January 15, 2026

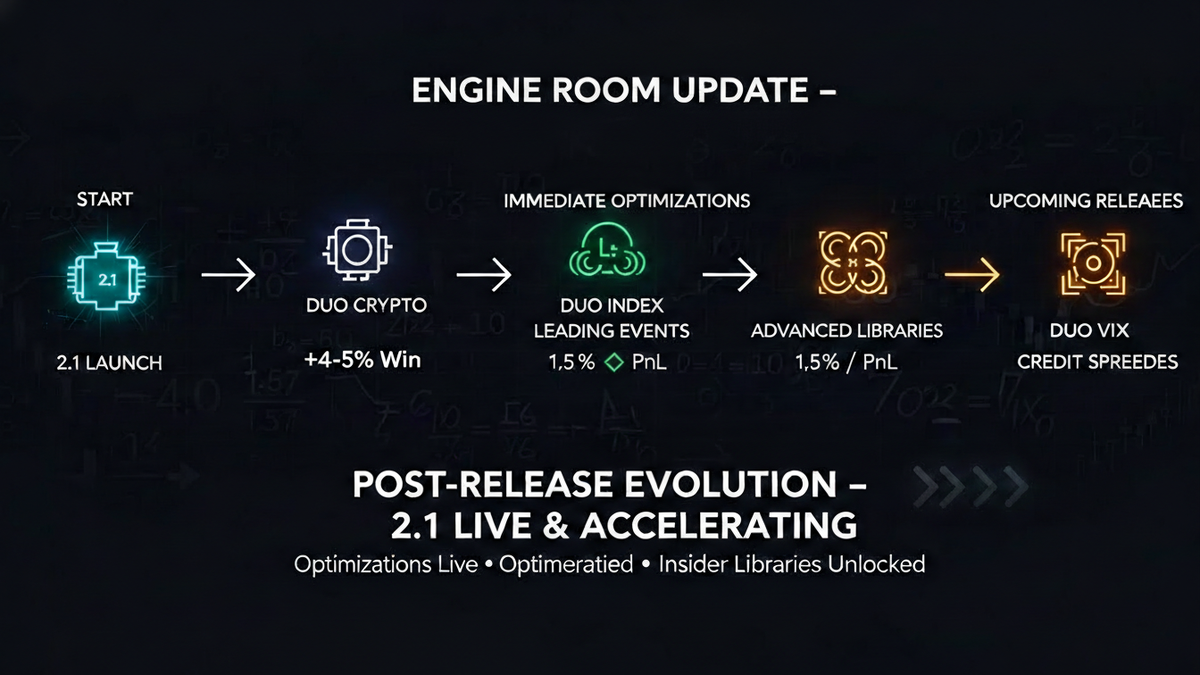

The 2.1 rollout is live, and immediate optimizations are already showing strong results. Here's the current state and roadmap ahead.

