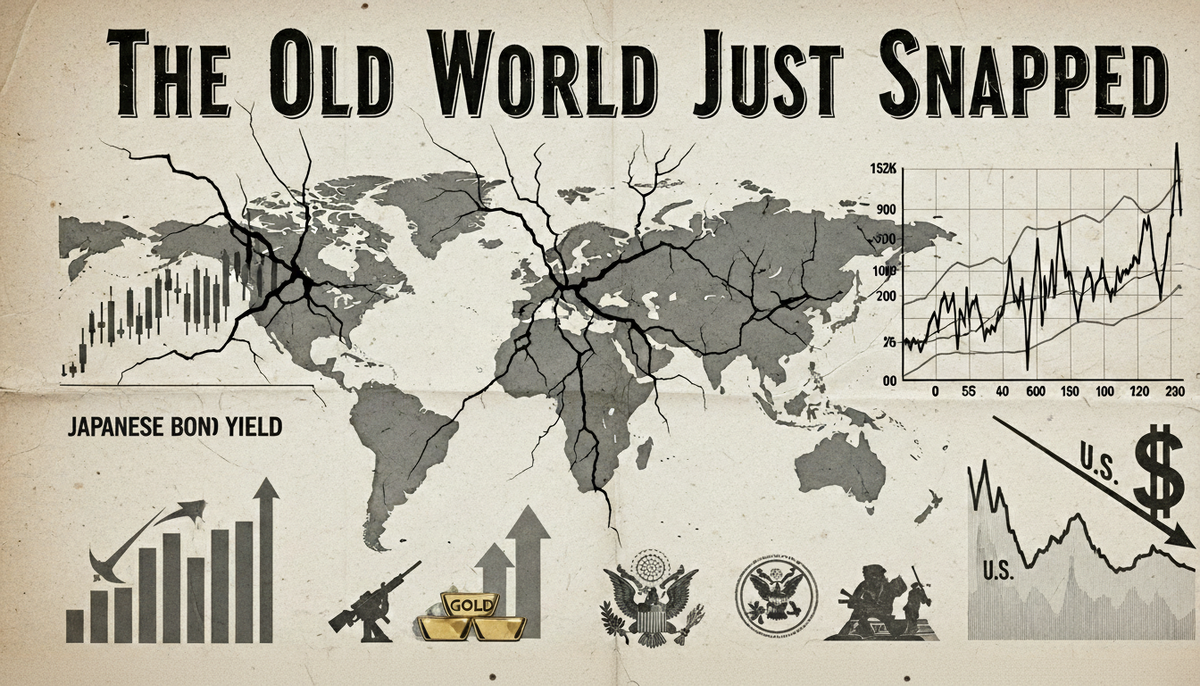

Alpha Report: The 2026 Snap: Greenland Leverage, the JGB Detonation, and the "Sell America" Pivot

The Old World Just Snapped The old world just snapped. Japan’s yield curve detonated. Gold went vertical. Defense surged. Markets are bleeding, narratives are scrambling, and the dollar sold off while the market tanked - nobody can explain what’s really happening. But this isn’t chaos. This is

