T-bill Standard, brought to you by crypto" is a development that demands our keenest attention. It hints at a subtle desperation beneath the surface calm, a new variable in the complex equation of future liquidity, and thus, future risk asset performance. We will monitor these flows with heightened vigilance.

The Digital Corporate Playbook: Rebuilding TradFi Rails with Crypto Fuel

Beyond the stablecoin framework, there are deeper structural shifts unfolding that underscore the long-term conviction of "big money" in crypto. The key takeaway is simple: major institutions are positioning for profit with minimal overhead, even if retail investors "hate the asset". Fees generated by entities like BlackRock from simply holding crypto are immense, and this model is extending to Ethereum. This reinforces our thesis that smart money is quietly accumulating while public interest is at a low ebb.

Furthermore, the emergence of initiatives to "rebuild TradFi rails" for crypto, with prominent figures like Palmer Luckey and Peter Thiel stepping in, signals a crucial turning point in regulatory clarity.

The prior "absurd rules around banking and interacting with anything 'crypto related'" in the USA led to a loss of potential builders. These new announcements are clear hints at what's brewing beneath the surface: imminent and definitive answers regarding how crypto will be regulated and funded by the SEC, CFTC, and other bodies. This isn't just about legitimacy; it's about creating the infrastructure for massive institutional capital to flow more freely.

Consider the recent transaction led by MOZAYYX and a consortium of influential investors, raising a quarter-billion dollars specifically to acquire and stake ETH. While these individual numbers may seem small compared to Bitcoin ETFs, the nuance lies in the staking. Once ETH is acquired and staked, it becomes a "productive asset." These players can simply hold, generating yield, regardless of price fluctuations. This is a brilliant strategic move, and we shouldn't be surprised if they "follow the same playbook and issue 0% converts to get the ETH for free and simply wait it out."

If this trend continues—where public companies strategically acquire and stake crypto, potentially driving their equity value higher—we could indeed witness "one of the wildest bubbles in history." For now, the most probable path is a "slow grind up," but the potential for a dramatic acceleration is certainly worth dreaming about, with our eyes wide open.

Giving You Even More Details... The Silent Roar of Institutional Accumulation

The institutional footprint in crypto is becoming undeniable, even as public sentiment remains mired in pessimism. This is the very definition of a high-conviction contrarian play, and the underlying data is screaming.