Immediate Post-Release Optimizations

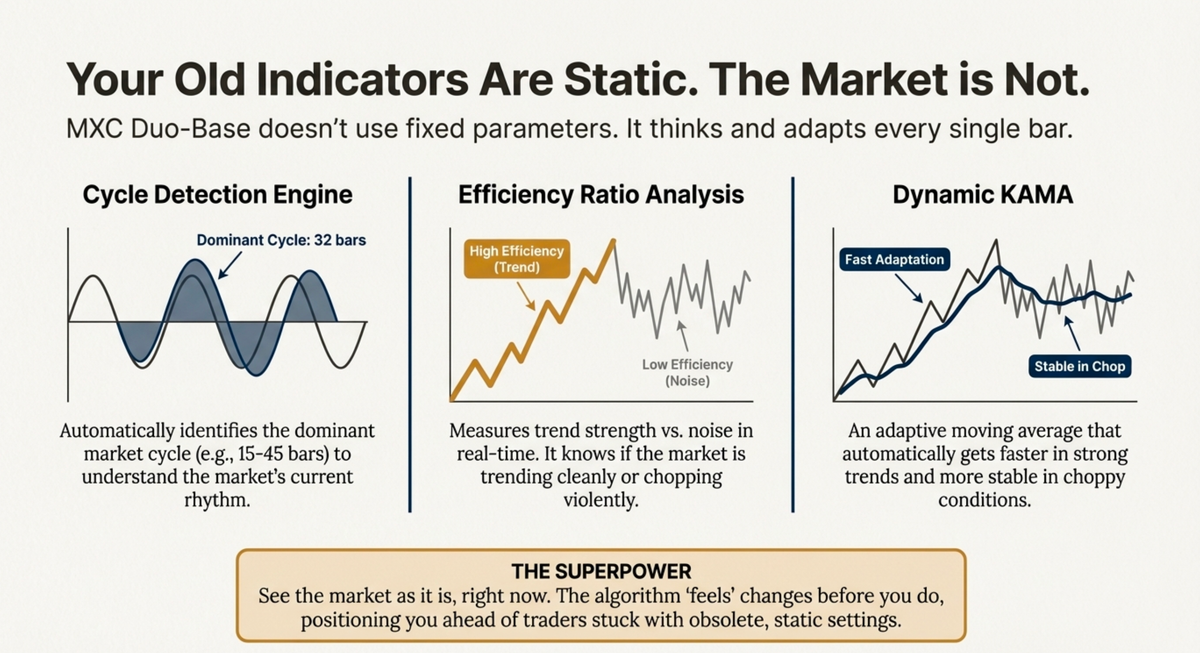

- DUO Crypto — Further refined by blending Dynamic KAMA with physics-boost equations. On ETHUSDT benchmarks (3D and 4D timeframes), win rate increased 4–5 percentage points, with PnL returns 1.5–2× in several setups. The physics layer is proving especially effective in volatile crypto regimes.

- DUO Index — Released initially to a limited Insider group. It combines the adaptive engine with Leading Events signals to optimize entries/exits on leveraged index products. Results show 3–4 trades per year on average, with very high annualized returns (exact figures in the upcoming Insider publication next week). Options strategy integration is in final testing — full update exclusive to Insiders.

- MXC Leading Market Events — Performing well on breadth, VIX structure, and chaos detection. Next 2 weeks: adding credit spreads, put/call ratios, and advanced leading indicators to increase confluence scoring. We're also working to extend reliable signals to higher timeframes (>3 days) — a complex but high-value task. This indicator works hand-in-hand with Duo Index; it will be offered to all Insiders shortly, with potential expansion to Pro tier under review.

Upcoming Releases & Enhancements

- MXC DUO VIX — Optimized for shorting UVXY and similar decay-prone volatility products. Final backtesting and options-based algorithm nearing completion. Results are, shall we say, very interesting. Exclusive to Insider tier.

- Insider-Exclusive Access — Advanced algorithms (Duo Index, Duo VIX, MXC Leading Events) + full foundation libraries (mxc_ta, mxc_ind, mxc_ma, mxc_crypto + core blocks). This enables Insiders to explore the math, experiment, and co-innovate alpha.

→ Insider subscriptions limited to a curated 200 spots (with ~10 new openings annually) — for focused attention and high-return potential.

Deactivation Notice

In the next 3 days, old subscriber accounts will be deactivated (TradingView access removed). If you want to maintain access, email admin@momentumx.capital with your TradingView username, subscription level, and email address. We'll confirm immediately.

YouTube & Content Launch

We've launched the MomentumX YouTube channel — shifting heavily toward AI-generated educational content, with live videos and updates coming soon. Starting tomorrow, two new series begin:

- QUANT VIEW – Tiger Quant

Deep dives into indicator construction, smart positioning, structural accumulation vs. fake-outs, and market setups that separate signal from noise. - Retail Trailblazer – Mikey Foxx

Unfiltered real-capital trading journal. Live entries/exits, position sizing debates, emotional discipline challenges, and proof that elite signals compound dramatically — even in modest accounts.

Both series focus on live execution, education across all knowledge levels, and practical use of the full MXC stack (signals, trade management, margin/crypto wallets, risk rules, and more).Upcoming Videos (Next Few Days into Next Week)

- Engine 2.1 live walkthrough with real position examples

- Portfolio Construction — Core, Tactical, and Moonshot plays

- Mikey Foxx kick-off — starting the 2026 2× challenge series

ps. Mikey Foxx Video, idea... is something we wanted to have fun with the help people and accelerate their learning cycle, getting it to months vs. years for retail investors. Shout out to Mikey our customer success team memeber.

Can a Retail Investor 2X an Account in 365 Days? Mikey Foxx’s 2026 Real Money Challenge starts Jan 15.

— a13v (@newzage) January 15, 2026

Real capital, no sims, full transparency - every move, P&L, wins & losses live on YouTube.

Kick-off video in the first comment.

Mikey (MomentumX customer success team) nailed… pic.twitter.com/ynMjHJLYmX

Additional Updates

- Alpha report delayed slightly — coming today.

- Performance Dashboard reworked for performance pricing, public track record display, and enhanced Flight Deck — live later today/tomorrow.

- New indicators page on the site + detailed how-to videos/documentation for each tool — rolling out by end of this week.

We're truly grateful for the amazing emails and appreciation you've shared — it means a lot and keeps the team motivated.We've also received several thoughtful requests to embed Heikin Ashi directly into our calculations (instead of requiring users to apply it on the chart layout). We're actively evaluating the best way to implement this — balancing seamless performance with user control and transparency. We'll share a decision and update on this in the coming days.Thank you again for the feedback and support — it directly shapes what we build next.

Thank you for your patience — there are only so many hours in a day, and we're pushing hard to deliver at the level you expect.

MomentumX Team