Engine room update: Level: PRO+ post.

Written by Volatility Bongo MomentumX Capital | January 18, 2026

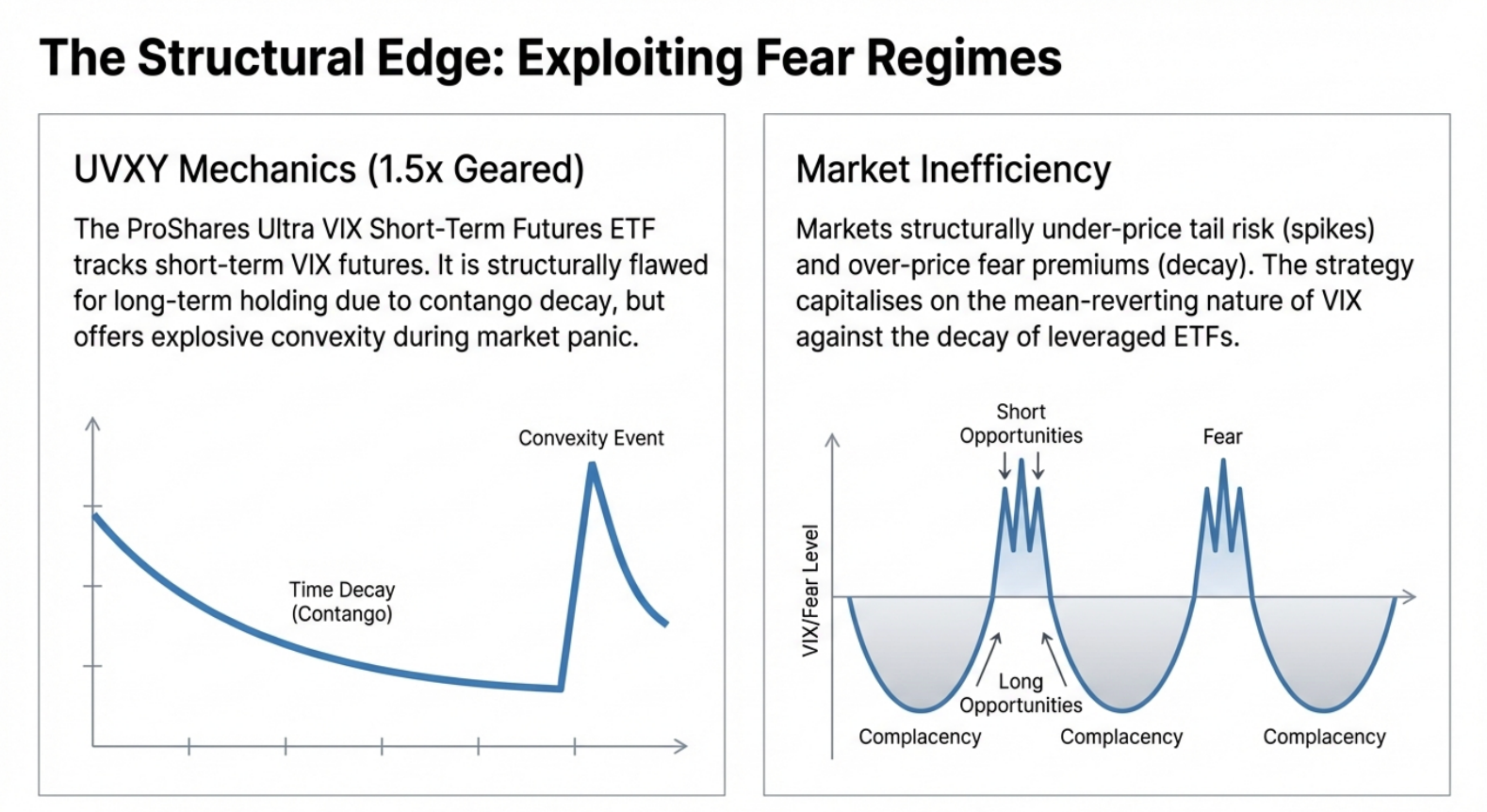

Volatility is the market's kinetic energy - chaotic, unpredictable, and capable of massive force when unleashed. Like a particle accelerator smashing atoms to reveal hidden truths, UVXY (ProShares Ultra VIX Short-Term Futures ETF) collides fear with futures, producing explosive reactions in panic and slow entropy in calm.