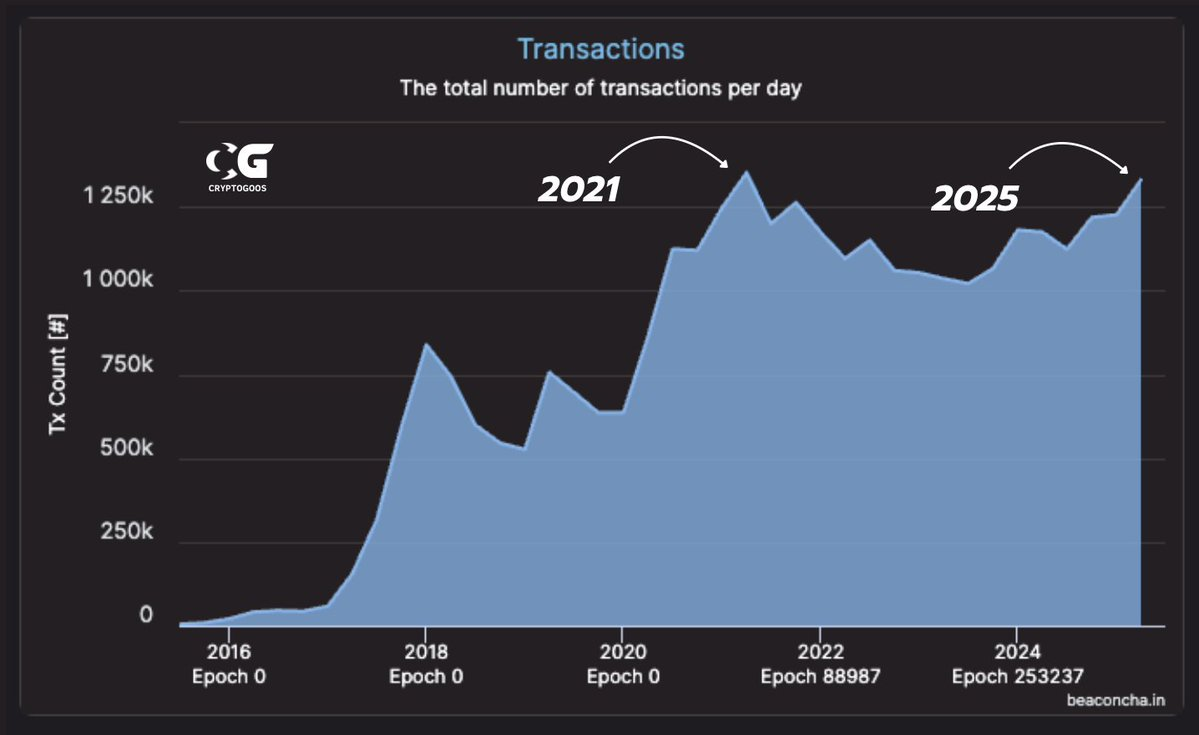

- Ethereum's Quiet Surge: Daily transactions on Ethereum are nearing ALL-TIME HIGHS for the first time since 2021. Yet, to the first-level thinker, "NOBODY is paying attention". This divergence is a scream from the data, confirming genuine network activity and utility, not just speculative froth. It highlights the quiet accumulation we've been tracking.

- BlackRock's Growing Appetite: BlackRock, a titan of traditional finance, now holds a staggering $4.45 billion worth of $ETH, commanding a dominant 42.8% market share. They are, quietly, the largest holder. This isn't small money making small bets; this is a clear signal of deep, strategic institutional conviction. The fact that BlackRock's Bitcoin ETF is already driving more revenue than its S&P 500 fund demonstrates they've "tasted the blood" and recognize the immense profitability in this burgeoning asset class. This is a powerful shift, a testament to the fact that money flows to where the profit is, regardless of prevailing narratives.

This data paints a very clear picture: the "big boys" are not just wanting in; they are already in, consolidating positions and laying the groundwork for the next major leg up. Retail may "hate the asset", but our systems are designed to see beyond the noise and recognize where the smart money is truly positioning.

Final Conviction: Accumulate and Wait for the Signal.

In case it isn’t clear, our stance remains firmly positive, especially now that we’ve navigated through Q1. The confluence of factors is simply too compelling to ignore: escalating geopolitical tensions often lead to money printing, the "Big Beautiful Bill" is explicitly money printing, and the continuous emergence of crypto public companies is creating undeniable demand.

The accelerating divide between rich and poor is not just an economic observation; it's a structural reality that favors assets that cannot be easily confiscated. In this environment, crypto, with intelligent self-custody, represents one of the few assets that offers this critical advantage. While we are aware of the risks of physical theft, the strategic spreading of wallets and keys, and avoiding the pitfalls of centralized "safe deposit banks," mitigates this risk.

We are patiently awaiting the catalyst of negative labor market data, which we believe will "get this show on the road" by compelling a definitive Fed pivot. Until then, our strategy is clear: continue to accumulate core holdings like ETH and BTC, and remain poised for the moment our key signals flash for the broader altcoin rally. This isn't just a market; it's a great game, and we intend to win it with precision and unwavering discipline.

Key Signal to Watch: The True Tell

Our heightened vigilance remains fixed on the OTHERS/BTC ratio. The moment this critical ratio confirms a decisive reversal, it will serve as the earliest and most reliable signal—a siren call, if you will—that a high-beta altcoin rally is not just possible, but imminent.

We will continue to track these critical signals with the precision of a hawk. Rest assured, you will be alerted the precise moment our triggers fire. Stay tuned, and above all, remain disciplined. For as history consistently demonstrates, true opportunity almost always emerges when sentiment is at its bleakest.

We’ll keep you updated and alert you the moment our triggers fire. Stay tuned and stay disciplined—opportunity often emerges when sentiment is at its bleakest.

May your data be clean, and your returns asymmetric -

A13V, Tiger Quant

Disclaimer: MomentumX Capital is not a registered investment advisor. All content is for research and educational purposes only and should not be considered personalized financial advice. Please do your own research and consult with a qualified financial professional before making investment decisions. Past performance does not guarantee future results.