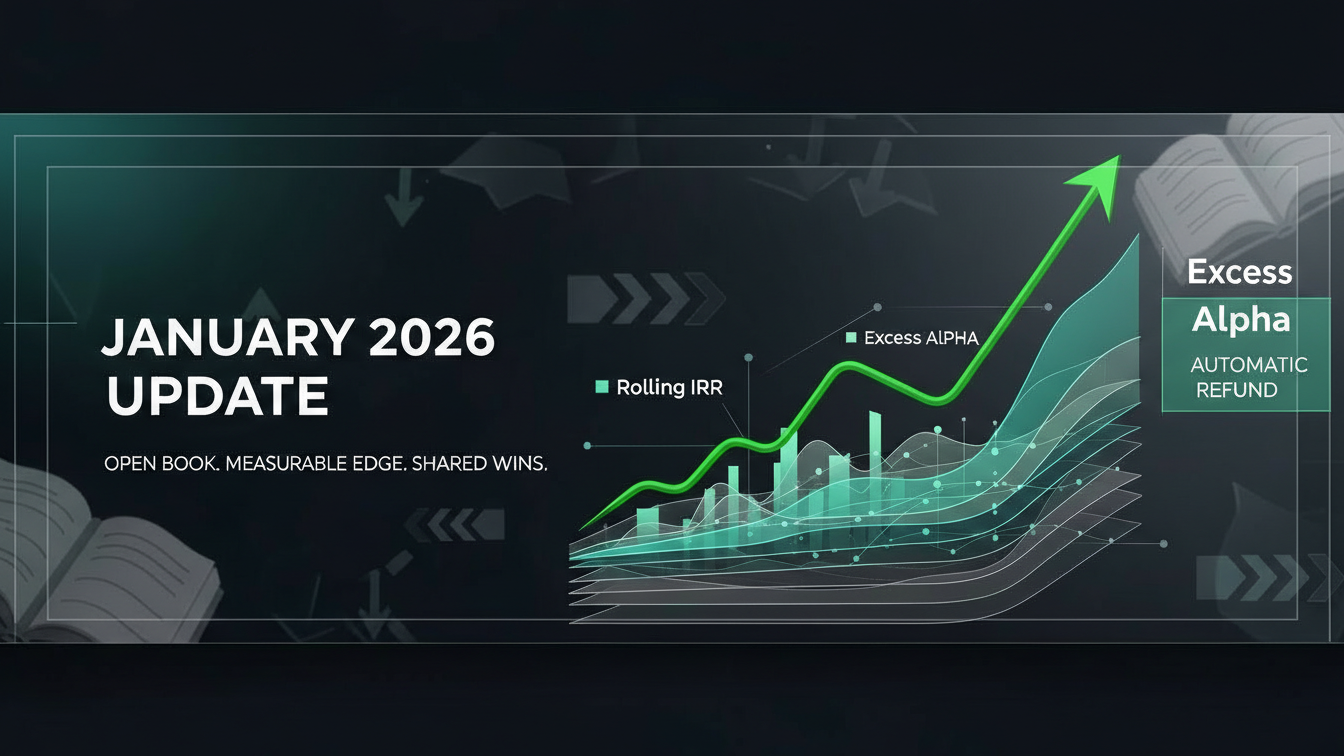

Performance Dashboard & Process Update – January 2026

MomentumX 2025: +85% in 9 months. Performance pricing live: full fees only on outperformance + auto-refunds. Jan 2026: +7.3% vs S&P +1.4%. Revamped dashboard & public track record. Open books. Measurable edge. Shared wins.

UVXY: Mastering Fear Cycles - Timing, Edge & the Full Playbook

UVXY isn’t a stock - it’s a 1.5× fear machine. Contango chews 90% annually, but spikes deliver 100%+ in days. Our MXC Duo-VIX (82% accuracy on 6H) powers a strategy with Sharpe 3.0, 205.9% CAGR, and a strict 22.8% Max DD. The next regime is coming. Are you ready?

Alpha Report: Last Leg Up – Ride It, But Eyes Open.

The grind rolls on as complacency peaks. Capital slips from tech leaders while retail piles into noise. Small-caps take the baton; crypto hits its "last dance" stretch. A few weeks of upside remain before the music changes. Stay sharp -the real move comes when the crowd least expects it.