It’s not a simple asset. It’s a 1.5× leveraged daily instrument on short-term VIX futures - engineered to surge like a gravitational wave during crises and decay through contango friction like an unstable isotope. The physics are relentless:

- Contango drag: ~80–90% annualized decay in equilibrium states

- Backwardation acceleration: 100%+ velocity in chaotic phases

- Daily reset compounding: Quantum-like slippage that warps multi-day positions

But as any physicist knows, the greatest discoveries come from harnessing instability. UVXY offers one of the purest asymmetric experiments in finance — if you can time the phase transitions.

This report shares our lab results: A 6H indicator with 82% directional accuracy, a long/short strategy posting Sharpe 3.0 and CAGR 205.9% (2020–2026), and a roadmap to evolve it into a full volatility particle collider.

This isn’t about random collisions. It’s about precise control over market forces.

You can read the rest of the article or review a more technical deck on the topic, providnig additional quant foundation.

Let’s get into it!

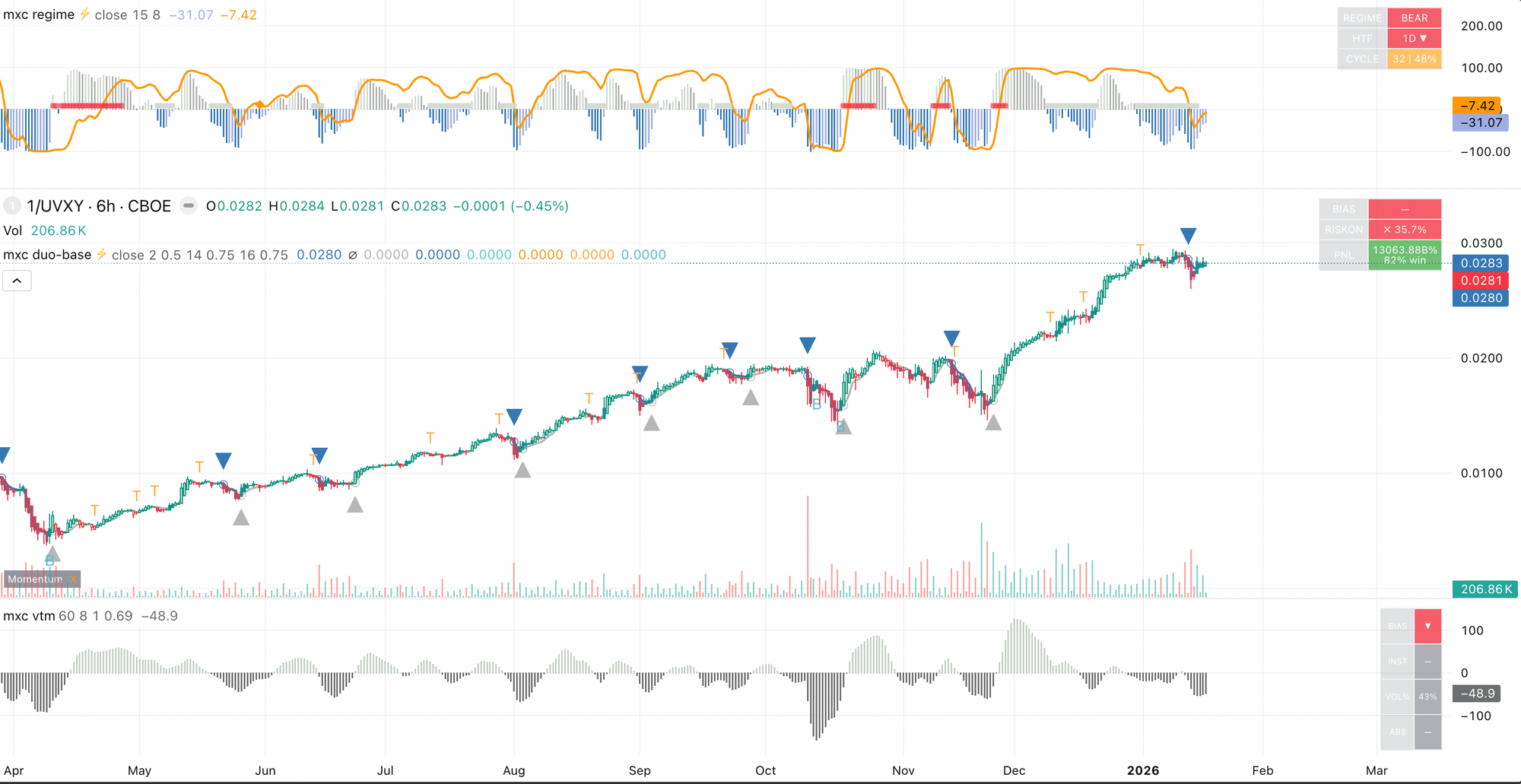

1. MXC Duo-VIX Indicator –

6H UVXY Tracking (82% Directional Accuracy)

Volatility behaves like wave-particle duality — sometimes smooth and predictable, sometimes erratic and quantum. To capture it, we needed a detector that senses phase shifts before they cascade.

Enter the MXC Duo-Vix: A momentum-regime composite calibrated for UVXY’s entropic decay on the 6-hour timeframe. It measures acceleration in fear particles and deceleration in calm states.

Core Components (And Why They Matter)

- Gaussian-filtered momentum (Length 2, Sigma 0.5): Ultra-responsive noise reduction — like a high-pass filter catching early wave amplification

- Adaptive-period momentum (Period 14, Smoothing 0.75): Cycle-aware baseline that expands in low-energy grinds and contracts in high-energy bursts

