After months of backtesting and live refinement, MXC Duo Engine 2.1 is officially live (Jan 12, 2026). This release fuses four core pillars into one unified, adaptive system:

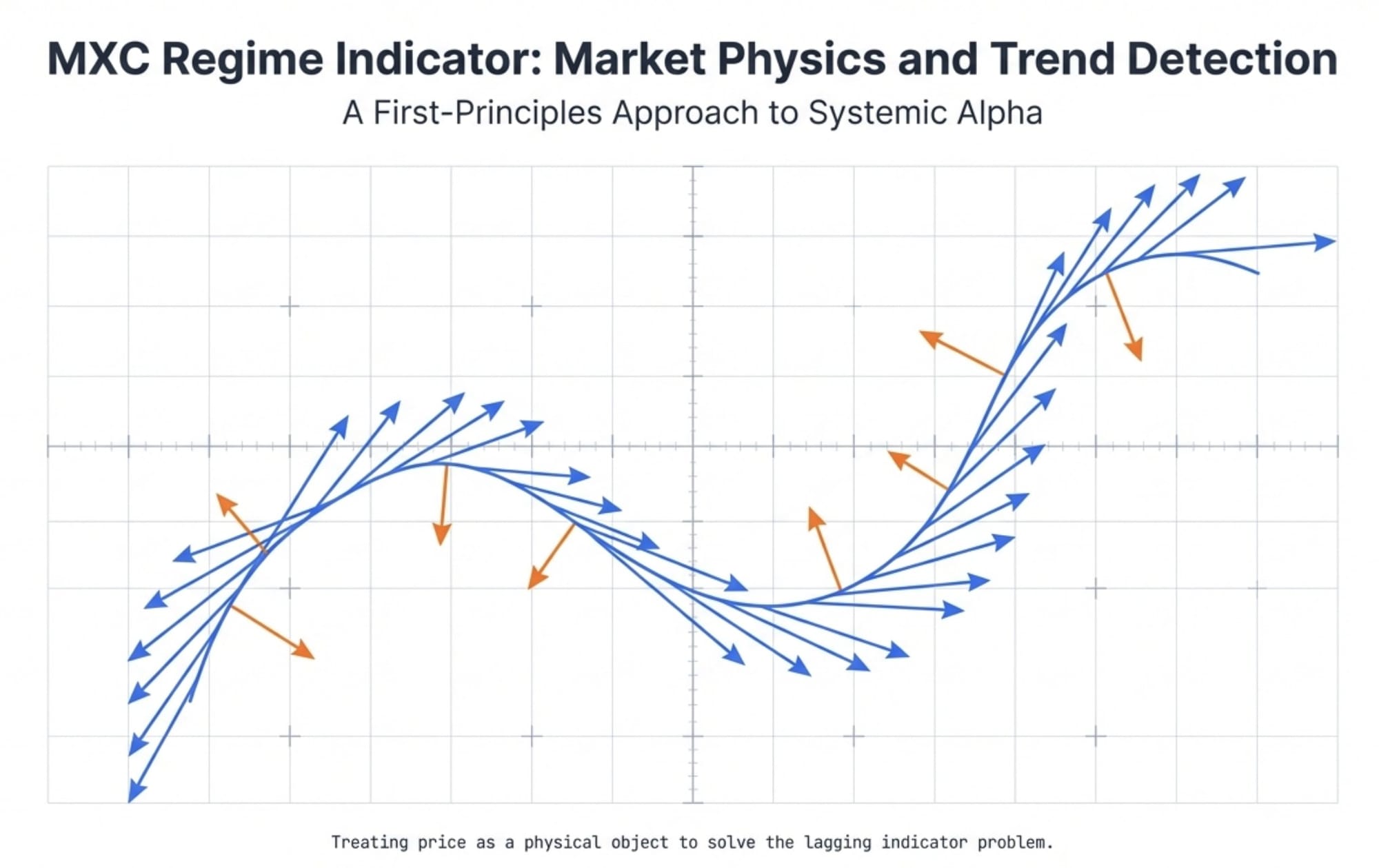

- Regime — physics-based motion detection (velocity → acceleration → jerk)

