Foundational Information on Cycles - our cycles work is based on proprietary analysis which uses Hurst Cycles theory among other ideas. Below link provides excellent foundational information on J.M. Hurst cycles theory.

Cycles Compass: Navigating the Rhythms of Opportunity

You know, the market isn't just a random walk; it dances to predictable rhythms. Our cycles work dives deep into this underlying order, leveraging insights from Hurst Cycles theory and our own proprietary analysis to anticipate the big moves.

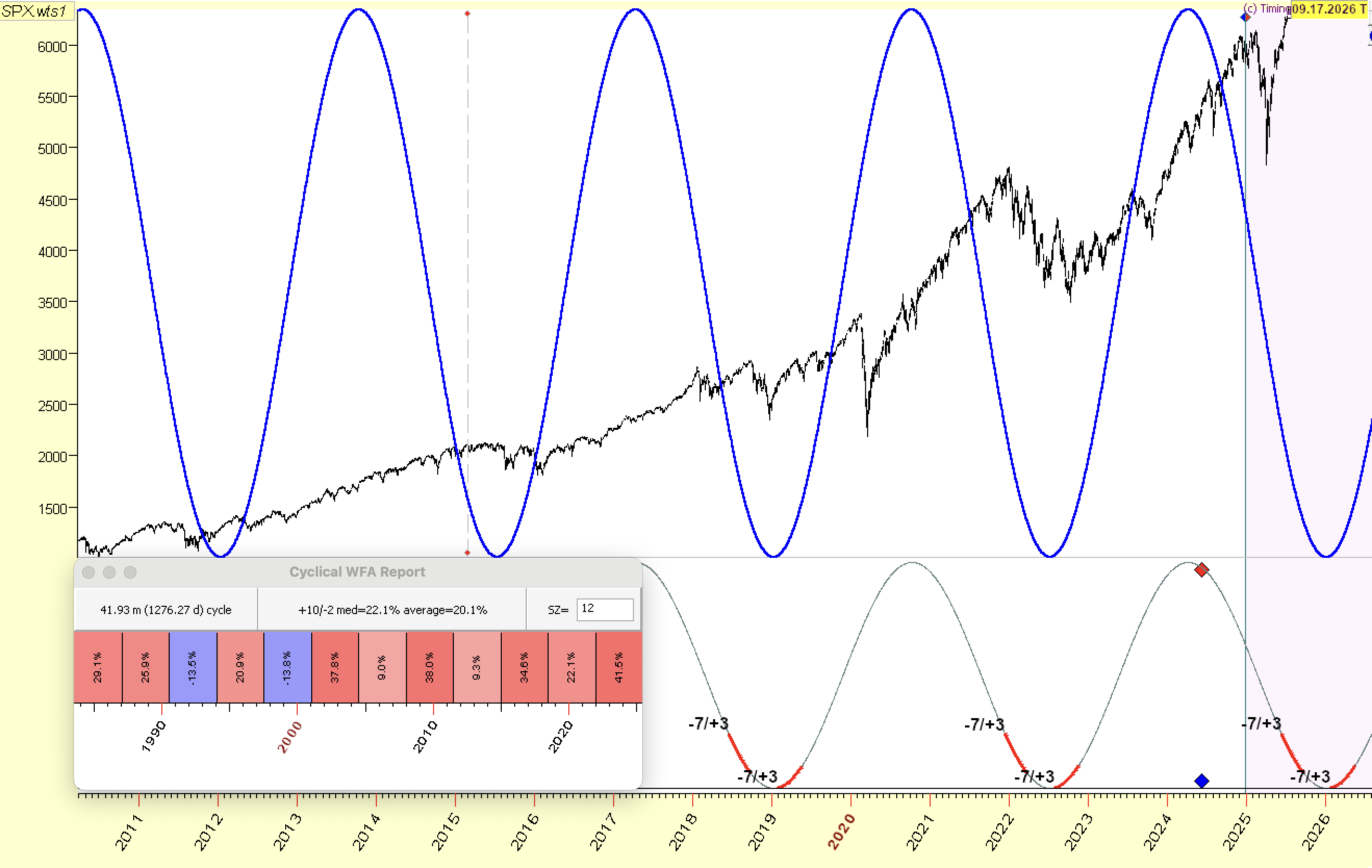

The Grand Cycle: 3.5-Year Rhythm – Eyeing the Q3 2025 Peak

Now, here's where it gets particularly fascinating. Our primary thesis is that the 3.5-year market cycle, which began in October 2022, is headed for a peak in Q3 2025. History, my friends, often rhymes. Major lows tend to appear every 3.5 to 4 years, and while there's always a touch of variation in cycle length – because nothing is ever certain in markets, only probable – the overall cadence is clear.