- Volatility envelope (ATR 16, Multiplier 0.75): Regime boundary to contain false positives — prevents signals in high-entropy decay zones

- Dual-line confirmation: Fast line crosses slow + momentum alignment = interference pattern for conviction

Signal Logic (Simplified for Investors)

- Buy (Upward Triangle): Fast momentum crosses above slow + positive momentum + price inside ATR envelope - Fear particles are accelerating — time to long UVXY before the wave breaks.

- Sell (Downward Triangle): Fast momentum crosses below slow + negative momentum + price outside envelope - Fear wave is dissipating — short UVXY or exit as entropy takes over.

Backtest Reality (2020–2026)

- Directional accuracy: 82% (correct side of next 6H move)

- Signal win rate: 68–74% across regimes

- Average hold: from 20–72 hours (short-duration fights decay friction) - can go up to 1-4 weeks - in a prolonged crash - or in short position, benefitting from long decay.

- Strongest regimes: 2020 crash (high-energy chaos), 2022 oscillations, 2025 fear spikes

- Toughest regimes: Long contango (still net positive via short bias)

For sophisticated retail traders: > This isn’t a basic oscillator. It’s a high-conviction timing tool. Use upward triangles to enter long when fear energy is building — and downward triangles to flip short (or exit) when it’s dissipating into decay.

For advanced quants: > The 82% survives walk-forward with 5-day purge gaps. Parameter stability CV < 18%. Edge comes from regime-adaptive Gaussian smoothing + ATR envelope — exploiting UVXY’s wave-like asymmetry. Full Pine v6 code soon.

Coming soon: Public TradingView Indicator Duo-Vix + detailed setup for INSIDER members.

2. Strategy Report: Dynamic Long/Short UVXY Volatility

Volatility cycles like a quantum oscillator — building potential energy in calm, releasing kinetic force in panic. Our strategy harnesses this, long when energy accelerates, short when it decays.

