Alpha Report: Engine 2.0 Live and The Market Turn

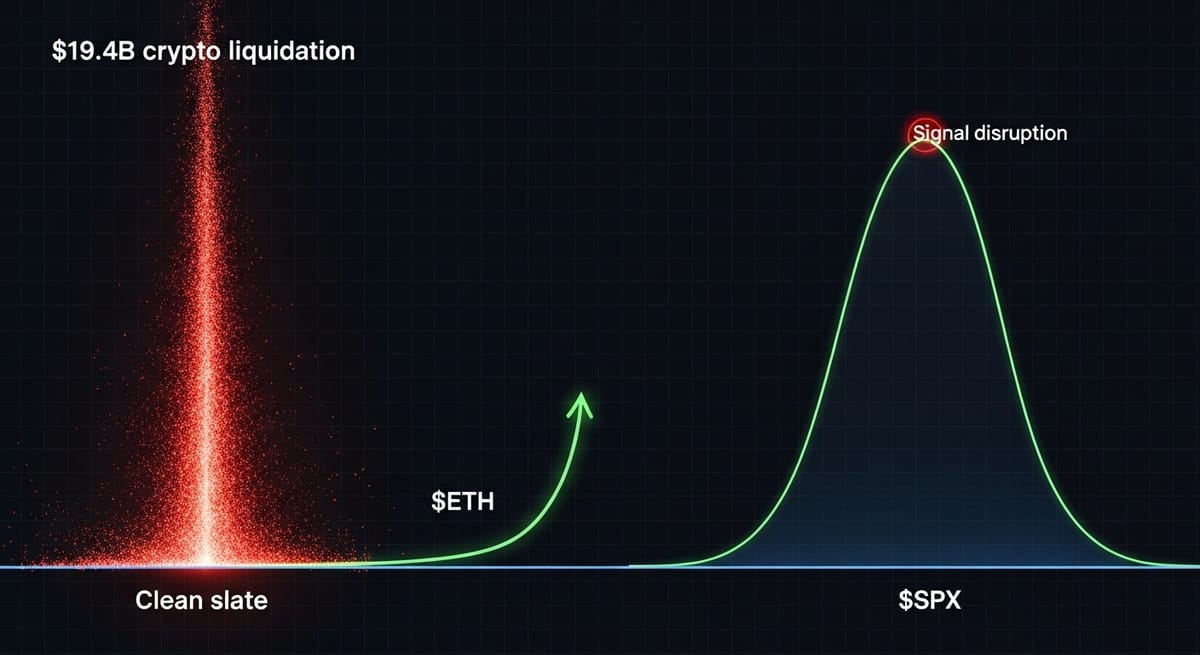

Engine 2.0 is live. We are exiting Accumulation. SPX bottoming near 6400. BTC/ETH on institutional support. Shorts closing shorts; we are buying the dip. This is the protocol upgrade you've been waiting for. Read the full Alpha Report inside.