a13v, Tiger Quant

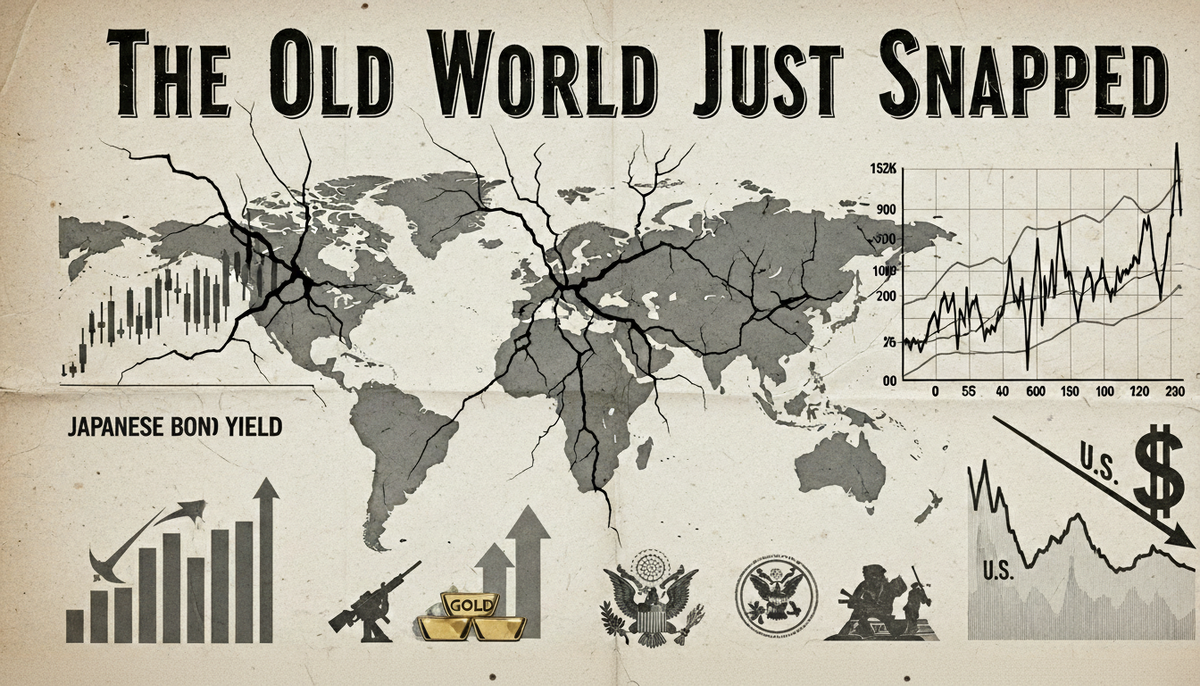

The Old World Just Snapped The old world just snapped. Japan’s yield curve detonated. Gold went vertical. Defense surged. Markets are bleeding, narratives are scrambling, and the dollar sold off while the market tanked - nobody can explain what’s really happening. But this isn’t chaos. This is