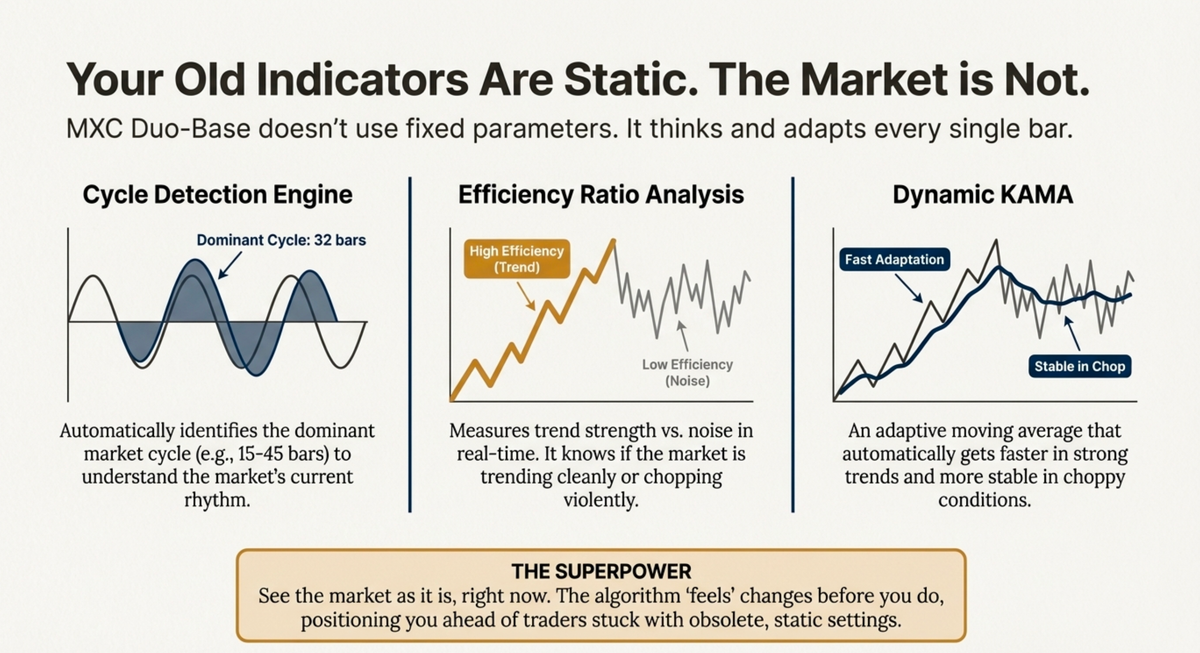

- Duo Base — cycle-adaptive KAMA execution across all assets

- Duo Crypto — leveraging the new engine + advanced physics for volatile crypto behavior

- Duo Index — combining the adaptive engine with Leading Events for index precision