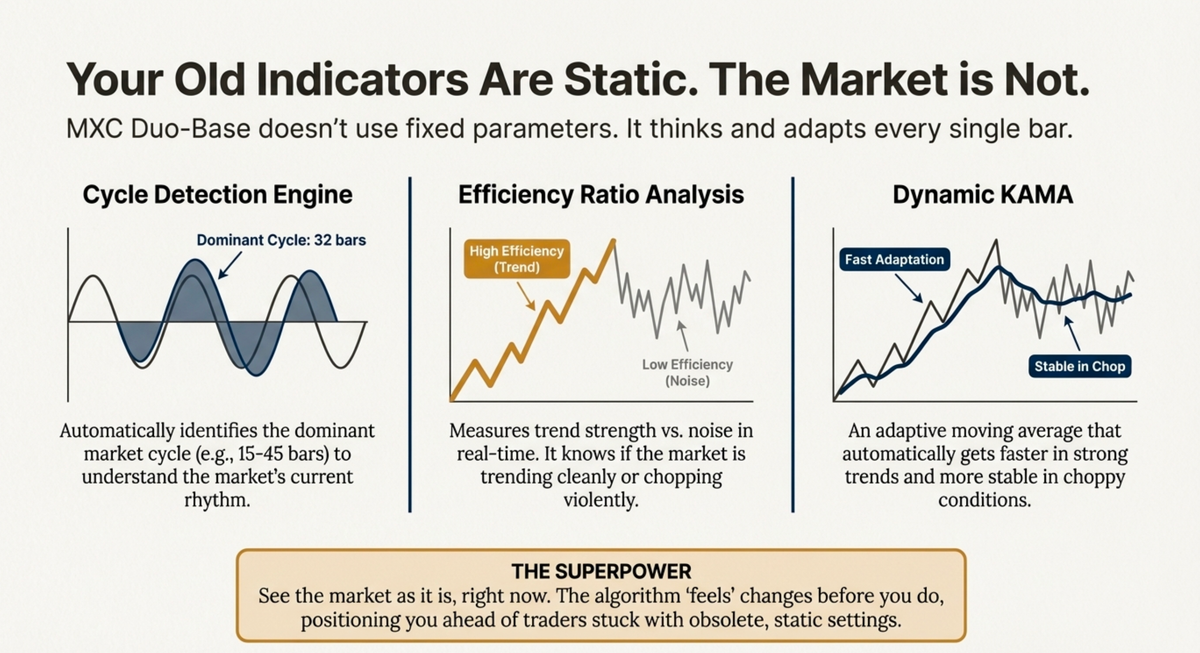

MXC Duo Engine 2.1 – Live Now. Adaptive Trend Intelligence Powered by Physics

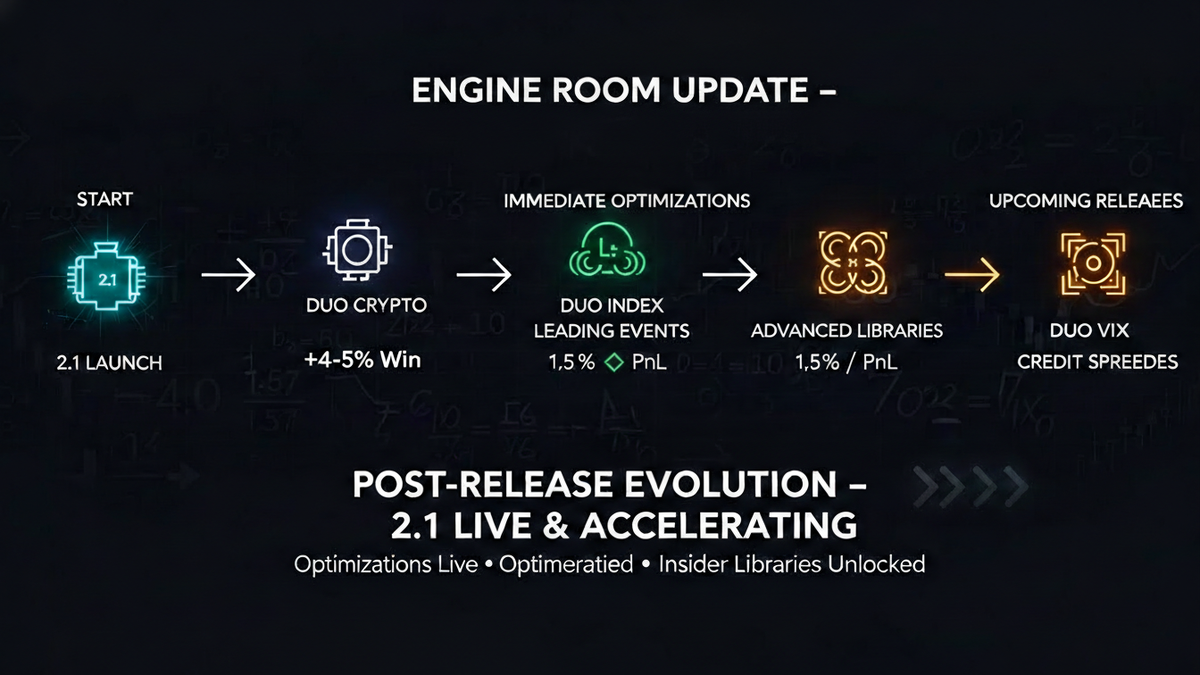

Engine Room Update: The Stack Is Live.

Nuclear Renaissance, From Legacy Sector to High-Growth Infrastructure Play.