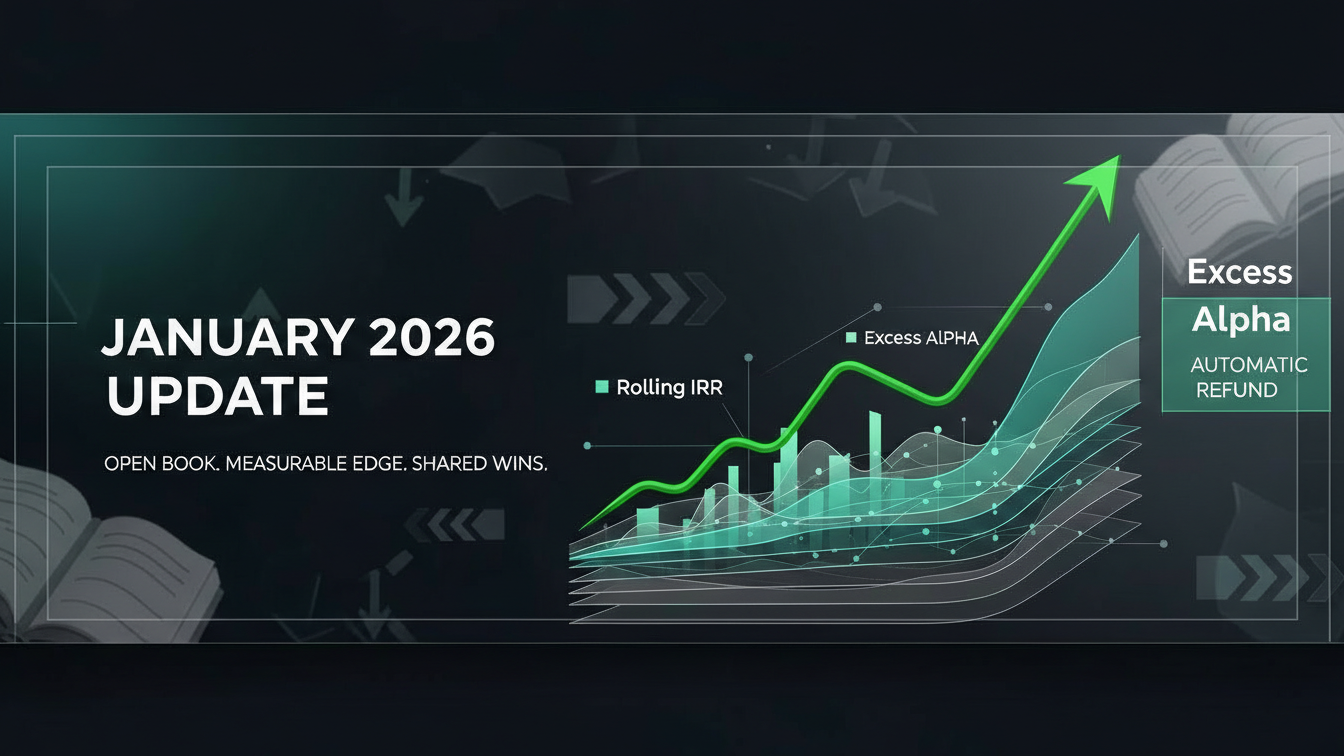

MomentumX 2025: +85% in 9 months. Performance pricing live: full fees only on outperformance + auto-refunds. Jan 2026: +7.3% vs S&P +1.4%. Revamped dashboard & public track record. Open books. Measurable edge. Shared wins.

UVXY isn’t a stock - it’s a 1.5× fear machine. Contango chews 90% annually, but spikes deliver 100%+ in days. Our MXC Duo-VIX (82% accuracy on 6H) powers a strategy with Sharpe 3.0, 205.9% CAGR, and a strict 22.8% Max DD. The next regime is coming. Are you ready?

The grind rolls on as complacency peaks. Capital slips from tech leaders while retail piles into noise. Small-caps take the baton; crypto hits its "last dance" stretch. A few weeks of upside remain before the music changes. Stay sharp -the real move comes when the crowd least expects it.

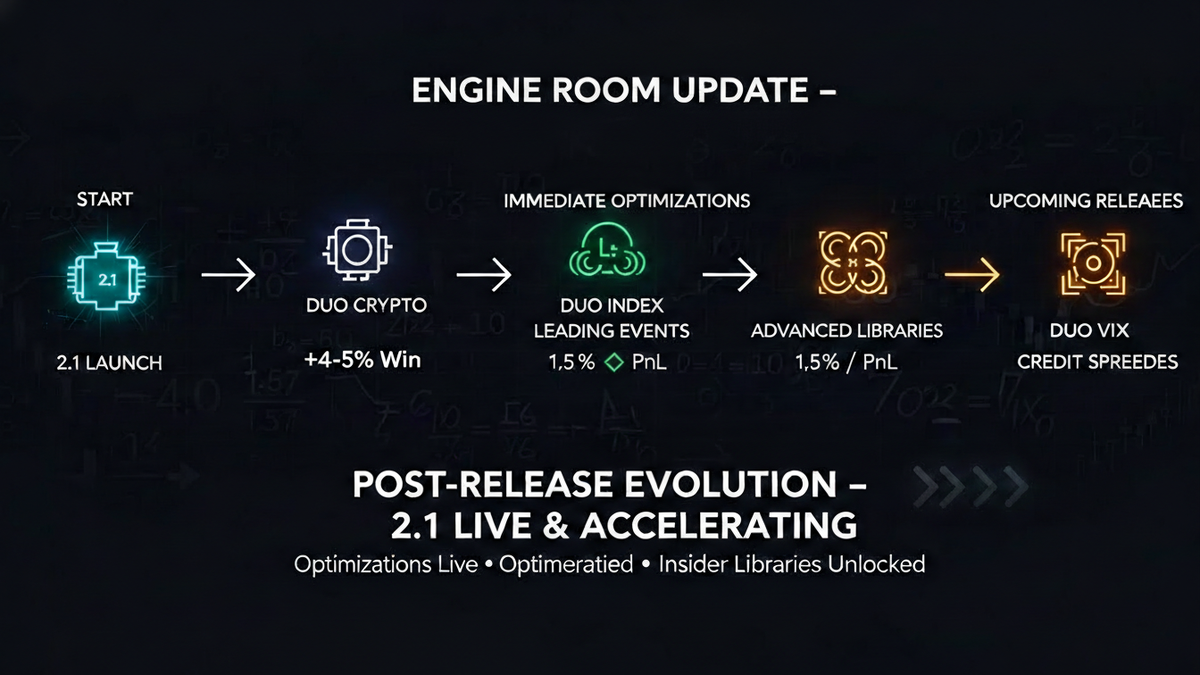

Live and Accelerating.