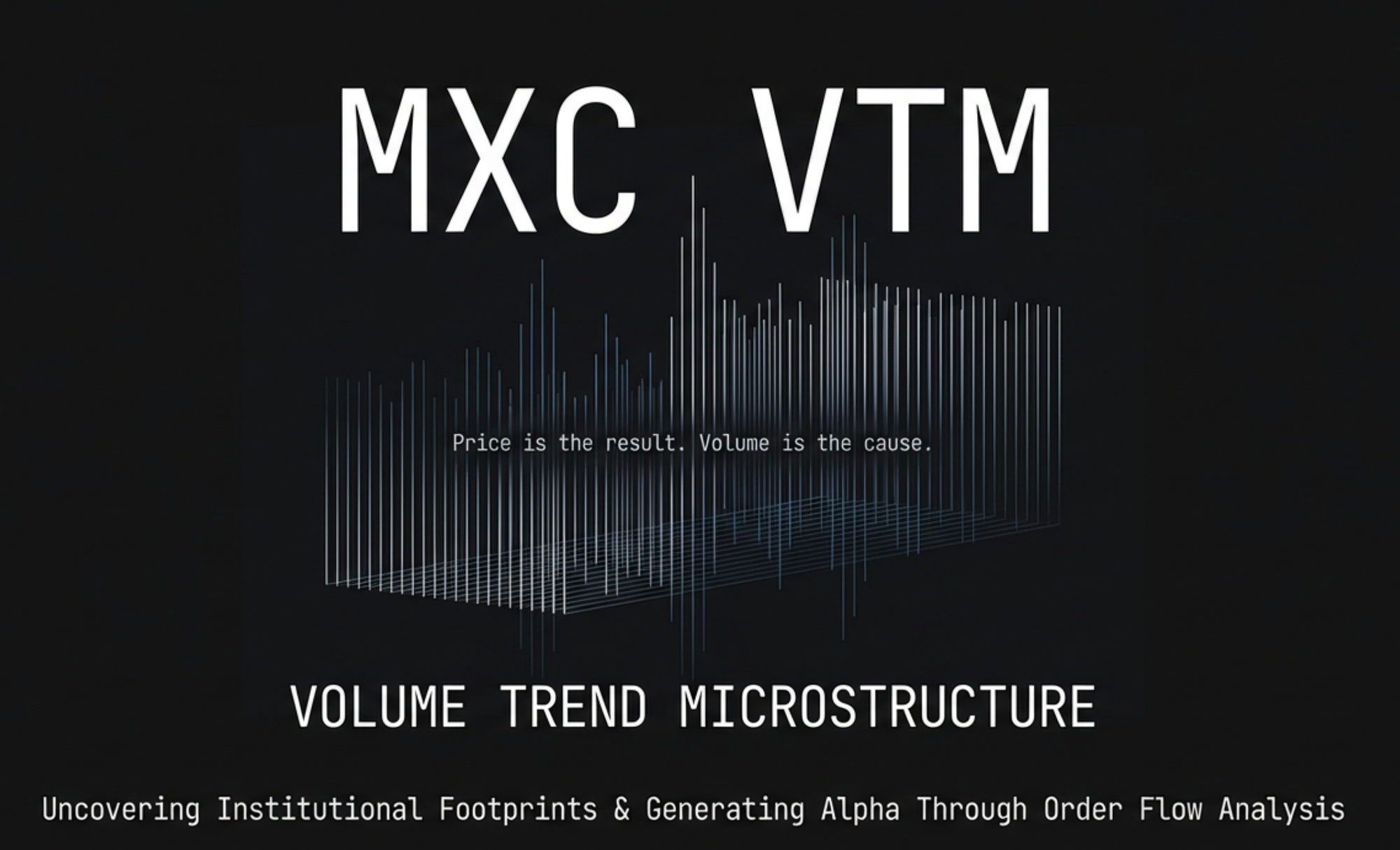

- VTM — smart-money volume microstructure confirmation

Plus:

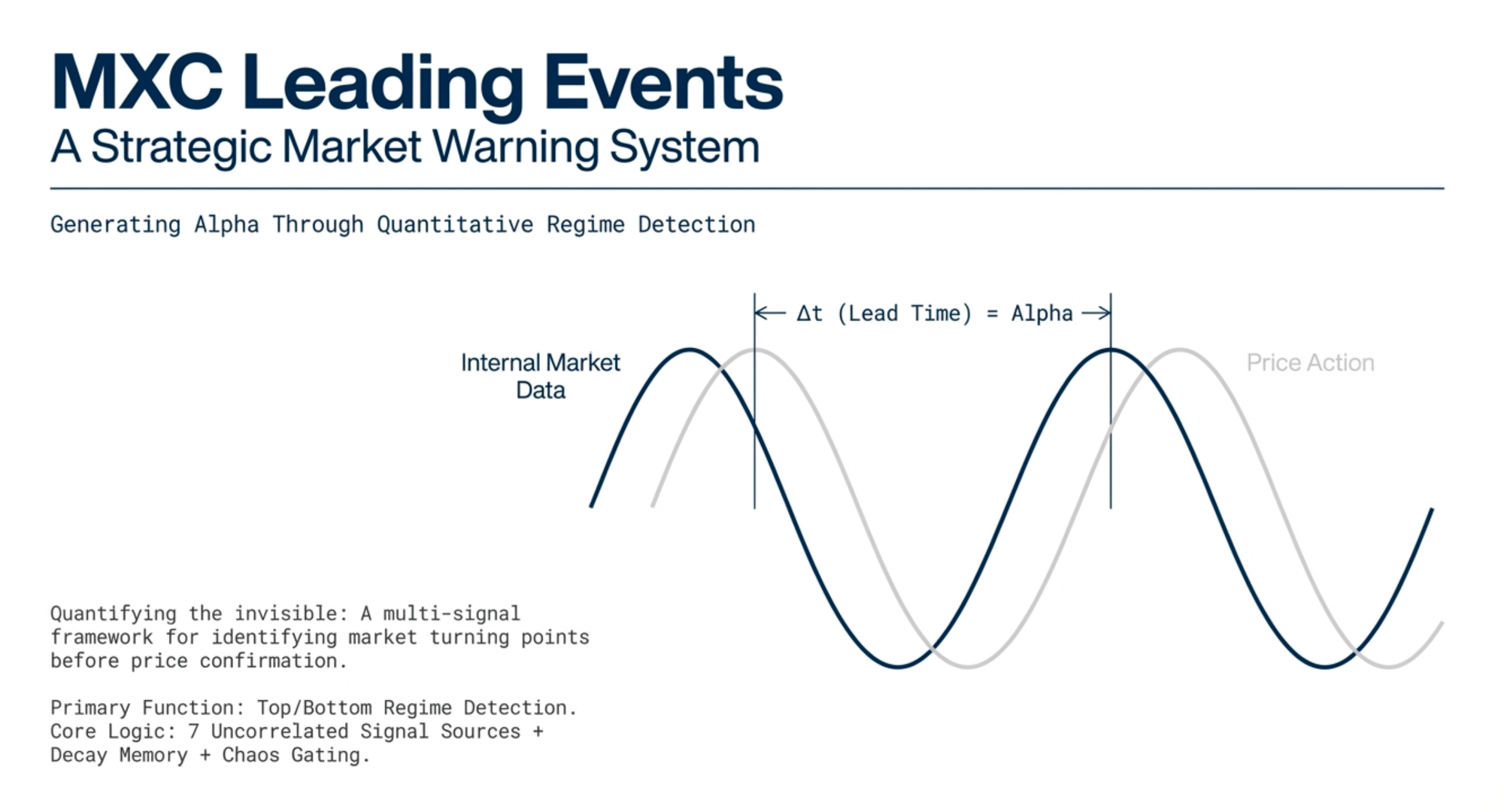

- MXC Leading Market Events — early-warning confluence from leading indicators

- MXC AVWAP, Pulse, Duo VIX, and more — all engineered for high-conviction position trading, options, and sophisticated index strategies.

The result is a full-stack framework that anticipates shifts, filters noise, and positions with institutional-grade conviction — no more fighting regimes or reacting late.

Tangible Impact: Before vs After

Before 2.1

Higher-timeframe swing trades only (daily+). Solid 65% win rates on clean HTF trends, but frequent whipsaws in chop, almost unusable on lower timeframes (5–15 min), average R:R ~1.8:1. Fixed parameters meant fighting the market when cycles or volatility shifted.

After 2.1

Full timeframe flexibility — 5-min scalps to monthly positioning. Consistent 58–78% win-rate range across assets, fintunable >75% in optimized setups. Whipsaws reduced 40–55%, R:R climbing to 2.8–6.5:1 in confirmed regimes.

The real “aha” moment came during live testing: seeing >60% win rates on 5–15 min and 4H charts across wildly different behaviors — ETH (volatile crypto), SPX (broad index), UVIX (extreme vol product) — and pushing past 75% with light fine-tuning.

The physics engine + dynamic KAMA + cycle adaptation + VTM confirmation finally let the system breathe on any timeframe without breaking.

This isn’t cherry-picked backtest magic. It’s the difference between reacting to price after the move and positioning with the market’s actual rhythm before it happens — and it’s only the beginning.

Real-World Examples on Benchmark Assets

We benchmarked against key assets and timeframes — the difference is night-and-day:

- SPX on 2D (2-day) — Before: choppy entries/exits with frequent stops. After: clean regime reads + early VTM confirmation → higher conviction, better R:R.

From Pnl 15K% to 51.7B% - on auto regime - no finetuning.

Link - ETH on 4D (3-day) — Before: missed volatility shifts. After: cycle adaptation + acceleration signals → captured explosive moves with reduced drawdown.

From Pnl 15K% to 436K% + Win Rate: 76% - no finetuning.

Link - BTC on 1D (1-day) — Before: lagged in ranges. After: Volrank + Regime physics → early breakout entries, stronger trend rides.