Nuclear is not a climate trade; it is a structural grab for 24/7 uptime in an AI world that cannot run on weather. Own the chokepoints - steam turbines, uranium supply, and HALEU enrichment - rather than betting on which SMR design wins the race - more inside.

Alpha Report: Early 2026 Resilience – Grinding Higher with Distribution Signals

26 kicks off with resilience: $SPX grinding fresh ATHs on rotational momentum, but distribution signals flash - fading acceleration, thin volume echoing Feb '24. Base case: ~7,200 over 4-6 wks. Short-term juice in risk assets & crypto. Then: 12%+ correction in Feb. Energy/tangibles is the edge.

Alpha Report: Neither Risk-On Nor Risk-Off - Range Warfare in Action

SPX hits 6721 amid a sharp pullback from 6900 highs - welcome to Range Warfare. While fear grips the crowd, smart money is quietly rotating out of overhyped AI into the real economy's backbone. A deeper probe could hand us generational buying levels soon, setting up a powerful Q1 rally...

THE $4.50 RECKONING: The End of Cheap Natural Gas

The 'Cheap Gas' era is over. A structural collision of AI demand, LNG exports, and Permian bottlenecks is forcing a $4.50+ floor. Insiders (Warren/Kinder) just deployed $120M+ of personal capital. This is a rare accumulation window.

MomentumX Launches Pricing That Puts Our Money Where Our Signals Are.

We Only Get Paid Full When You Win Big.

The Scarcity Pivot: A Shipping Playbook (2026-2030)

Aging fleets, jammed shipyards, & Red Sea disruptions spell multi-year high shipping rates. Ditch dividend chasing - embrace scarcity for capital gains. Our playbook spotlights 5 stocks to buy, and 1 stock to avoid (Star Bulk). Risks, entries, and setups. Navigate the tangible asset boom; Roadmap ⬇️

Alpha Report: SPX Pendulum Swings: Range Warfare & The "Near Miss"

Deeper pullback thesis dead at 6850 - now range warfare between momentum chase and valuation gravity. Key lines: Sell trap > 6900, defend floor 6801. We are buying generational lows in select plays - on SPX dips < 6750, skipping S&P chase. Crypto’s “Last Dance” consolidates for ETH and alt bounce.

![DAT Sector Reset Part 2: [Micro]Strategy, The Bitcoin Treasury Paradox](/content/images/size/w1200/2025/12/Whisk_89ec8117d0e5c8fb9514ddb6e2b6b0fadr.jpeg)

DAT Sector Reset Part 2: [Micro]Strategy, The Bitcoin Treasury Paradox

The DAT Sector Reset is here. MSTR is no longer the only game in town. As institutional capital rotates from leverage to yield, the premium is collapsing. We analyze the "Reflexivity Death Spiral" and why the inst. money is moving to zero-debt alternatives.

Crypto's Last Dance and DAT Sector Reset: The 2026 Extinction Event & Survival Guide

The Jan 15 MSCI decision risks an $8.8B forced unwind. The premium trade is dead. We’re shifting to true yield and defensive ops. 50% of DATs vanish by 2026. Don't be exit liquidity. Here is the probabilistic path to play this setup in the next 3-6 mo.

Alpha Report: Pivotal Weeks Ahead & Crypto's Last Dance

Risk reset incomplete. We expect a final SPX flush to 6400. Pivot: 6750. We are aggressively rotating into Energy & Metals. Crypto: Cycle Peak confirmed, but the "Last Dance" offers one final vertical move before Winter 2026. Get the full execution roadmap inside.

Protocol Update: Homepage Overhaul, New Tiers & The Launch of Kinetic-Flow.

The new home-page and site is live.

Alpha Report: Engine 2.0 Live and The Market Turn

Engine 2.0 is live. We are exiting Accumulation. SPX bottoming near 6400. BTC/ETH on institutional support. Shorts closing shorts; we are buying the dip. This is the protocol upgrade you've been waiting for. Read the full Alpha Report inside.