The big takeaway here is simple: we're likely in the final phase of this bull market. This isn't a call to panic, but a clear signal to shift our thinking. From Q4 2025 onwards, our focus will pivot firmly towards capital preservation. Our models indicate the S&P 500 still has some juice left, with intermediate buy signals flashing. We'll enjoy this final sprint, but with one eye firmly on the exit.

We are likely in the final phase of the current bull market and need to look at our indicators later this year and from Q4 2025 onwards focus on capital preservation.

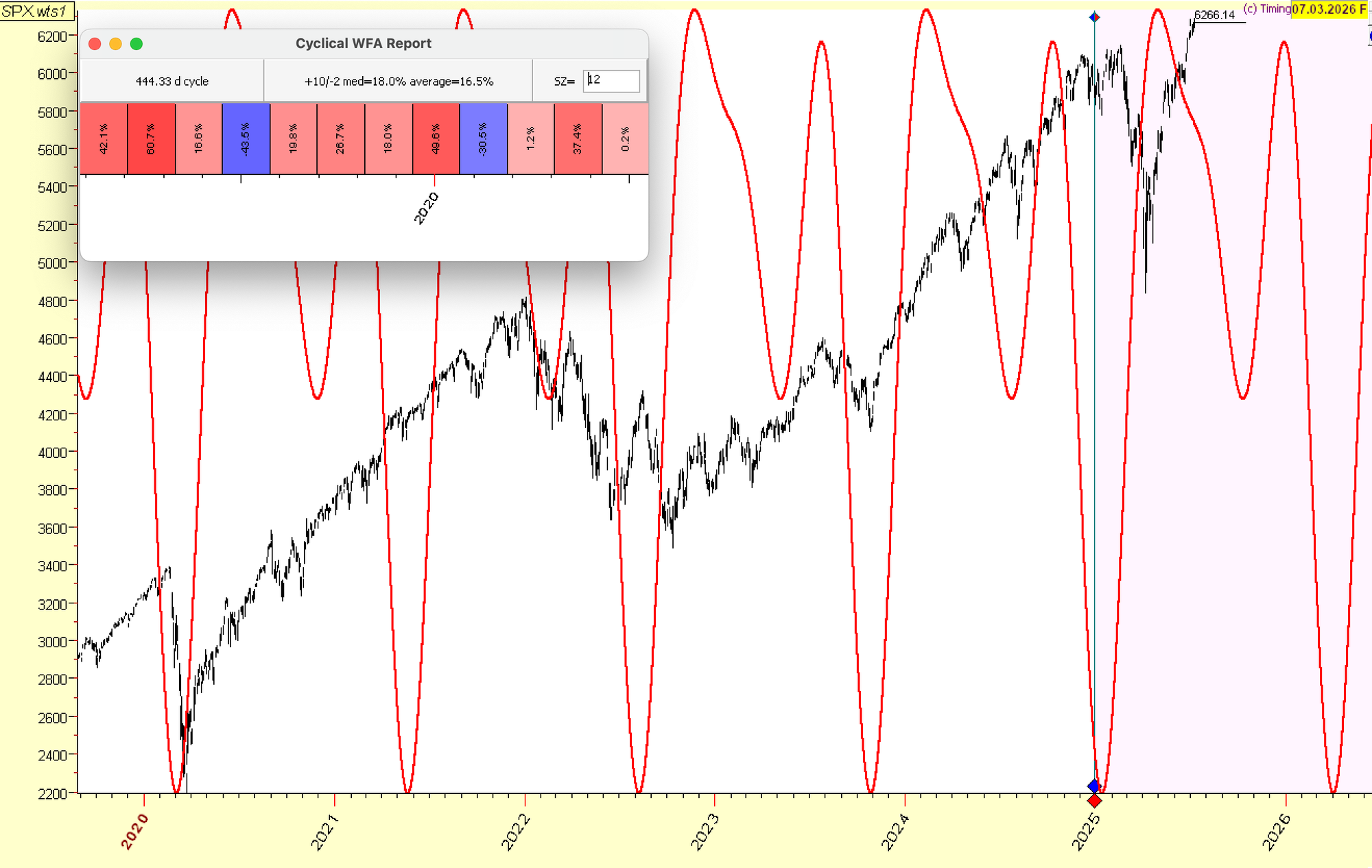

The Intermediate Beat: 18-Month Nominal Cycle – Riding the Momentum into Q3

The 18-month nominal cycle might not have the surgical precision for day trades, but it's an indispensable tool for understanding the multi-month trend's pulse and the current market regime. Typically swinging between 15 and 17 months, it absolutely needs to be cross-referenced with our shorter-cycle analysis and, of course, our proprietary indicators for those actionable buy triggers around cycle lows.

SPY & QQQ: Our Duo-Lens Caught a Double Signal!

Our proprietary Duo-Lens system flagged both SPY and QQQ with the exact same pattern and a confirmed "Buy" signal during the mid-April corrective move. We focus on these ETFs because they provide superior volume data and offer more precise forecasts than their underlying indexes.

While we would not rely on it to call tops, we can hypothesize down move in H1 2026:

The most recent low in this rhythm hit in April 2025, and bam! Our indicators flashed a confirmed buy signal mid-April on the 2-week timeframe. That, my friends, explains the strong upward momentum we've seen since then, with more upside energy expected to propel us through Q3 2025. While we don't rely on this cycle to call tops with pinpoint accuracy, it certainly suggests a potential downward move in H1 2026.