From Pnl 75K% to 945K% + Win Rate: 75% - no finetuning.

Link - Gold on 3H — Before: struggled in chop. After: full adaptive smoothing → stable in ranges, aggressive on expansions.

Pnl 19K% + Win Rate: 70% - no finetuning.

Link - 3H

Link - 15 Min - 70% win rate (pnl limited by data on chart)

(We won’t show the "before" charts here — the contrast is so stark it’s almost unfair. The afters speak for themselves.)

The Four High-Impact Concepts

Cool Concept Decks and Videos

To help you understand exactly what changed and why it matters, we’ve created short, high-production concept decks and videos focused on the three biggest upgrades driving the 2.1 leap:

Watch any of the three in any order—they’re designed to stand alone but together they show the full transformation from reactive to predictive trading.

Regime Physics Engine: Motion over position. We break down velocity, acceleration, and jerk—showing how the system detects regime health and exhaustion 3–5 bars before price confirms.

Concepts Deck

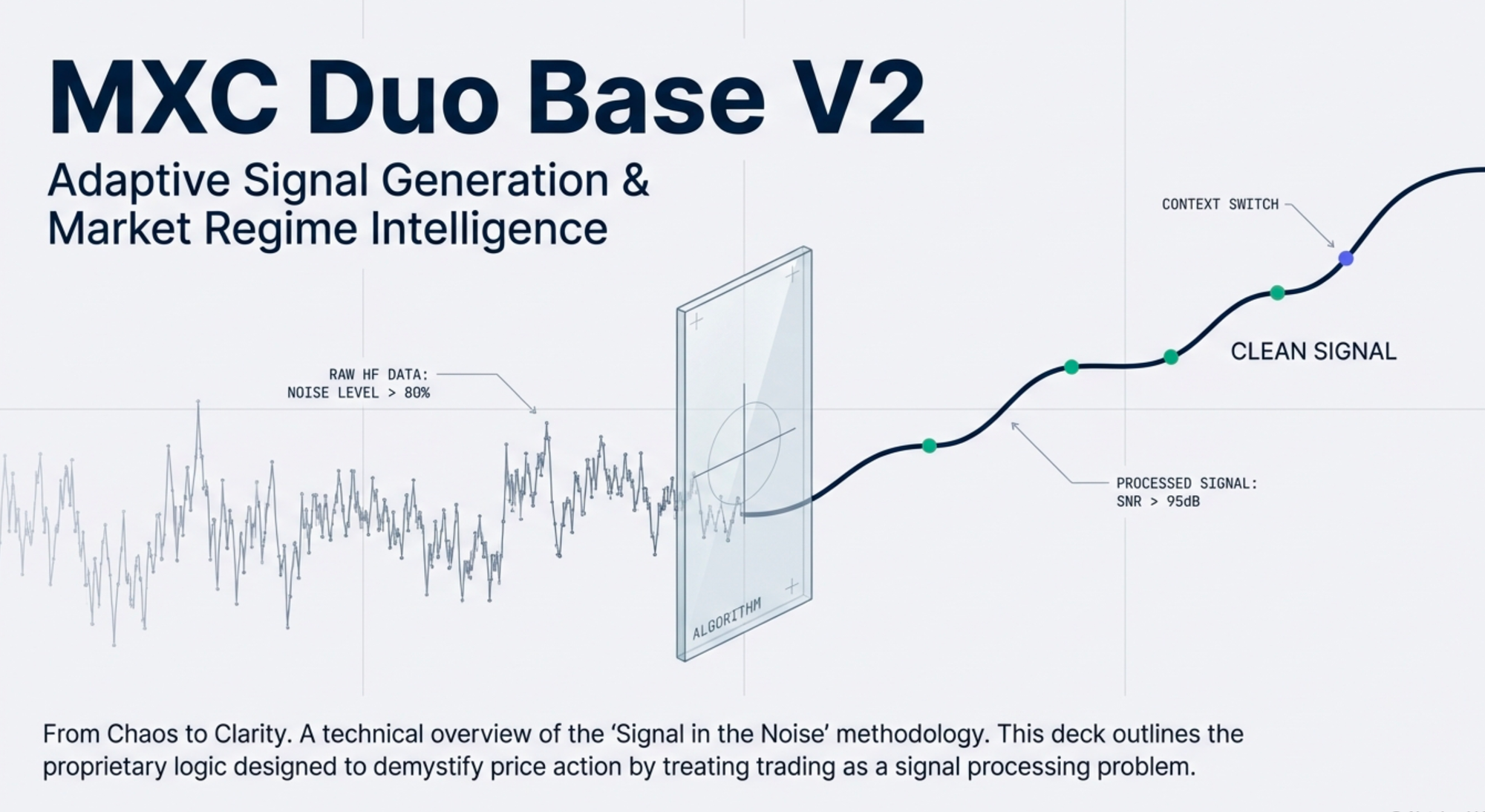

Adaptive Duo Engine 2.1: The heart of the system. We explain how cycle detection + real-time parameter scaling turns a static KAMA into a living, breathing trend engine that adapts every bar.

Concepts Deck

Volume Trend Microstructure: Institutional footprints in real time. Volume decay, wick absorption, and pressure scoring reveal hidden accumulation/distribution before price reverses.

Concepts Deck

Leading Market Events – Early Warnings & Chaos Protection: Seven uncorrelated signals (Zweig, Lowry, McClellan, VACC divergence, RSP concentration, VVIX/VIX pivots, Lyapunov kill switch) with decay and confluence for regime-turn conviction.

Concepts Deck

Rollout Update:

Now live for all users. Missed in rollout? Email admin@momentumx.capital with:

- TradingView username

- Subscription level, and email - so we can grant you access - you can view indicators you are getting for your level in the list below.

We’ll activate immediately.

Access Levels & Indicators Included

Retail Trailblazer (Base access)

Get the foundational tools to start seeing the edge:

- Duo Base: https://www.tradingview.com/script/RryCd1sx-mxc-duo-base/

- Regime: https://www.tradingview.com/script/mTwrMbcN-mxc-ind-price-pressure/

- VTM: https://www.tradingview.com/script/IgNVqVb0-mxc-ind-vtm/