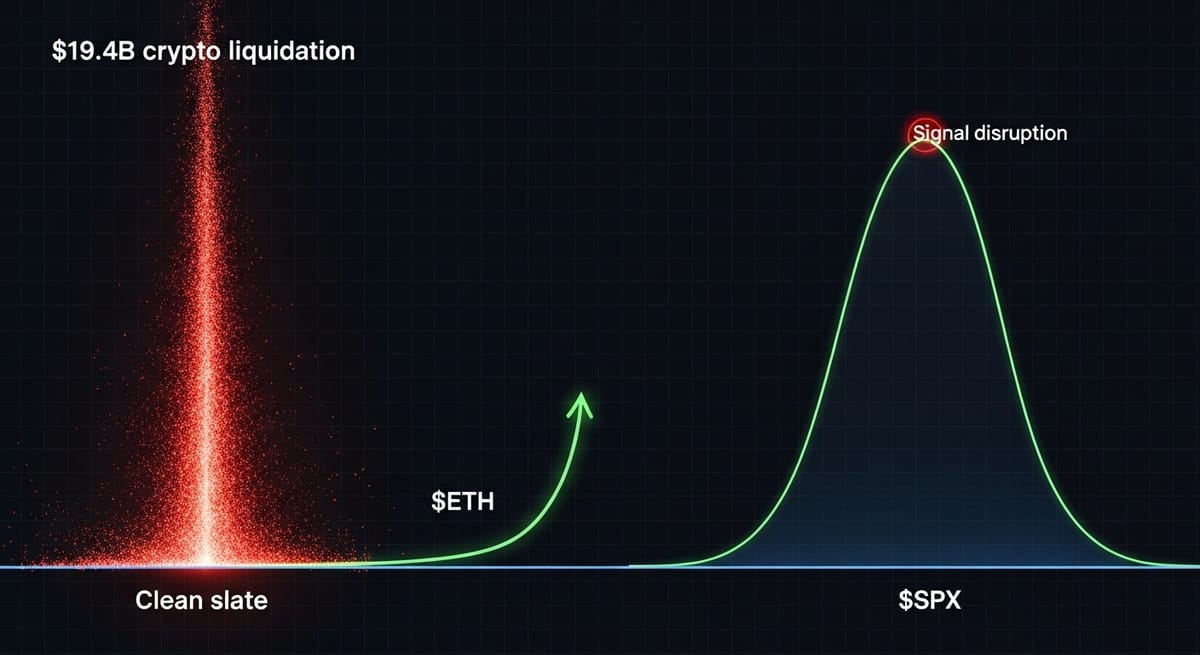

Alpha Report: A Clean Slate After the Reckoning, and Topping Signals for TradFi

Crypto - $19.4B flush created a clean slate. We expect a final topping in TradFi ($SPX ~7k), which we'll use to sell the bounce. High probability remains for one last push for $ETH to a new ATH (~$6k)... $BTC's R:R is poor. The altcoin dream fades (30% prob). The play: use strength to de-risk.

Alpha Report: The Powell Pivot & The Crypto Shakeout

The Powell pivot is here, creating a deceptive market. While equities enter a potential 3-6 week melt-up, crypto hesitates, flashing warning signs. We cut through the noise to identify the real high-conviction signal and the tactical plays required for this complex new market phase.

The Fed's Full Confession: Why Yields Are Heading Lower, Faster

Don't get lost in the noise. The signal is simple: The Fed has capitulated. They've confessed they will sacrifice their 2% inflation target to save the labor market. This is a profound, unpriced policy shift. Our latest analysis unpacks the asymmetric trade setup.

Beyond the Shale Dream: The Energy Infrastructure Imperative — An Investment Blueprint for the New Era

The U.S. shale era is over. A new, multi-trillion-dollar capital cycle is beginning. This definitive framework shows how to pivot from volatile speculation to owning indispensable infrastructure—the "toll roads" of the new energy economy, from offshore services to AI power grids.

The Lithium Paradox

While the crowd is distracted by short-term noise from China, the long-term signal in lithium remains unchanged. The path forward is now more complex, requiring greater discipline. Our final brief provides the updated playbook for this asymmetrical opportunity.

Alpha Report: A Funny Thing Happened During the Cool Off...

The market is correcting, but not in the way most people expect. As we noted last week, the "boring part" is where discipline is forged. That period of quiet has now ended, shattered by a data shock that confirms our thesis.

Alpha Report: The Psychology of the Cool Off

The cool off month is here, as anticipated. First-level thinking sees boredom; we see a high-probability setup. Our playbook is simple: accumulate cash and patiently stalk generational lows in our high-conviction plays. This is where discipline forges the next win.