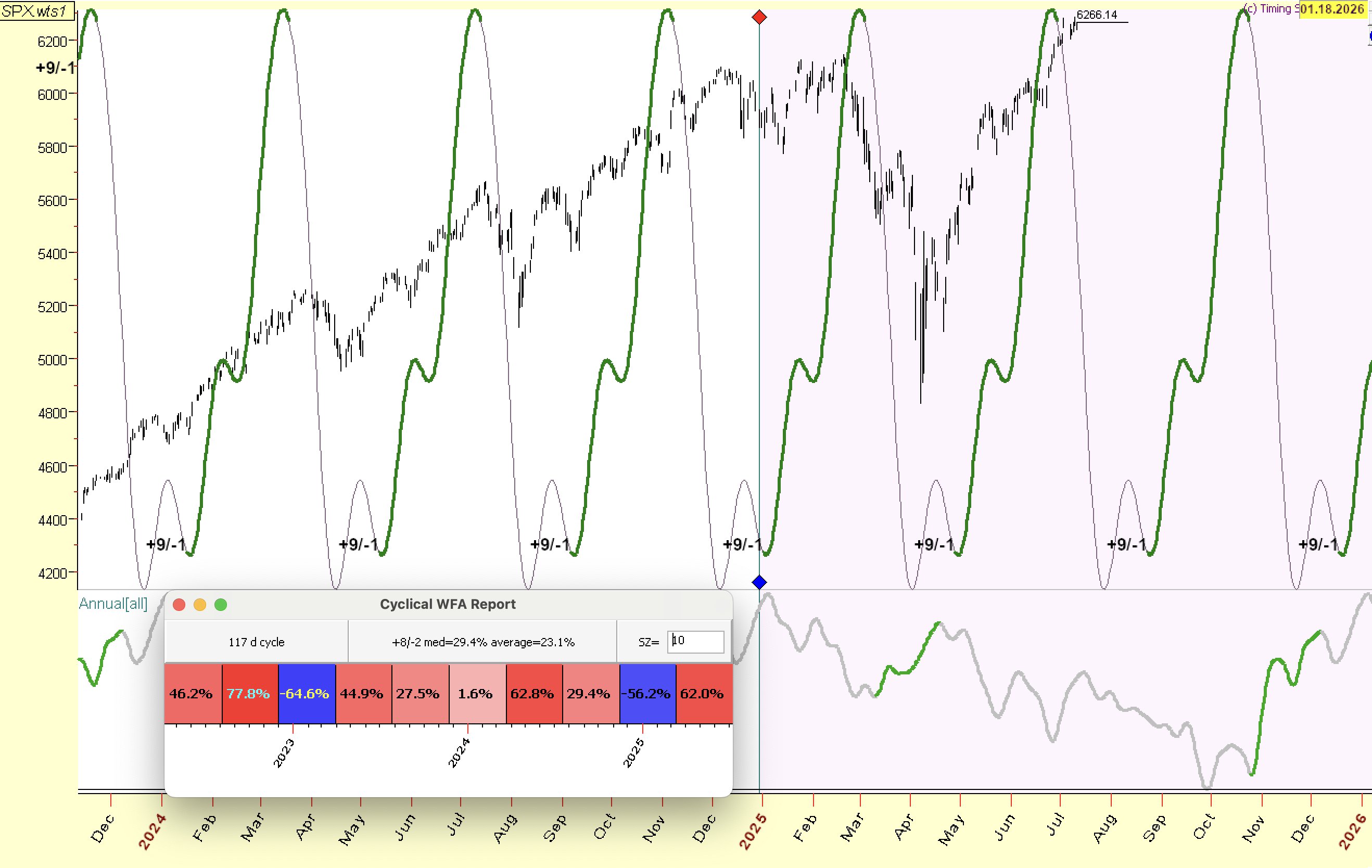

The Short-Term Groove: 20-Week Nominal Cycle – A Quick Reset Before August's Push

The next low can be expected end of July-early August and should provide an entry into next leg up

This 20-week cycle, averaging around 17 weeks lately, has been a beautiful source of entry points for adding to positions during those healthy bull market pullbacks. The latest low kicked off in early April and is currently basking in its peaking phase. It’s been an absolute rocket of a cycle, so we can expect a swift, perhaps 2-3 week pullback to shake off those overbought conditions.

We anticipate the next low for this cycle around late July-early August, setting us up perfectly for another leg higher into what will become the 40-week cycle peak. Between us base hunters, that means we're looking at August being a strong month for the stock market!

Cycles Synthesis: Our Roadmap for the Weeks and Months Ahead

Pulling it all together, that April 2025 18-month cycle low has truly given the market some serious upward thrust. We're now anticipating a brief, tactical 2-3 week pullback starting around the week of July OpEx (July 18th), followed by a delightful rebound with more upside through August.

But come early fall, that's our signal to start getting serious about capital preservation. We'll be on high alert for those tell-tale peaking signs, as the big 3.5-year cycle is expected to begin its descent into a multi-quarter correction, creating a generational major buy point sometime in 2026.

Remember, this is our strategic roadmap. It's a probabilistic framework, not a crystal ball. As always, we’ll be relying on our proprietary indicators across multiple timeframes for those precise buy and sell triggers. That's how we play a more intelligent game.

May your portfolio dance with the cycles - Fox Strategist, The Master of Cycles

Ps.

Reconciling the Views: The Road Ahead

To close out this market update, the Tiger Quant and I had quite the spirited debate, a healthy clash of minds, you might say! We're in lockstep on the immediate horizon: a major correction in late August or early Fall is highly probable. The economic impact from those persistent tariffs, combined with a noticeable slowdown in jobs and housing, is going to become undeniably evident.

Now, here's where the nuance comes in. While the Tiger acknowledges that necessary "detox" for the market, his conviction remains strong that we could see a significant new high after that correction. Why? He's got his eyes firmly on that anticipated "$5 Trillion Big Beautiful Bill" and the massive liquidity injection that's expected to follow. We actually laid out this very forecast in our last Alpha Report.

It's a classic case of discerning the short-term turbulence from the long-term current. We both agree on the storm, but the Tiger's looking beyond it to what he sees as the inevitable flood of capital! Always a fascinating discussion when you blend the macro with the mechanics, wouldn't you say?

Disclaimer: MomentumX Capital is not a registered investment advisor. All content is for research and educational purposes only and should not be considered personalized financial advice. Please do your own research and consult with a qualified financial professional before making investment decisions. Past performance does not guarantee future results.