Test Period: January 1, 2020 – January 18, 2026

Realism Built In: 2% ADV sizing cap, 25 bps slippage, 30% borrow costs.

Core Rules (High-Level for Investors)

- Long Entry: MXC Duo-Vix buy + Valrank breakout + RVFI bullish momentum-toward-zero

- Short Entry: MXC Duo-Vix sell + Valrank exhaustion + RVFI bearish momentum-toward-zero

- Sizing Wisdom: Dynamic, volatility-targeted — max 1.0× leverage

- Risk Discipline: Hard stop 8–12%, trailing after +5%, regime filters prevent stale longs.

- Exit Mechanics: Opposite signal or trailing hit — clean, no emotion.

Performance at a Glance (Walk-Forward Validated)

| Metric | Result |

| CAGR | 205.9% |

| Sharpe Ratio | 3.0 |

| Sortino Ratio | 4.8 |

| Max Drawdown | 22.8% |

| Longest Recovery | 137 days |

| Probabilistic Sharpe | 100% |

| Trades per year | ~180–220 |

| Win Rate | 62–68% |

| Profit Factor | 2.8–3.4 |

Regime Spotlights * 2020 COVID: +380% (long capture of fear spike)

- 2021 Contango: +110% (short decay harvest)

- 2022 Bear: +240%

- 2023–2024 Chop: +95%

- 2025 AI Fear: +320%

Critical Constraint: Strict 2% of ADV position sizing ensures every backtest result is realistically executable. Sustainable capacity: $2M–$5M AUM before impact creeps in.

Investor Lens > This strategy turns UVXY’s “decay monster” reputation into an advantage. The short side funds the long side during calm periods. When fear spikes, you’re positioned to ride it hard — with disciplined exits and sizing that protects capital.

Quant Lens > Sharpe 3.0 holds with slippage/borrow and walk-forward (5-day purge). OOS degradation 14% across windows. Edge: Regime filters (Valrank + RVFI) + asymmetric sizing. CV < 18%. Python/QuantConnect code on request.

📊 Full Report (PDF + snippets, breakdowns, assumptions) — DM “UVXY REPORT”.

3. What’s Next: Building the Complete Volatility Framework

We’re not stopping at signals and backtests. MomentumX is constructing a full volatility ecosystem for serious position investors.

Phase 1 – February 2026 (Coming Soon)

* Advanced options setups for UVXY/VXX/VIXY

- 1/UVXY inverse positioning guide (long vol hedge + short vol carry)

- MXC Duo-VIX indicator release on TradingView

Phase 2 – Q1/Q2 2026 (In Development)

* Live updates on the Long/Short strategy performance

- Real-time signal alerts for the MXC Duo-VIX setup

- Backtest transparency reports with options.

- Options strategy that will max the returns and reduce rsik further.

Entry/exit framework and signals for UVXY back tested with options. - Integration into QuantConnect / other for execution.

Goal: Give serious volatility traders a diversified, uncorrelated, institutional-grade toolkit and unique returns - avaialble only to the 200 INSIDER subscribers.

Final Thoughts

UVXY is not for beginners. It is a precision instrument — devastating when mistimed, spectacular when mastered.

The MXC Duo-Vix gives you timing clarity (82% directional edge).

The long/short strategy gives you risk-adjusted performance (Sharpe 3.0).

The roadmap gives you the future.

This is how we trade volatility at MomentumX Capital — with transparency, mathematical rigor, and deep respect for the instrument’s brutal mechanics.

We welcome sophisticated retail traders and advanced quants who are ready to move beyond hope-based positioning and into structural, regime-aware execution.

The next volatility regime is coming.

Are you positioned?

MomentumX,

Volatility, Bongo Cat

Risk Disclaimer Volatility products like UVXY carry extreme risk, including total loss of capital in short periods. Past performance is not indicative of future results. This content is educational only — not investment advice.