State of Play: Crypto Market Update – September 2025

A healthy consolidation is underway for ETH after its ATH, with a classic pattern of crypto front-running equities. With rate cuts priced in, the equity market faces an asymmetric risk profile, vulnerable to any negative data. This reinforces our expectation for a cooler Sept across all risk assets.

Decoding the Dragon: Our Playbook for China's New Era

China is at a rare inflection point. The DeepSeek AI breakthrough & a historic A-H share convergence have rewritten the rules, creating a structural technology leadership play. Our evolved framework shows how to navigate this new era, filter for policy alignment, & find the real signal in the noise.

Alpha Report: The Architected Rally, Navigating a Policy-Driven Mirage

This isn't a bull market; it's an architected rally. A policy-driven mirage designed to sell a weak economy at a high price. Second-level thinking is required to see the divergence. We're showing you how to navigate the final act, protect and multiply your gains. This is the signal.

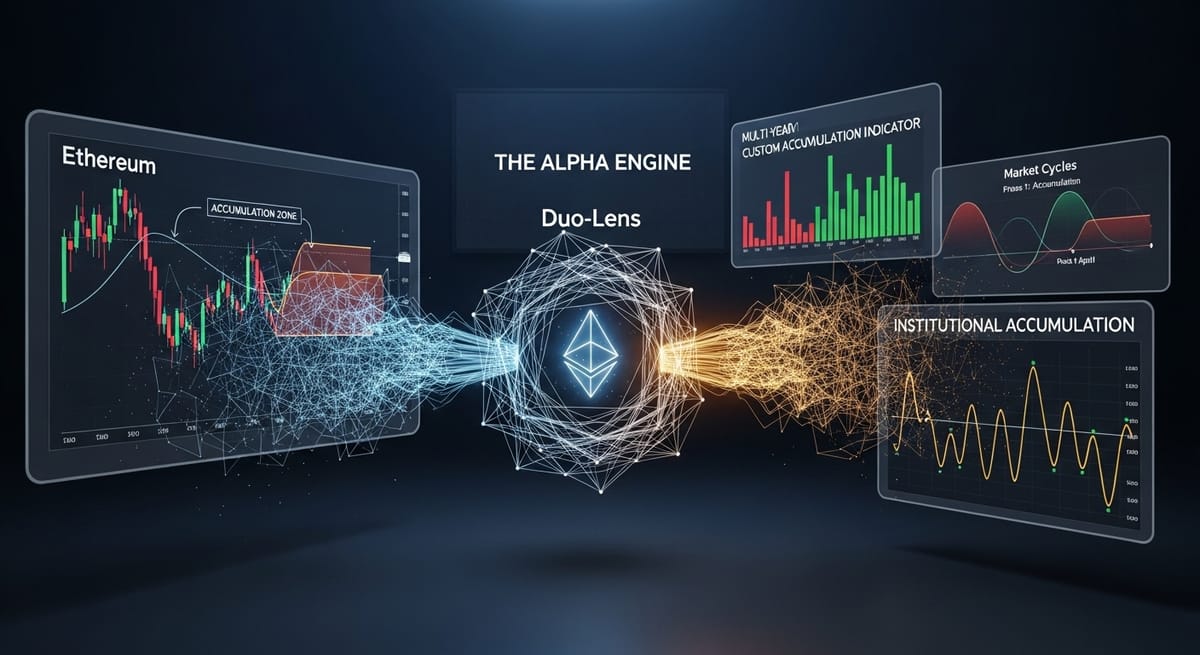

An Invitation to a More Intelligent Game: The MomentumX Test Access Launch

After 8 years of building privately for investors and funds, our system for finding institutional footprints is now public. We fuse timeless market cycles with modern quant to give you a verifiable edge over the noise 95% of traders fight. Join our Test Access Launch and find the real signal.

Offshore Drilling: A Capital Cycle Renaissance and Oligopoly Formation

After a decade of capital destruction, offshore drilling presents a classic capital cycle opportunity. With rationalized supply, oligopoly formation, and valuations reflecting extreme pessimism, the sector offers a rare, asymmetric risk-reward profile for patient investors.

The Cannabis Contrarian: Unpacking the Founder's Playbook in MAPS

The market has priced in permanent despair for cannabis tech leader MAPS. We see a calculated founder-led playbook for a take-private. This disconnect creates a deliciously asymmetric bet with limited downside and a clear path to significant value creation.