- AVWAP: https://www.tradingview.com/script/Z2bRBEGq-mxc-avwap/

Key note for this release: With MXC Duo Engine 2.1 and the new performance-based pricing structure, Trailblazer users now have access to the core indicators (previously higher-tier only in some cases).

This change is a big win for the community — it lowers the barrier to entry while still rewarding Pro/Insider tiers with advanced optimizations, exclusive tools (Duo Crypto, Pulse, Duo Index, etc.), and priority features.

Pro Level (Trailblazer +)

Everything above, plus crypto-optimized adaptations and momentum tools:

- Duo Crypto: https://www.tradingview.com/script/GGwIjqBv-mxc-duo-crypto/

(Duo Base + enhanced physics & momentum equations tuned for volatile crypto markets) - MXC Pulse: https://www.tradingview.com/script/tBnQXJFG-mxc-pulse/

Insider Level (Pro +)

Full institutional-grade toolkit — high-conviction positioning across indexes, volatility, and leading signals:

- Duo Index: https://www.tradingview.com/script/zjL8AJIU-mxc-duo-index/

(Duo Base optimized for index trading + Leading Events support) - Leading Events: https://www.tradingview.com/script/5e6AVm2i-mxc-ind-lind-events/

- Duo VIX: Volatility trading for pros — coming soon

Upgrade path: If you're on a lower tier and want access to Pro/Insider tools, email admin@momentumx.capital with your TradingView username and current subscription level — we’ll guide you.

When starting with the new indicators, switch your chart to Heikin Ashi candles for optimal performance. The algorithm was specifically optimized for Heikin Ashi, delivering dramatic improvements in win rate and PnL by smoothing noise and revealing cleaner trends.

We considered hardcoding this into the engine but opted to leave it configurable via chart layout—for transparency and flexibility. This way, the impact is evident, and you can experiment easily. We may revisit this in future updates.

What's Next:

- Claim your access - email us with your TV username.

- We will be releasing remaining parts - ex. MXC Duo Vix, and severla related components.

- Our detailed documentation and how-to videos will be fully updated on the help site over the next 2 weeks.

Stop Trading. Start Positioning.

Available now. Engineered for today’s markets. Edge unlocked.

MomentumX Team...