The Dental Dislocation

Market fear has created a profound pricing dislocation in dental tech. Our new report ignores the narrative to follow the signal: deep institutional footprints in two asymmetric setups - a mispriced fortress where the CEO is buying heavily and a deep-value turnaround with a new operator at the helm.

The Crypto Treasury Play: A Speculator's Guide to Riding the Hype and Dodging the Spiral

Crypto treasury stocks are a speculator's game of riding a premium-to-NAV. The play is the "capital markets flywheel"; the risk is the "NAV death spiral". This playbook deconstructs the model, showing you how to capitalize on the hype and manage the catastrophic risk.

Beyond the Smoke: The Real Signal in Cannabis

After a 95% sector collapse, our data reveals heavy insider buying and a textbook accumulation base, signaling a major inflection point as federal catalysts align.

The "Big Beautiful Bill" is Here: What it Means for Your Assets (And Why Patience Pays)

Alpha Report July 6th - The "Big Beautiful Bill" unleashes $5T, inflating assets amidst a dangerous market illusion. This late-cycle trap means S&P, assets, & crypto surge. Position to own more assets, await the Fed pivot for alt season. Rates are the only wild card, but remain bullish.

The Quiet Roar: Why Smart Money is Stacking Metals (While You're Not Looking)

The commodity capital cycle is here, fueled by AI, electrification, infra & defense. While markets focus elsewhere, deep structural deficits in copper, lithium, palladium, and REE are brewing. Our brief identifies undervalued miners where smart money is quietly positioning for asymmetric returns.

Etsy: Handcrafted Opportunity?

Etsy ($ETSY) isn't just rebounding; it's entering a high-probability Phase 2 markup. Our data confirms smart money's quiet accumulation and a defined short squeeze setup. This contrarian opportunity, optimized for precision and patience, offers an asymmetric path to profit.

The Final Lap: Navigating the Euphoria Rally

Alpha Report June 29th - A euphoric, policy-driven rally is pushing markets to new records. But the smart money is quietly rotating into hard assets. We are positioning for the coming top and the new leaders of the next cycle.

Estée Lauder - From the Pit Lane to the Main Straight

After a 2-year pit stop, our system confirms Estée Lauder (EL) has re-entered the race. A high-volume breakout validates our base analysis and institutional telemetry. The markup phase is green-lit, and our execution protocol is active. This is where engineering meets acceleration.

The Copper Conundrum: Why Structural Scarcity is Overruling Slowdown Fears

While first-level thinkers are paralyzed by recession fears, the copper market is screaming a story of structural scarcity. A multi-decade supply deficit, confirmed by a powerful breakout in miners, signals the start of a new bull market. This is a masterclass in positioning for what's inevitable.

The Silent Accumulation and The Sidelined Crowd

While public interest in crypto remains at 2022 lows, our data reveals aggressive institutional accumulation in Ethereum. From consistent inflows & a tightening supply to massive short interest & macro tailwinds, the smart money is positioning for a significant, "hated" rally.

Why Brazil's Arithmetic Outweighs Argentina's Narrative

Don't chase Argentina's expensive narrative. In Brazil, political gloom has created a deep margin of safety, with equities near COVID lows. The astute investor focuses not on the story, but on the price paid. True edge is found where pessimism is priced in and the arithmetic is strong.

Beyond the Narrative: What Smart Money Is Doing in Rare Earth Metals

Forget the EV narrative; the price of rare earth metals tells a story of brutal decline. The real question is: what is happening now? Data reveals a 30-month accumulation base, a quiet absorption by institutional players, creating one of the most asymmetric opportunities of the coming cycle.

Palladium Breaking Out

While consensus fixates on palladium's weak demand narrative, our data reveals a different reality. A multi-year accumulation base, supported by a geopolitical supply floor, shows the negative story is priced in. The smart money is positioning for the inevitable. The inflection point is likely now.

Alpha Report: The 2026 Snap: Greenland Leverage, the JGB Detonation, and the "Sell America" Pivot

Performance Dashboard & Process Update – January 2026

UVXY: Mastering Fear Cycles - Timing, Edge & the Full Playbook

Alpha Report: Last Leg Up – Ride It, But Eyes Open.

Engine Room Update – Post-Release Enhancements and What's Coming

MXC Duo Engine 2.1 – Live Now. Adaptive Trend Intelligence Powered by Physics

Nuclear Renaissance, From Legacy Sector to High-Growth Infrastructure Play.

Alpha Report: Early 2026 Resilience – Grinding Higher with Distribution Signals

Alpha Report: Neither Risk-On Nor Risk-Off - Range Warfare in Action

THE $4.50 RECKONING: The End of Cheap Natural Gas

MomentumX Launches Pricing That Puts Our Money Where Our Signals Are.

The Scarcity Pivot: A Shipping Playbook (2026-2030)

Alpha Report: SPX Pendulum Swings: Range Warfare & The "Near Miss"

DAT Sector Reset Part 2: [Micro]Strategy, The Bitcoin Treasury Paradox

Crypto's Last Dance and DAT Sector Reset: The 2026 Extinction Event & Survival Guide

Alpha Report: Pivotal Weeks Ahead & Crypto's Last Dance

Protocol Update: Homepage Overhaul, New Tiers & The Launch of Kinetic-Flow.

Alpha Report: Engine 2.0 Live and The Market Turn

Alpha Report: A Clean Slate After the Reckoning, and Topping Signals for TradFi

Alpha Report: The Powell Pivot & The Crypto Shakeout

The Fed's Full Confession: Why Yields Are Heading Lower, Faster

Beyond the Shale Dream: The Energy Infrastructure Imperative — An Investment Blueprint for the New Era

The Lithium Paradox

Alpha Report: A Funny Thing Happened During the Cool Off...

Alpha Report: The Psychology of the Cool Off

State of Play: Crypto Market Update – September 2025

Decoding the Dragon: Our Playbook for China's New Era

Alpha Report: The Architected Rally, Navigating a Policy-Driven Mirage

An Invitation to a More Intelligent Game: The MomentumX Test Access Launch

Offshore Drilling: A Capital Cycle Renaissance and Oligopoly Formation

The Cannabis Contrarian: Unpacking the Founder's Playbook in MAPS

The Dental Dislocation

The Crypto Treasury Play: A Speculator's Guide to Riding the Hype and Dodging the Spiral

Beyond the Smoke: The Real Signal in Cannabis

The "Big Beautiful Bill" is Here: What it Means for Your Assets (And Why Patience Pays)

The Quiet Roar: Why Smart Money is Stacking Metals (While You're Not Looking)

Etsy: Handcrafted Opportunity?

The Final Lap: Navigating the Euphoria Rally

Estée Lauder - From the Pit Lane to the Main Straight

The Copper Conundrum: Why Structural Scarcity is Overruling Slowdown Fears

The Silent Accumulation and The Sidelined Crowd

Why Brazil's Arithmetic Outweighs Argentina's Narrative

Beyond the Narrative: What Smart Money Is Doing in Rare Earth Metals

Palladium Breaking Out

While first-level thinkers are paralyzed by recession fears, the copper market is screaming a story of structural scarcity. A multi-decade supply deficit, confirmed by a powerful breakout in miners, signals the start of a new bull market. This is a masterclass in positioning for what's inevitable.

While public interest in crypto remains at 2022 lows, our data reveals aggressive institutional accumulation in Ethereum. From consistent inflows & a tightening supply to massive short interest & macro tailwinds, the smart money is positioning for a significant, "hated" rally.

Most traders are paralyzed by crypto's volatility, mistaking sideways chop for a lack of opportunity. This is a critical error. Our data shows a textbook accumulation phase in major assets, with quiet institutional buying since mid-April. The signal isn't the noise; it's the silence.

Don't chase Argentina's expensive narrative. In Brazil, political gloom has created a deep margin of safety, with equities near COVID lows. The astute investor focuses not on the story, but on the price paid. True edge is found where pessimism is priced in and the arithmetic is strong.

Forget the EV narrative; the price of rare earth metals tells a story of brutal decline. The real question is: what is happening now? Data reveals a 30-month accumulation base, a quiet absorption by institutional players, creating one of the most asymmetric opportunities of the coming cycle.

First-level thinking sees China's monopoly on rare earths as absolute. Second-level thinking sees King Americus's grand strategy to dismantle it. A new world order is being forged in critical minerals, creating a historic opportunity for the patient investor. The accumulation phase has begun.